Good Morning Traders,

As of this writing 4:10 AM EST, here’s what we see:

US Dollar: Up at 95.695 the US Dollar is up 249 ticks and trading at 95.695.

Energies: October Crude is down at 44.31.

Financials: The Sept 30 year bond is up 10 ticks and trading at 156.14.

Indices: The Sept S&P 500 emini ES contract is up 53 ticks and trading at 1929.25.

Gold: The October gold contract is trading up at 1139.40. Gold is 1 tick higher than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and oil is down- which is normal and the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading down which is correlated. Gold is trading up which is not correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded lower. As of this writing Europe is trading mainly higher with the exception of the Spanish IBEX exchange which is trading lower.

Possible Challenges To Traders Today

- ADP Non-Farm Employment Change is out at 8:15 AM EST. This is major.

- Revised Nonfarm Productivity q/q is out at 8:30 AM EST. This is not major.

- Revised Unit Labor Costs q/q is out at 8:30 AM EST. This is not major.

- Factory Orders m/m is out at 10 AM EST. This is major.

- Crude Oil Inventories is out at 10:30 AM EST. This could move the crude market.

- Beige Book is out at 2 PM EST. This is major.

Currencies

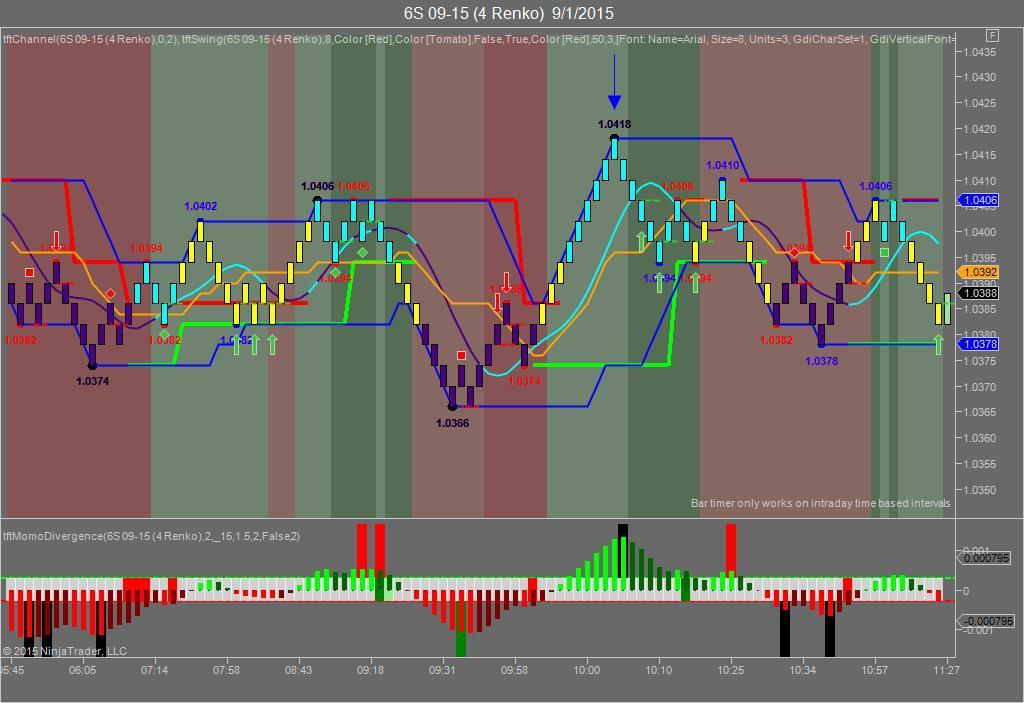

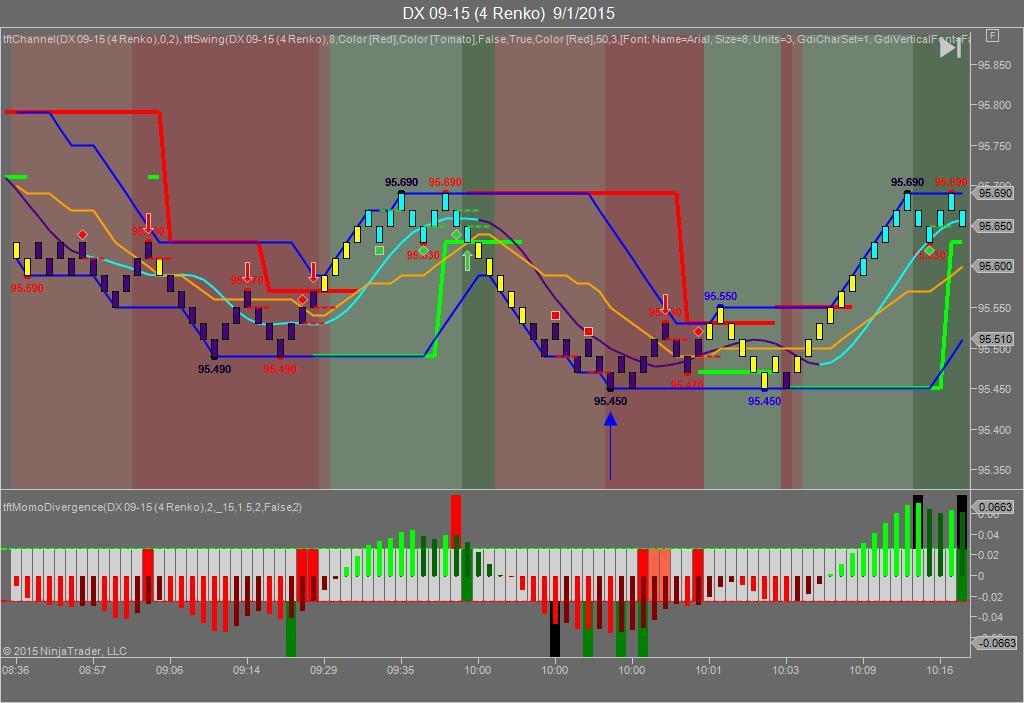

Yesterday the Swiss Franc made it’s move at around 10 AM EST right around the time that the economic news was reported. The USD hit a low at around that time and the Swiss Franc hit a high If you look at the charts below the USD gave a signal at around 10 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 10 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the downside and unfortunately we were correct. The Dow dropped 470 points and the other indices dropped as well. Today we aren’t dealing with a correlated market however our bias is neutral.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was to the downside as both Gold and the Bonds were trading higher yesterday morning. Europe was trading lower and Asia had traded lower thus our bias was down. Needless to say none of the economic news reported yesterday met expectation with the exception of Auto Sales which came in at 17.8 versus 17.3 expected. Ironically this is because low interest rates are fueling auto sales at a rapid pace and this month (September) Labor Day sales aren’t being counted towards August sales. The Fed should consider this come FOMC Day…

So China is experiencing a downturn and the whole world goes bonkers. As we in the capitalist West know already what goes up must surely come down. I don’t think China ever experienced this before and hence it is undiscovered country for them. So why is this happening? In our opinion two reasons: China has over produced its goods thinking that the boom market will go on forever and secondly many domestic producers are bringing back production to their respective countries. Making goods in China may at first glance appear to be a good idea as it’s cheaper but guess what? The quality leaves much to be desired. How many times have you bought a made-in-China product only to replace it within two years because it fell apart?

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.