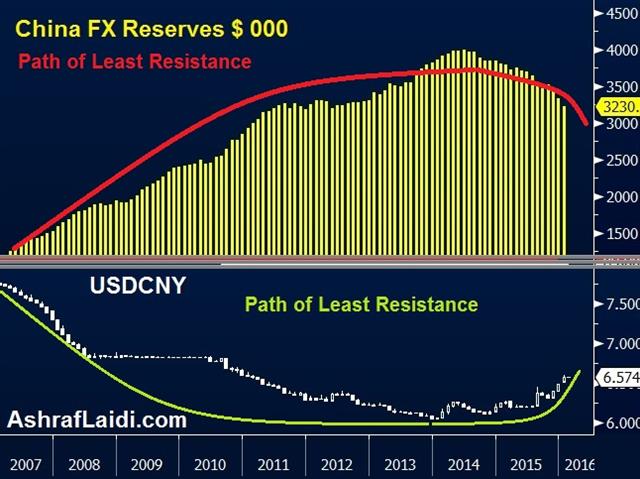

January forex reserve data revealed on the weekend that China is burning through reserves at an unsustainable pace in order to strengthen the yuan. Yet the common theme remains that China wants to soften their currency. We look at the dilemma officials are facing and how it will end.

It's Chinese New Year Monday and markets there and in other parts of Asia will be closed all week. That may give markets an opportunity to stabilize as one of the factors driving volatility is removed.

It's also a chance to try to make sense of China's strategy. Why not just allow market forces to weaken the yuan?

For Chinese officials, what's as important as the direction of the currency is why it's moving. At the moment, they see capital exiting China on jitters about the economy and stock market. Beijing is obsessed with stability and the appearance of control. That's why they've put much effort into smoothing yuan and stock market moves.

China wants to have open markets, but only on its terms. Unfortunately, even the most well-developed, transparent markets are prone to irrational volatility, as 2016 so far has proven. China won't spend all its reserves to combat the inevitable loss to market forces, so it's a matter of when and how they give in.

Naturally, Beijing wants to give up control on its terms but it's increasingly likely that markets won't cooperate. The opacity of the Chinese economy will always make it vulnerable to capital flight. China's true dilemma is whether to accept it or change course back towards tighter capital controls. The latter is more likely than most market participants believe.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -87K vs -127K prior JPY +37K vs +50K prior GBP -45K vs -47K prior AUD -26K vs -33K prior CAD -52K vs -67K prior NZD -8K vs -5K prior

This is the first look at the data since the surprise BOJ decision. The yen long trade wasn't squeezed as much as it appeared, although the numbers could also reflect fresh shorts after the USD/JPY to 121 fizzled. Instead, it was euro shorts that rushed out of the way and that was before the latest break above 1.10.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.