Polish Zloty (EUR/PLN) – elections coming up

The previous week everybody was analyzing what the Fed will do after a worse than expected NFP reading. This past week though, the market was analyzing the possibility that global central banks (mainly the ECB) could increase monetary easing. At this time, rather not. Mario Draghi was already mentioning that the QE program in the Eurozone is working even better than the bank anticipated. How did emerging market currencies moved in this environment? The Polish Zloty was, again, rather stable. In Poland, the main topic are the upcoming parliamentary elections on October 25th. The rightist Prawo i Sprawiedliwosc (Law and Justice) party is leading the polls in front of the currently ruling, Platforma Obywatelska (Civil Platform). As before elections time, parties are promising things they will do if elected. Of course, few of them are realistic (decreasing the retirement age and social help for poor families where the money for that would earned by taxing banks and big retail chains). As with the previous elections, I expect a weakening of the Zloty in case the rightists win. As for macro data, CPI inflation (yearly basis) stood at -0.8% in September (matching forecasts). We see no improvement in this area so at this moment, we cannot the MPC to consider hiking interest rates next year. Unless of course, the Fed starts its monetary policy tightening process soon and the economic situation of the country quickly improves (no signs of this though).

If we take a look at the daily chart, we the EUR/PLN rebounded from the 4.21 support (61.8% retracement level of the last upward move) last week. It reached a weekly high of 4.24 but was unable to continue the increase. Currently, the market seems undecided about which direction to take (the stochastic oscillator also does not provide a clear signal. Breaking the 4.24 resistance should take the market to its local highs of 4.26. The closest, strong support is at 4.21 and if broken, could trigger a market move even towards 4.21.

Pic.1 EUR/PLN D1 source: xStation

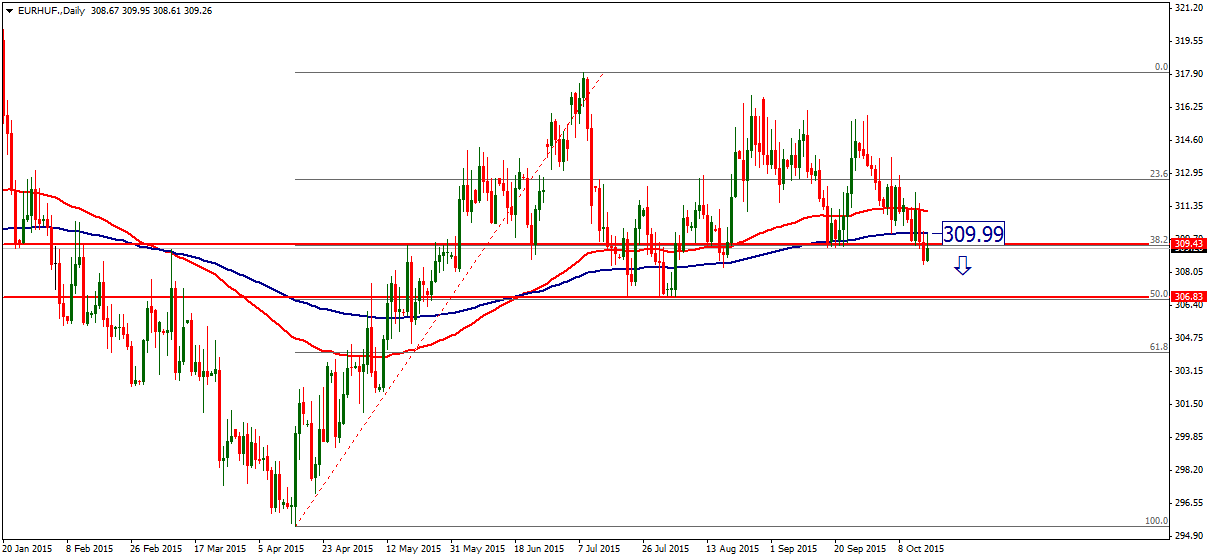

Hungarian Forint (EUR/HUF) – positive week for the Forint

Hungary’s Forint firmed to 310 versus the Euro on Monday afternoon but then it broke the support line today. Investor sentiment overseas may be impacted by comments of Fed officials. From the local view, the volume of Hungary’s construction output declined by 3.6% (monthly basis) in August. Output was 6.1% lower compared to the same month of last year. One of the main reasons for this negative trend in the last few months is that state investments cannot possibly accelerate, as the absorption of EU funds is at its peak for Hungary needs to spend the resources in the 2007-2013 programming period by the end of the year. However, this news had no major effect on the EUR/HUF Emerging markets has been focusing only on the Fed in the past few weeks.

Hungary's Forint briefly visited territories below 310, which corresponds to a 0.4-0.5% gain compared to its late Friday level. If 310 remains as the resistance, the EUR/HUF's target next week could be the 306 support. Under the 200 DEMA we can see more Forint power in the future.

Pic.2 EUR/HUF D1 source: Metatrader

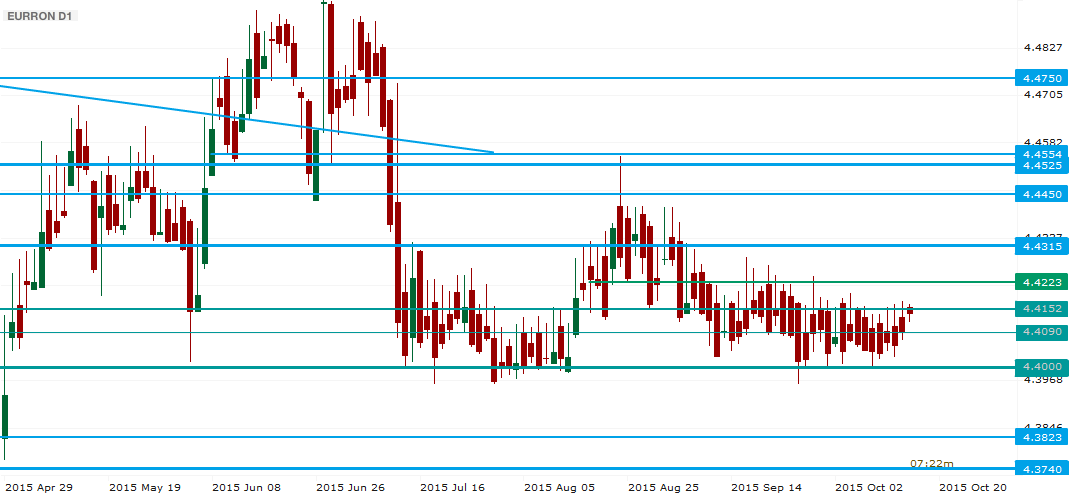

Romanian Leu (EUR/RON) – Insulated from the “madding crowd”

Has any of the European or global noise reached out towards EUR/RON? Not yet, as it seems that the current economical path leads higher, and provides a shield against the stress of more lax fiscal environment. Data from the constructions sector pointed to a large 10.6% jump in August 2015 vs. August 2014, while retail sales jumped by 0.6% y/y (seasonal and fiscal factors led to a 4.9% m/m decrease). The possible ending of the IMF deal that provided protection during the aftermath of the last crisis does not rattle the investors’ nerves now. We see a bit of risk to the upside next week, as the descending trend in interbank rates reduces appetite, and global factors begin to weigh in more heavily, pushing EURRON above 4.42 or even 4.43 in the week(s) ahead.

In the technical approach there has been a clear range within a larger lateral path. As of now, it appears to be leaning to the upside, while only a push above 4.4220 would allow the chart to get some jitters, and the next stop would be 4.4315. Will the market gain enough strength to do that? It may need some more time, and a re-test of 4.4000 in the mean time is possible. Action would be interesting to watch if there is a breajout below 4.4000, leaving 4.3823 exposed to the desire of traders eagerly waiting for some more volatility.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.