The GBP/USD pair fell to an intraday low of 1.4865 levels on Thursday as the markets continue to build fresh long USD positions after Fed surprised investors with its hawkish Dot Chart. Sterling spiked from 1.4938 to 1.5002 levels in Europe in anticipation of a rebound in the UK retail sales, but failed to find takers even though the rebound was much higher than the market estimates.

The pair took out 1.48595 support as expected in the scenario study report (Macro Scan), but has recovered to 1.4929 levels in Asia today. With no major UK data due, the USD could remain bid heading into the holiday season.

Technicals – Bearish break below falling channel

-

As pointed out in the report here (Macro Scan), the pair is moving in a two falling channels.

-

As of now, the daily chart shows, the pair has witnessed a bearish break below the falling channel despite the upbeat UK retail sales data.

-

Consequently, the cable appears likely to test another falling channel support at 1.48 levels. The slide would gain pace below 1.4888 (76.4% of Apr-Jun rally)

-

A daily close above 1.4934 (bigger falling channel resistance) would open doors for a re-test of 1.5070 (falling trend line – Nov 2 high to Nov 19 high – resistance).

EUR/USD Analysis: Weak stocks could support EUR

The EUR/USD pair fell below 1.0890 (38.2% of 1.1495-1.0517) and extended losses to hit a session low of 1.0803 levels on Thursday. The broad based USD demand on account of the hawkish Fed dot chart pushed the EUR/USD pair.

EUR could re-test 1.0890 on weak stocks

The stock markets in the US dropped more than 1%, highlighting nervousness among investors due to prospects of four rate hikes next year. Investors were expecting a 25 basis points, but were not prepared for the Fed to hint at four hikes in 2016.

The Asian equities have turned lower today as well. At the time of writing, the S&P futures were down 0.25%. Consequently, the odds of the weakness in the Eurozone stocks is high and that may help the EUR re-test 1.0890 (38.2% of 1.1495-1.0517) levels.

Technicals –Bearish view intact

-

Euro’s close below 1.0890 (38.2% of 1.1495-1.0517) after having failed repeatedly to take out the 200-DMA and sustain above 1.10 levels indicates the currency could be heading towards 1.0748 (23.6% of 1.1495-1.0517).

-

However, re-test of 1.0890 appears likely on account of the weakness in the stocks.

-

But, the bearish developments on the daily chart mentioned above says the pair is unlikely to take out 1.0890. Thus, a failure to rise above 1.0890 could result in a break below 1.0803 (previous day’s low)and a slide to 1.0748 levels.

-

Only a daily close above 200-DMA at 1.1037 levels could turn the outlook bullish.

EUR/JPY: Is it heading towards 130.30 levels?

The BOJ kept the rates unchanged, but announced announced an additional JPY 300B in annual ETF purchases beginning in April. But, this program is initiated to offset a program that started in 2002 to buy financial shares which are scheduled to be sold slowly beginning in April and continuing for 5 years.

Consequently, the stimulus is not as big as it initially appeared and thus the Nikkei index dropped into losses, while the Japanese Yen regained its poised.

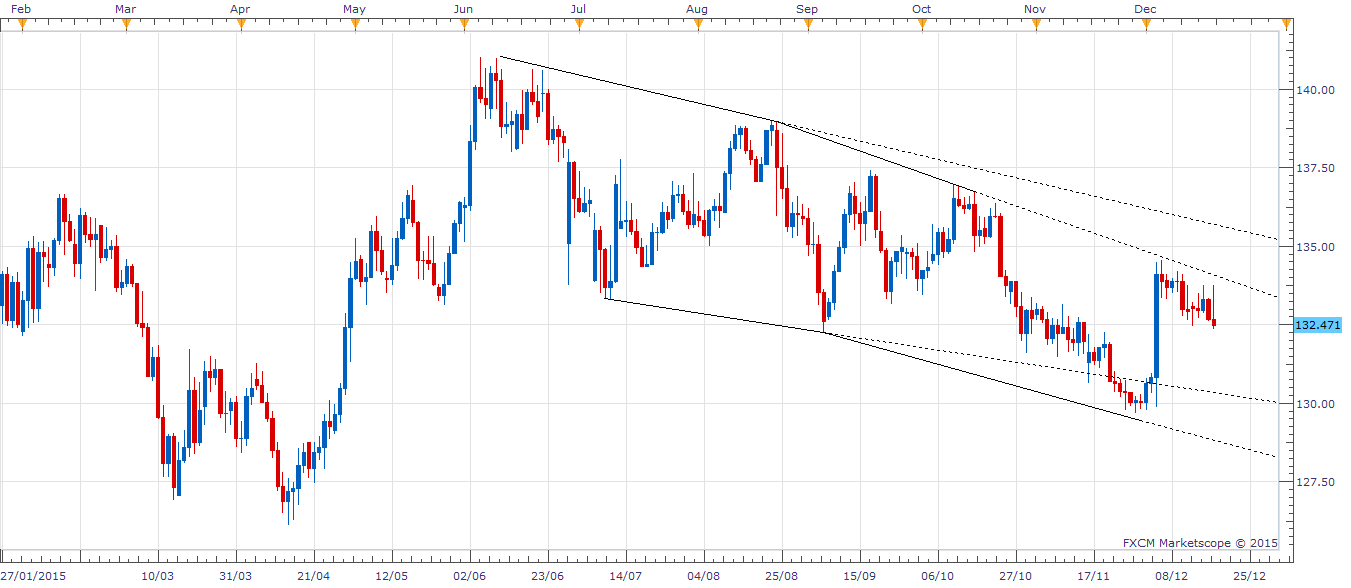

Technicals – Falling channel on the daily chart

-

EUR/JPY’s failure to sustain above the 50-DMA despite the BOJ’s minor stimulus announcement, coupled with the increased odds of a correction in the stock markets has opened doors for a drop to 131.69 (23.6% of 149.79-126.09).

-

The daily chart shows the cross is moving in a falling channel and the upside momentum has repeatedly stalled near channel resistance.

-

Consequently, a break below 131.69 would open doors for a drop to the channel support at 130.30 levels.

-------

What will 2016 bring to the Forex traders? Attend our event, Forex Forecast 2016 - The Panel with Ashraf Laidi, Valeria Bednarik, Boris Schlossberg, Adam Button, Ivan Delgado and Dale Pinkert. Register for the live event on Dec. 18th and get the recording too.

-------

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.