![]()

In typical Christmas week trade, the forex market has been generally quiet today as the US dollar is putting in a mixed performance against its G10 rivals. As my colleague Fawad Razaqzada noted earlier today, EURUSD is edging higher off a key long-term support level, but the world’s reserve currency is gaining ground elsewhere, including against the pound, yen, and commodity dollars. In the EM space, the dollar’s performance is similarly mixed as traders continue to reverse some of last week’s panic moves.

Of course, the epicenter of last week’s panic was in Russia, where the ruble lost over 33% of its value agains the US dollar in the first few trading days before Russia’s central bank was forced to step in and hike rates by a staggering 650bps to 17%. While this will undoubtedly put a damper on economic activity down the road, it has been successful in stabilizing the currency in the short term.

Unfortunately for Russian policymakers, the currency’s collapse has claimed at least casualty: over the weekend, Russia’s National Trust Bank required a RUB 30B bailout from the Central Bank of Russia amidst mass withdrawals. Though it was only the country’s 32nd largest bank, many analysts fear that its failure is the proverbial “canary in the coal mine” for further bank runs in the coming weeks. Meanwhile, former Finance Minister Alexi Kudrin ominously warned last week that Russia could face into a “full-scale economic crisis” next year, with inflation rising above 15%, GDP contracting by 4%, and a “cascade of defaults” among major Russian corporations.

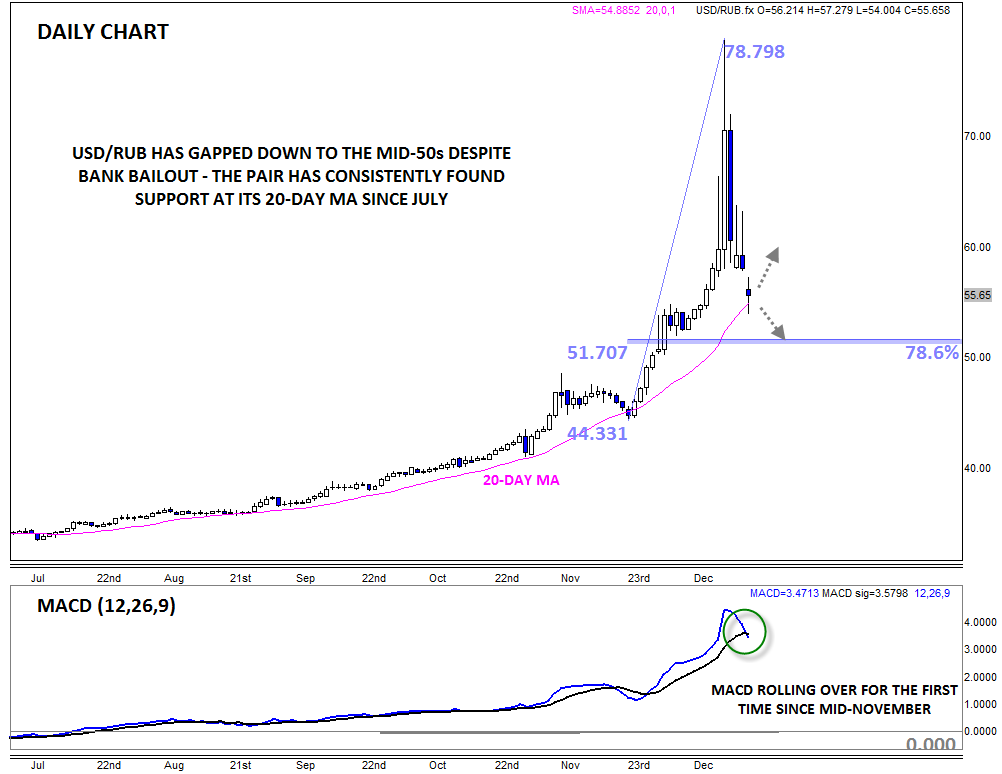

As we go to press, traders are at least taking a relatively sanguine view toward Russia’s financial issues. USDRUB gapped lower into the mid-50s to start the week, and the currency has managed to hold near that level thus far today. The efficacy of technical analysis is limited in such an emotionally-driven market, but for what it’s worth, the pair is now testing a key support level at the 20-day MA, which has consistently provided support since July. The pair’s MACD indicator is now back to showing signs of rolling over for the first time since mid-November.

If no further suprises emerge over the holiday season, USDRUB may break key support at its 20-day MA, clearing the way for a move down to its 78.6% Fibonacci retracement at 51.70 or key psychological support at 50.00. On the other hand, if oil prices resume their decline or the failure of National Trust Bank prompts runs on other banks, USDRUB could easily turn higher off its support level and rise back toward 60 by New Year’s Day.

Source: FOREX.com

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold rises above $2,340 as US yields retreat

Gold gained traction and advanced above $2,340 in the European morning on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.7% ahead of key inflation data from the US, helping XAU/USD stretch higher.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.