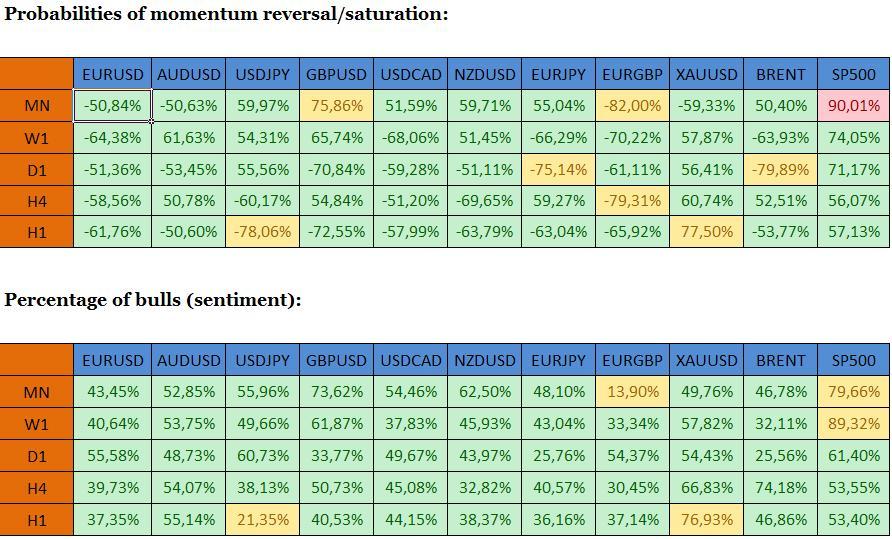

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.3655 -1.3670 on the upside, 1.3465-1.35480 on the downside.

AUDUSD: 0.9405-0.9420 on the upside, 0.9305-0.9320 on the downside.

USDJPY: 101.95-102.10 on the upside, 100.65-100.80 on the downside.

GBPUSD: 1.7185-1.7200 on the upside, 1.7035-1.7050 on the downside.

USDCAD: 1.0780-1.0795 on the upside, 1.0615-1.0630 on the downside.

NZDUSD: 0.8775-0.8790 on the upside, 0.8620 – 0.8635 on the downside.

EURJPY: 138.80-138.95 on the upside, 136.65-136.80 on the downside.

EURGBP: 0.7985-0.8000 on the upside, 0.7820-0.7835 on the downside.

XAUUSD: 1350.00-1360.00 on the upside, 1255.00-1265.0 on the downside.

BRENT: 109.50-110.50 on the upside, 103.00-104.00 on the downside.

SP500: 1995.00-2005.00 on the upside, 1920.00-1930.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.