It’s time for another edition of my Forex Trading Guide! This time, let’s take a closer look at the upcoming U.K. jobs release and how it could affect pound price action.

What is this report all about?

Employment is one of the most important aspects of an economy, as it influences consumer confidence and domestic spending. A stable jobs market generally encourages consumers to spend more, which then boosts business production and overall economic growth. In other words, improving labor trends are good for the economy and its currency!

The U.K. jobs report has two main components: the claimant count change and the jobless rate. The claimant count change indicates the number of people claiming unemployment benefits during the month, making it a gauge of how many jobs were lost in that period. Meanwhile, the jobless rate shows the percentage of the labor force that is unemployed and looking for full-time work.

What happened last time?

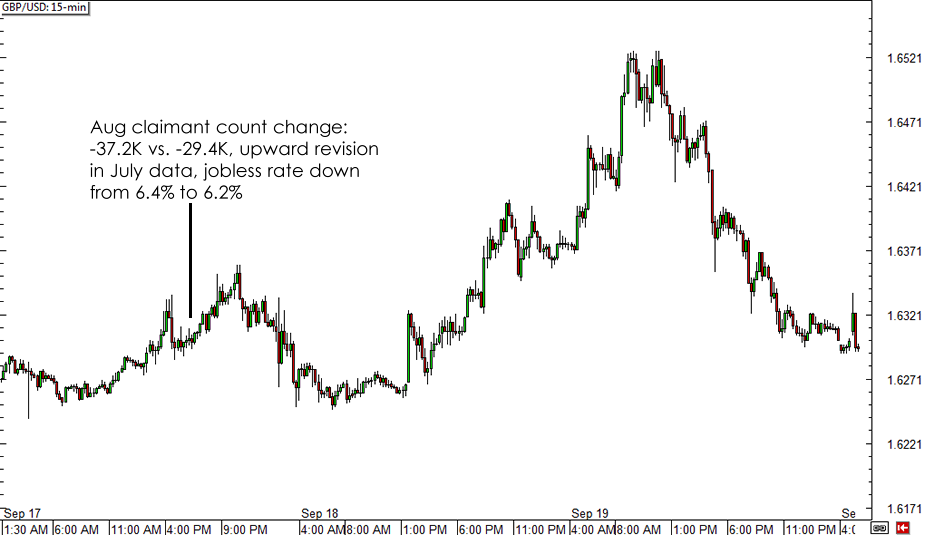

For the month of August, the U.K. economy added 37.2K jobs and saw an improvement in the jobless rate from 6.4% to 6.2%, surpassing analysts’ estimates of 29.7K in hiring gains and a 6.3% jobless rate. As you can see from the GBP/USD chart below, the pair reacted positively to the release and was able to sustain its climb for the rest of the week.

GBP/USD 15-min Forex Chart

Looking further back reveals that the U.K. has been churning out consistently strong jobs figures since May, averaging roughly 34.5K in employment gains for the past four months. In fact, the jobless rate has been steadily declining from 7.2% in February all the way down to 6.2% in August. To top it off, previous months’ data tend to be upgraded in the succeeding releases, indicating that the pickup in hiring is usually much stronger than initially reported.

What’s expected for the upcoming release?

For September, the U.K. economy is expected to have added 34.2K jobs, which is slightly lower than the previous month’s increase. Another improvement is expected for the jobless rate, which could dip to 6.1%.

As in previous releases, average hourly earnings could draw a lot of attention since BOE officials had been commenting on the lack of wage growth. For them, this shows that there’s a significant amount of economic slack to be absorbed. The 3-month average earnings index is projected to post a 0.7% uptick, a slightly faster pace of increase compared to the previous 0.6% reading.

How might GBP/USD react?

Another strong U.K. jobs report could lead to more gains for the pound, which appears to be holding up pretty well against the rallying U.S. dollar so far. After all, five consecutive months of better than expected hiring gains would be hard to ignore. It might even be enough to convince more forex traders that the BOE is on track to tighten monetary policy sometime next year.

On the other hand, a dismal jobs report might cast doubts on the country’s ability to sustain strong hiring trends. This might even support the BOE’s warnings that the slowdown in the euro zone is starting to take its toll on the U.K. economy, which might then put GBP/USD in selloff mode.

Take note though that this event typically results in volatile forex price action for the pound pairs so you might wanna sit on the sidelines if this ain’t your cup of tea. Just don’t forget to review how the actual numbers turned out so you can decide whether or not to change your bias for the pound!

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.