Think the second version of the U.S. GDP report doesn’t have much of an impact on forex price action? Think again!

For the newbie traders just tuning in, you should know that the U.S. economy typically releases three versions of its GDP report: advanced, preliminary, and final. While the advanced GDP release tends to have the strongest market impact since it provides the first glimpse of how the economy fared in the reporting period, revisions for the second and third releases also usually have an effect on long-term dollar movement.

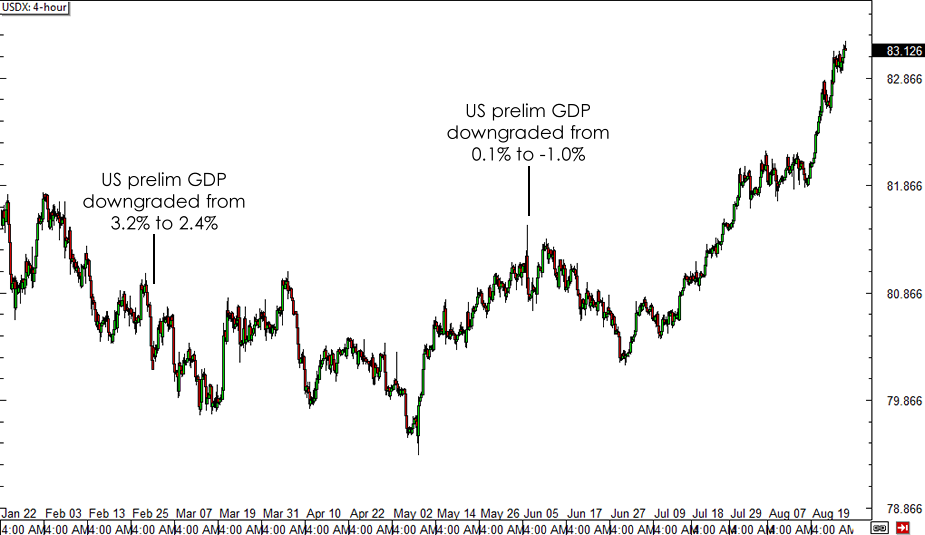

A quick review of past releases on the economic calendar reveals that the U.S. preliminary GDP report happens to contain significant revisions from the initial release. Heck, the GDP reading was dramatically downgraded from 0.1% to -1.0% in the previous quarter! Prior to that, the Q4 2013 GDP reading was revised from 3.2% to 2.4% while the Q3 2013 figure was upgraded from 2.8% to 3.6% during the second release.

With that, market participants are probably bracing themselves for a potential revision on the latest U.S. GDP reading, which showed a 4.0% expansion for Q2 2014. Economic experts predict that only a small downgrade to 3.9% might be seen for now, as retail sales figures have been lowered. Some expect to see upgrades in business investment and net exports, which might be enough to keep the GDP reading steady.

Another sharp downgrade could force the Greenback to return some of its recent losses, as previous downward revisions have resulted to dollar weakness in the weeks that followed.

On the other hand, no revisions or an upgrade could allow the U.S. dollar to extend its gains against its forex counterparts, as many are already taking a bullish dollar bias in anticipation of a rate hike next year. Strong growth figures could add support to these speculations, which might then lead to better business and consumer confidence. Eventually, this could lead to higher spending and investment, adding more fuel to growth prospects and potential Fed tightening.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.