USD/NOK

The dollar traded unchanged against most of its G10 counterparts during the European morning Wednesday, except AUD and NOK, where it was higher.

The 2nd estimate of UK Q3 GDP came in as expected at 0.7% qoq, unchanged from the initial estimate. Growth in the service sector was revised up but industrial production was revised down, adding to evidence that the recovery was less balanced than previously thought. GBP strengthened ahead of the GDP release but weakened afterwards to trade unchanged against the dollar. The growth report was not so encouraging and is likely to leave GBP vulnerable, especially if the US data to be released later in the day beat expectations.

The Norwegian krone depreciated after the country’s AKU unemployment rate for September failed to decline as the official unemployment figure did for the same month. Another reason for the increased pressure on NOK is the cautious mood of investors before the OPEC meeting on Thursday. Since Norway is the largest oil producer and exporter in Western Europe, the country’s currency could weaken further if the meeting ends without a consensus to stabilize oil market.

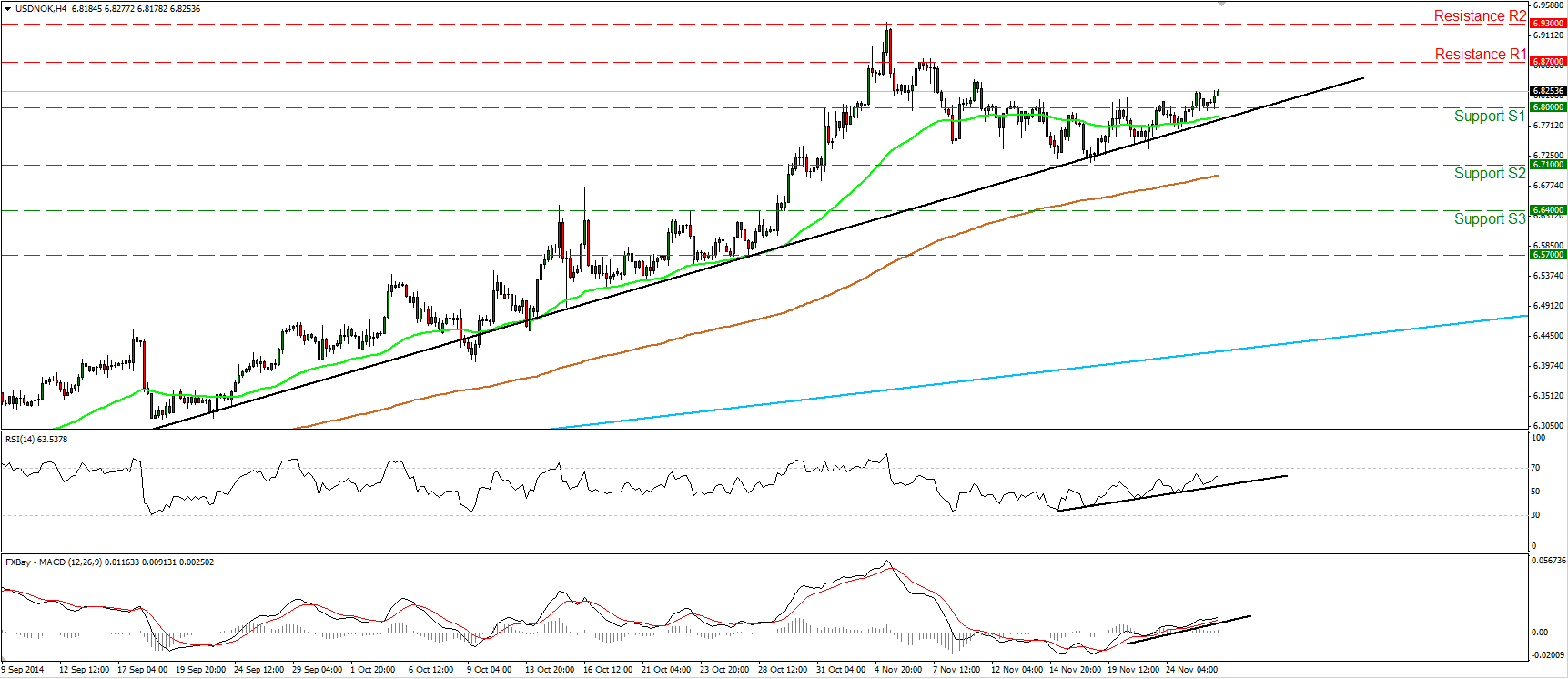

USD/NOK moved higher during the European morning after finding support near 6.8000 (S1). I would now expect the rebound to target the resistance zone of 6.8700 (R1). A clear break above that hurdle is likely to extend the bullish wave, perhaps towards the next resistance zone, at 6.9300 (R2), determined by the high of the 5th of November. Our short-term oscillators support this scenario. Both of them follow upside paths as marked by their upside support lines. Moreover, the RSI rebounded from slightly above its 50 line and edged higher, while the MACD stands above both its zero and signal lines. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 6.8000 (S1), 6.7100 (S2), 6.6400 (S3) .

Resistance: 6.8700 (R1), 6.9300 (R2), 7.0000 (R3).

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.