Market Brief

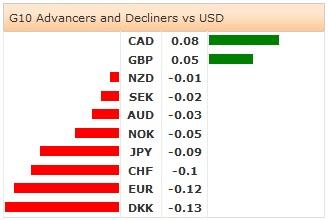

FX markets shifted into safe-haven positioning as Russia – Ukraine worries reappear. Regional equity indices fell as the Nikkei dropped -0.23% and the Hang Seng slipped -0.17%. However, in contrast China stayed positive further entrenching its unique defensive characteristics. Ukraine President Petro Poroshenko has charged Russia of sending its troops over the border. NATO also released satellite images for Russian military forces inside the Ukraine sovereign border. The Shanghai composite rose 0.55% and Shenzhen increased 0.50%. We see EURUSD rallies as an opportunity to reload short EURUSD positions based on geopolitical concerns and divergent monetary policy. In FX, USD was marginally stronger against the majors. EURUSD is ready to retest the week lows at 1.3150 while USDJPY traded in a tight range between 103.70 and 103.85 as 10yr US treasury yields were unchanged at 2.33%. In a whipsaw session, NZDUSD dropped nearly 0.20% to 0.8359 on the back of a weaker NZ business sentiment survey before sharply reversing to 0.8379. Asia EM FX, were basically unchanged, as the PBoC fixed USDCNY slightly higher to 6.1647. With a heavy scheduled economic calendar in the European and US session plus growing geopolitical concerns traders are holding current positions rather than build anything meaningful.

Weak data points to BoJ easing

Overnight, weak data in Japan further suggests to us that the BoJ will have to move forward to support the fading economic recovery. Japan’s industrial production increased 0.2% m/m in July, below 1.0% expectations. This weak read follows a prior fall of 3.4%. Total household spending decelerated -5.9% y/y on the month is following a -3.0% y/y drop in June (illustrating the VAT build up effect). Retail sales fell -0.5% in July, softer than the 0.3% m/m gain expected. Concerning still is the fall in vehicle production by -1.7% from 6.6% potentially indicating a further slowdown in exports. Japan’s inflation lessened to 3.4% y/y in July from 3.6% in June, in line with consensus. Core inflation ex-food remained unchanged at 3.3%. We are unsure of the exact nature and timing of the next BoJ action yet we are confident they will move forward. Given this expectations we remain significantly bearish on JPY and positive on Japanese equities (despite stretch valuations).

NZ activity slows

From New Zealand, ANZ business confidence dropped 24.4 in August (sixth consecutive month of declines) verse prior reading of 39.7 in July. Activity outlook fell to 36.6 in August from 45.1 in July illustrating a clear tern of slowing pace of growth. In other news NZ building permits rose slightly by 0.1% m/m in July, but below expectations of an increase of 1.0%. Finally in Asia, our constructive view on Asian growth recovery continues as South Korea’s industrial production accelerated 3.4% y/y in July, above growth expectations of 2.3%.

EU inflation is key

In the European session, traders will be keen to see how EA HICP inflation prints due to ECB Draghi comments linking stimulus measures with a sudden changed in data. Inflation is expected to dip to fall from 0.3% y/y in July to 0.2% y/y in August with slim risks to the upside. We expected QE to be launched early 2015 and remain bearish on EUR verse the USD. UK Gfk consumer confidence anticipated to rise to -1 in August, verse a July reading of -2. Swiss KoF leading indicator is expected to fall to 97.8 in August, from 98.1 print in July. Market will be watching the evolution of EURCHF as it grinds lower to 1.200 SNB threshold, in light of geopolitical concerns and expectations for ECB easing.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.