As we head into the Greek elections on Sunday, the anti-austerity party Syriza remains in the lead in the polls – a position it has occupied since May. However, an absolute majority by Syriza is far from a foregone conclusion.

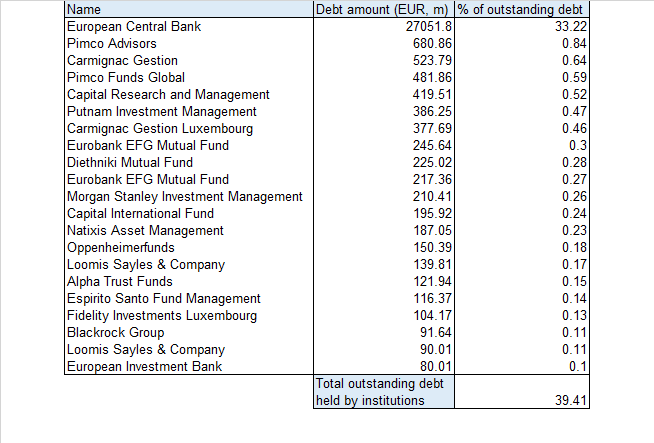

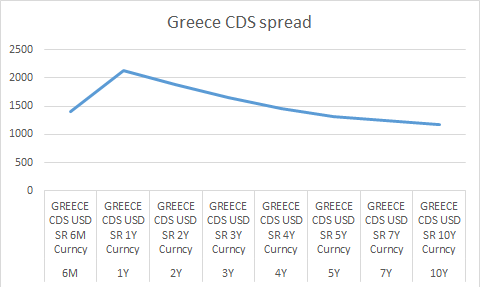

Under the Greek electoral system, the party with the highest votes in the popular elections is granted a 50-seat bonus in the 300-seat Greek parliament. But even with this bonus allocation, Syriza needs to gain at least 35 percent of the vote. According to a survey for the University of Macedonia conducted for Greece's SKAI Television, the latest poll puts Syriza in a 6.5 point lead over Prime Minister Antonis Samaras' New Democracy party. That lead translates to 33.5 percent of the vote – just short of the 35 percent needed to secure an absolute majority for the party that has pledged to renegotiate Greek debt, pushing for a 50 percent haircut on Greek obligations. Greek public debt currently stands at around EUR315bn.

Under the Troika agreement, Greece has been part of a EUR240bn bailout agreement since 2010. This agreement would have to be renegotiated by the new government.

On its website, Syrizia demands:

Immediate parliamentary elections and a strong negotiation mandate with the goal to:

• Write-off the greater part of public debt’s nominal value so that it becomes sustainable in the context of a«European Debt Conference». It happened for Germany in 1953. It can also happen for the South of Europe and Greece.

• Include a «growth clause» in the repayment of the remaining part so that it is growth-financed and not budget-financed.

• Include a significant grace period («moratorium») in debt servicing to save funds for growth.

• Exclude public investment from the restrictions of the Stability and Growth Pact.

• A «European New Deal» of public investment financed by the European Investment Bank.

• Quantitative easing by the European Central Bank with direct purchases of sovereign bonds.

• Finally, we declare once again that the issue of the Nazi Occupation forced loan from the Bank of Greece is open for us. Our partners know it. It will become the country’s official position from our first days in power.

However, the incoming government will face EUR7bn of repayment obligation in March – a sum that Greece’s current government coffers are unable to fulfil meaning that Syrizia – the self-styled anti-austerity party – would have to find a way of meeting these obligations or fall into default. This would put their demands for a “significant grace period in debt servicing to save funds for growth” up to an early test.

There is a possibility that the Troika would acquiesce to these demands, at least in the short term, granting credit through the European Stability Mechanism (ESM) to meet its obligations.

Coalition stability

Should Syrizia fall short of its 35 percent threshold, it would be forced to seek coalition partners with To Potami being the most likely candidates given their shared policy of pressure to give Greece a holiday on its debt repayments. A Syrizia-To Potomi coalition would probably be the most stable outcome in the eyes of the markets, with the less radical To Potomi moderating Syrizia’s more extreme demands over drastic restructuring of Greek debt.

2012 re-run

A third possibility is a re-run of the 2012 general elections when Antonis Samaras' New Democracy party scraped a victory with 19 percent of the popular vote compared with 18 percent for Syrizia. After a failure to secure a coalition agreement within 9 days, in accordance with Greek law a second vote saw New Democracy take 30 percent of the vote and form a coalition government with centre-left party PASOK. Such a situation would be extremely volatile falling so close to the end of the current bailout agreement.

New Democracy surprise

There is an outside chance that the electorate takes a look at what Syrizia is offering on voting day, looks at the drastic demands, and vote for a return of Antonis Samaras' New Democracy party. But that outcome is highly unlikely. Opinion polls show a Greek electorate highly in favour of public debt restructuring – something front and centre of Syrizia’s manifesto.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.