AUDUSD received a boost in its momentum to continue the recent Bull trend last night, just after midnight at 00:30GMT data was released for Australian unemployment. Expectations had been for worse data, instead not only were figures released much better than expected but they were also much better than previous numbers.

The unemployment rate was expected at 6% and was released at 5.8% lower than the previous month at 5.9%. Probably the most striking data was employment change, which represents the number of jobs added. This figure was expected at negative 10 thousand but was actually released at plus 71.4 thousand.

Not surprising then that the AUDUSD rallied from pre‐data levels of 0.7239 to 0.7333 within the space of 18 minutes. It has since been trading in a range and we may expect that to remain so until the Royal Bank of Australia (RBA) monetary policy meeting minutes are published next Tuesday 15th.

The meeting minutes can give insight as to how the board members feel about the economic outlook going forward and the resulting pressure on inflation. At the last meeting on December 1st there had been great anticipation the RBA would lower interest rates. However that did not materialize and the minutes published two weeks later stated stable employment and GDP growth predictions along with inflation pressure as reasons for their decision.

Further volatility may be seen tomorrow after data is released in the US for Retail sales at 13:30GMT and Michigan Consumer Confidence at 15:00GMT. Retail Sales show how active consumers are and account for a large proportion of economic activity. Data for Retail Sales is expected at 0.3% MoM, up from last month at 0.1%. Consumer Confidence is expected at 91.0 with a previous release at 91.3. Higher than expected data for either of those two releases could send AUDUSD back down again at least in the short term.

If you think AUDUSD will continue its recent trend higher then you may buy a Call option, this gives you the right to buy this pair at a preset price (strike) for a preset date (expiry) and for an amount of your choice.

The screenshot below shows that a Call option on AUDUSD with a strike at 0.7305, expiry 7 days and for A$ 10,000 would cost $57.74, which would also be your maximum risk.

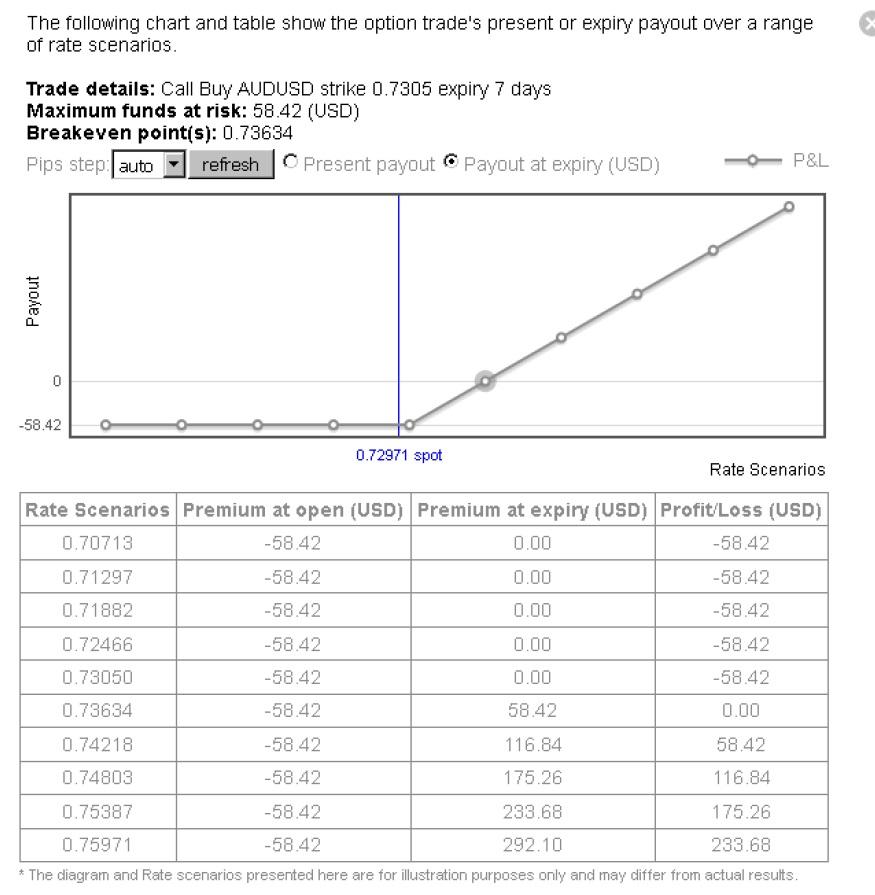

This screenshot shows the Profit and Loss profile for the above Call option, which you can see by pressing the Scenarios button.

If you think the AUDUSD will revert to its previous Bear trend then you may buy a Put option which gives you the right to sell AUDUSD at a preset strike, expiry and for an amount of your choice.

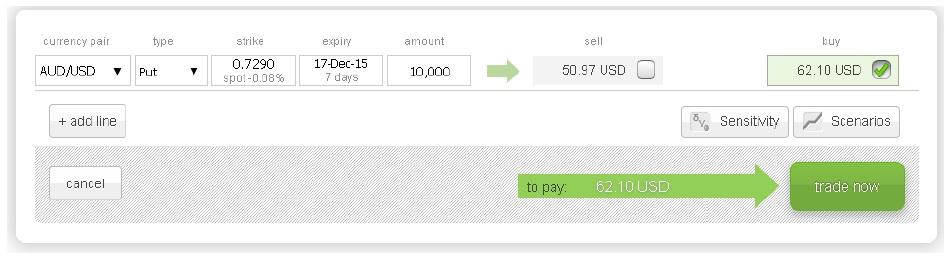

The screenshot below shows that a AUDUSD Put option with 0.7290 strike, expiry 7 days and for A$10,000 would cost $62.10, which would also be your maximum risk.

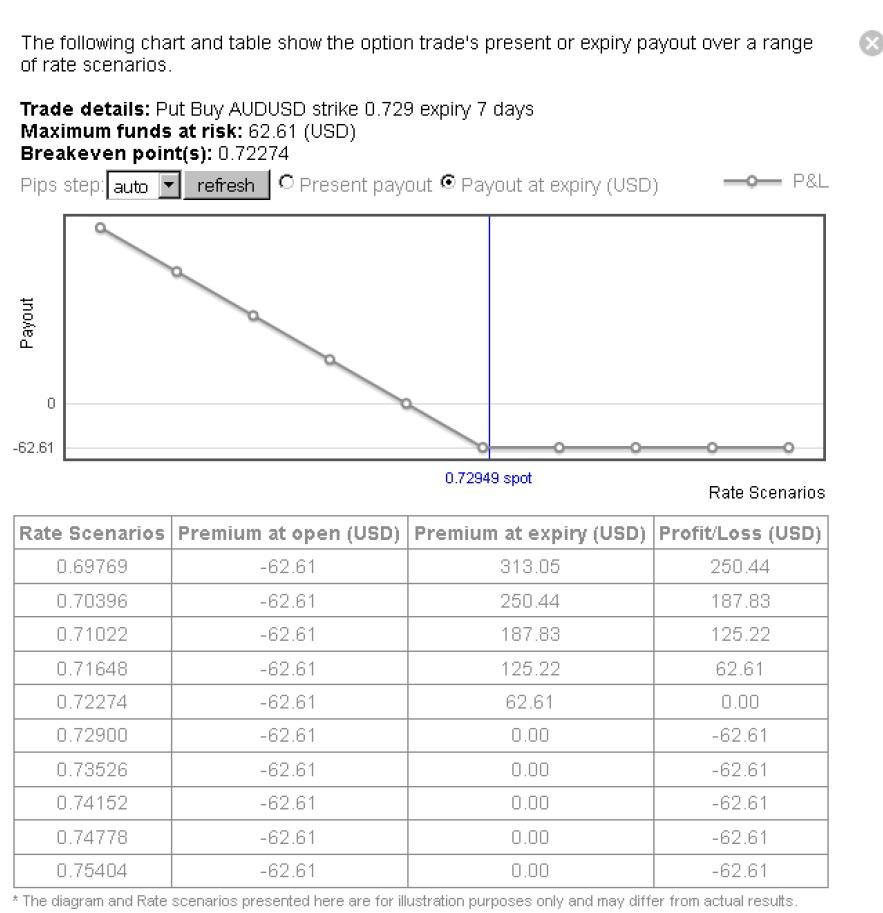

The screenshot below shows the Profit and Loss profile for the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.