![]()

This week has seen Q1 earnings season start to rev up. Some key US corporates have announced results already this week, and we have generally seen results beat expectations. Both sales and earnings growth has been strong so far; however we would note that at the time of writing only 49/500 companies had reported their Q1 results.

Financial sector gets its mojo back

The financial sector, which makes up nearly 17% of the S&P 500, has seen some big names report earnings this week. Compared to Q4 2014, when the financial sector was an underperformer, results, so far, have been good. For example, JP Morgan, Wells Fargo, Citigroup, and Bank of America all beat earnings expectations, even if their earnings were not consistent across departments; Citi, for example, managed to beat expectations even though trading revenues fell due to cost cutting.A special mention goes to Goldman Sachs, who smashed expectations of $4.25 per share, to post $6 per share. There was good news for trading and deal fees, and earnings rose by the most since the financial crisis. Unfortunately its peers still need to play catch up, suggesting that, once again, Goldman is ahead of the pack.

The market reaction:

US markets have taken the lead from Europe today and are in the red. Another day of weaker than expected US economic data as well as rising Greek default fears have weighed on market sentiment after a strong start to the year for the US index. The financial sector is one of the weakest sectors in the S&P 500 on Thursday due to the following reasons:1, Sentiment towards the global financial sector could get hit if there is a Greek debt default, although we think that any dip in sentiment may be short-lived.

2, Apart from Goldman Sachs, earnings at some of the other big financial firms were not as good as the headline figures suggest, with some of the earnings growth being driven by cost-cutting.

3, Goldman’s is one of the weakest performers in the financial sector today, even after the good set of earnings for Q1. The markets could doubt whether the bank can continue to make gains at this pace, or if they will slow down later this year. Thus, Goldman could be a victim of its own success.

Overall, we think that US stocks are not prioritising earnings season right now due to the shadow of a Greek debt default hanging over the markets. We believe that if Greece can’t pay its debts in the coming weeks then it could move into a “managed default”, which may be accepted positively by the markets. So, the markets could be selling the rumour before buying the fact.

Although markets are lower today, we continue to think that the trend for developed market stock indices is higher. Looking ahead, we believe that European stocks will continue to outpace gains in US indices, regardless of earnings, as the market looks towards a potential rate hike from the Federal Reserve later this year.

Upcoming earnings:

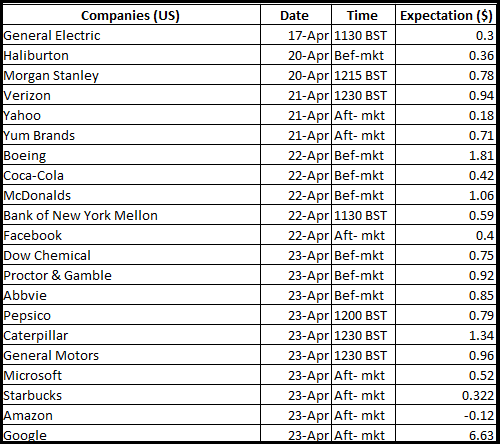

As you can see, earnings over the next 7 days are a mixture of household names and some of the tech giants. Due to this, the outcome of these results could be a key test of US economic strength and could have a large impact on the S&P 500.Worth noting is that Amazon is the only major company on the S&P 500 that is expected to report a decline in earnings for Q1, so the online retailer could be one to watch.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.