Following its climb to 8-month highs versus the US dollar, the Australian dollar has retreated somewhat; posting a particularly sharp drop after today’s RBA meeting. Specifically, the aussie has fallen from the 0.7772 high to 0.7510 in less than a week. The aussie had traded as low as 0.6826 during the first half of January. Looking at the charts, the aussie’s move looks like a normal reaction from overbought levels following a rapid move higher and the currency still lies far above its 200-day moving average as well as other support such as the Ichimoku cloud top. The tenkan-sen and kijun-sen lines are still positively aligned as well.

Turning to the fundamentals, the Australian economy is an exception among developed economies, as it is expected to post growth of nearly 3% during 2016, while its base interest rate is relatively high at 2.00%. The unemployment rate has come down below 6% (5.8% during March), while inflation during the fourth quarter was a bit lower than what the central bank had wanted at 1.7%. Looking at this data in isolation, without neglecting to mention the buoyant housing market in the country, would probably argue for a rising exchange rate against the other majors, some of which are facing deflation scares and negative interest rates while others have interest rates between 0% and 1%.

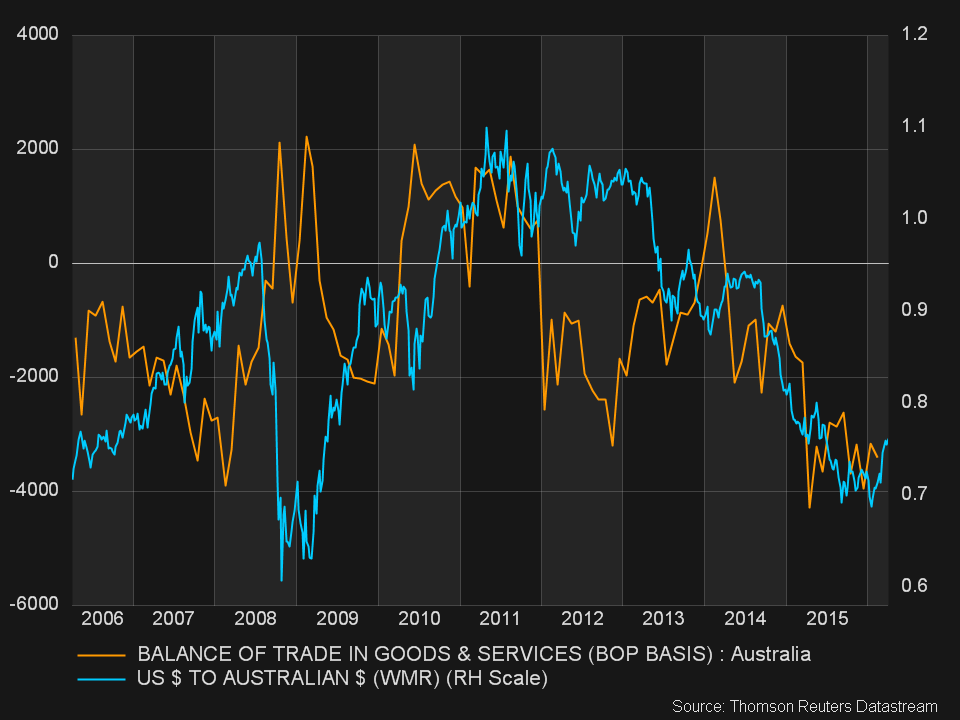

However, the fact that Australia is a major commodity producer and the importance of mining and commodity exports for its economy, should also be taken into account. The Australian trade deficit is near the worst levels of the past decade for example (see chart), whereas in the period when commodity prices were high, there were years when those commodity exports meant a trade surplus. Aside from mining, agriculture is also a sector that is a little more important in Australia compared to other developed economies.

Commodity prices have been under relentless pressure for the past 5 years - a trend that culminated in the collapse of the price of oil during the past year and a half. Because of the importance of commodities as an export-earner for the country, the downtrend in commodity prices has brought down the aussie with it, lowering AUD/USD from 1.10 in 2011 to 0.67 at the beginning of this year. Furthermore, the Reserve Bank of Australia used constant verbal intervention in order to drive the currency lower, so as to improve the country’s terms of trade by cheapening exports and making imports more expensive. China’s economic slowdown is also hurting the Australian dollar and the aussie often benefits when there is positive risk appetite.

One risk that aussie bulls are facing is that once the aussie breaks above, say the psychologically important 80 cent level, the RBA jawboning could become much louder. The bank could also threaten aussie longs with more interest rate cuts despite possible overheating of the domestic real estate market. Therefore, it would take a sustained uptrend in commodity prices and the RBA looking the other way for the aussie to enter a fresh bull phase and take out levels above 80 cents. This appears unlikely at the moment, while some more bad news out of China feels inevitable at some point later this year.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.