Good Morning Traders,

As of this writing 4:35 AM EST, here’s what we see:

US Dollar: Up at 96.775 the US Dollar is up 194 ticks and trading at 96.775.

Energies: March Crude is up at 30.38.

Financials: The Mar 30 year bond is down 10 ticks and trading at 165.23.

Indices: The Mar S&P 500 emini ES contract is up 5 ticks and trading at 1853.25.

Gold: The Feb gold contract is trading down at 1182.20. Gold is 97 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and crude is up+ which is not normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading higher which is not correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly lower with the exception of the Hang Seng and Singapore exchanges which traded higher. As this writing Europe is trading mainly higher with the exception of the Milan exchange which is trading lower.

Possible Challenges To Traders Today

- NFIB Small Business Index is out at 6 AM EST. This is not major.

- JOLTS Job Openings is out at 10 AM EST. This is major.

- Wholesale Inventories m/m is out at 10 AM EST. This is not major.

Currencies

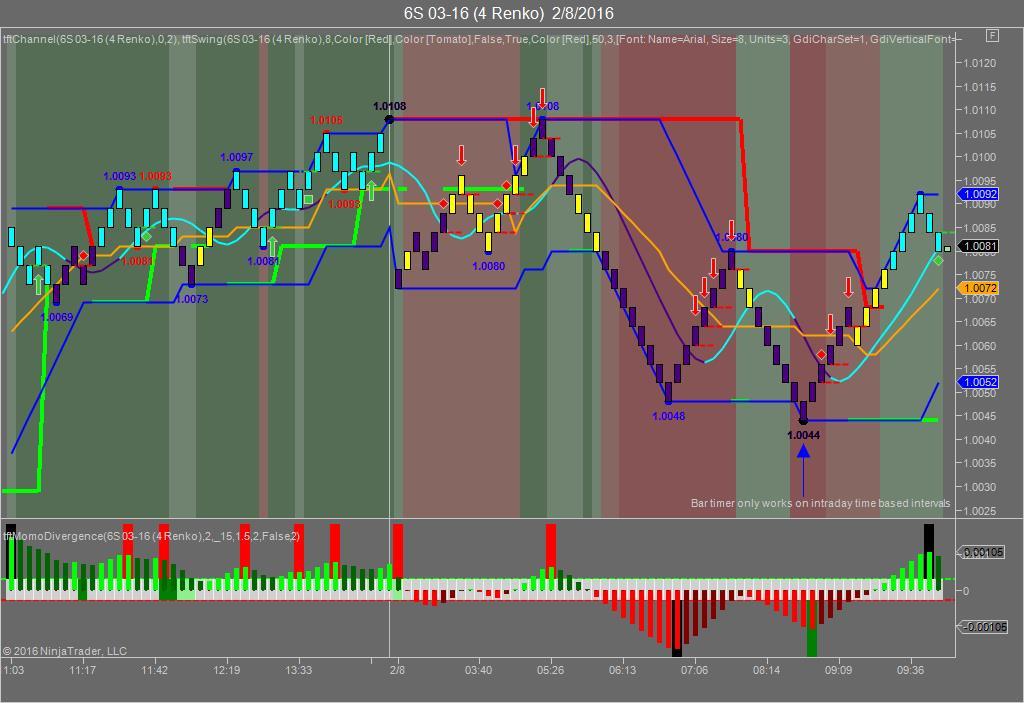

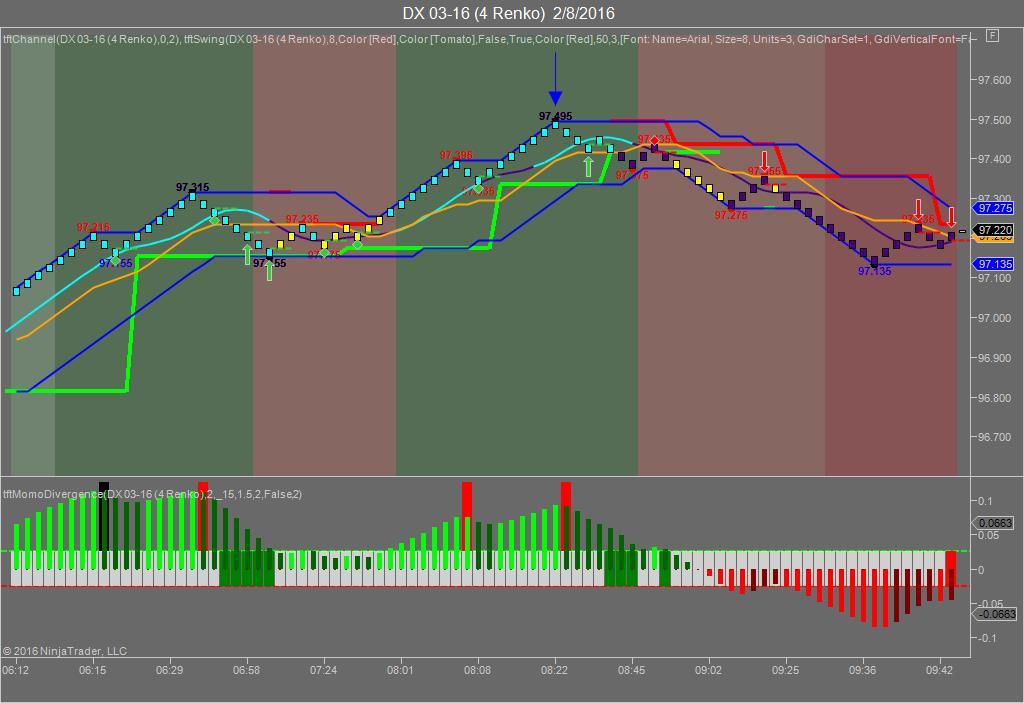

Yesterday the Swiss Franc made it’s move at around 8:30 AM EST with no real economic news to speak of. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 8:30 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 8:30 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted about 20 plus ticks per contract on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus the $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we maintained our neutral bias as the markets didn’t appear to have any sense of direction yesterday morning. The Dow dropped 178 points and the other indices lost ground as well. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Ordinarily the day after a major sporting event like the Super Bowl would have traders pumped up and clamoring for action. Not so yesterday as all the indices on the US markets fell in tandem yesterday morning as soon as the opening bell rang. The Dow fell into negative territory and remained there for the rest of the session. The other indices followed suit as well. Maybe it was because for the first time ever the Super Bowl commercials weren’t so super or perhaps it was because no one really bought into the Non-Farm Payroll numbers from Friday. Whatever the reason, the market will have more to digest tomorrow as Janet Yellen testifies before a congressional committee on Wednesday; so we can only speculate what the market reaction will be...

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD nears 1.0800 on broad US Dollar weakness

Optimism continues to undermine demand for the American currency ahead of the weekly close. EUR/USD hovers around weekly highs just ahead of the 1.0900 figure.

GBP/USD reconquers 1.2500 with upbeat UK GDP

Following BOE-inspired slump on Thursday, the British Pound changed course and trades around 1.2530. Better-than-anticipated UK GDP and a weaker USD behind the advance.

Gold resumes advance and trades above $2,370

XAU/USD accelerated its recovery on Friday, as investors drop the USD. Dismal US employment-related figures revived hopes for a soon-to-come rate cut from the Fed.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Euro area annual inflation is expected to be 2.4% in April 2024

Euro area annual inflation is expected to be 2.4% in April 2024, stable compared to March. Looking at the main components of euro area inflation, services is expected to have the highest annual rate in April.