A few fundamental factors are weighing on the ZAR:

Growth fears in South Africa

A rapidly rising budget deficit

Another flare up in social unrest in the mining region

A general dislike for carry currencies like the rand, the AUD, etc.

The last point is of particular concern – the market is ditching risky EM and carry currencies in favour of safe havens like the yen and the CHF. After falling for most of this year, JPYZAR is up more than 10% in the last 2 weeks.

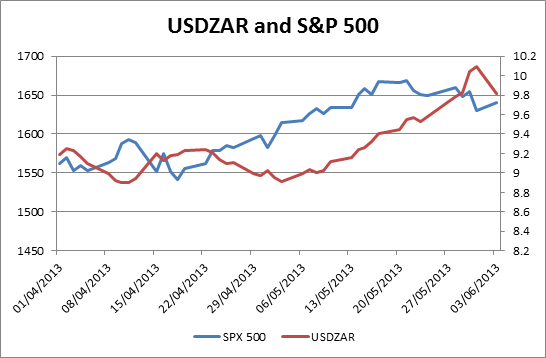

It is not only the yen that has an inverse relationship with the rand, stocks seem to as well.

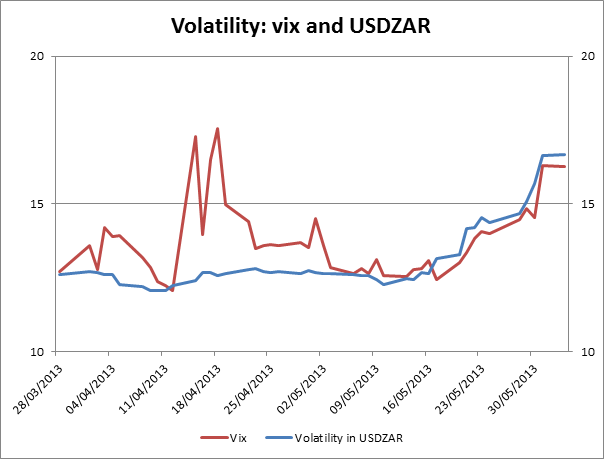

At the same time as pressure on ZAR has grown, stock markets have come off their highs. We believe there is a link between rising volatility in emerging market FX and the performance of the stock market. The chart below shows 3-month volatility for USDZAR (as measured by the option market) and the Vix volatility index, which measures volatility in the S&P 500. As you can see, volatility in USDZAR has surged and this has coincided with a rise in the Vix. When the Vix spikes stocks tend to sell off, and vice versa.

Source: FOREX.com and Bloomberg

Takeaway: emerging markets are a good reflection of fears that are starting to grip the market. Thus, it is worth watching USDZAR if you trade stocks, since in recent weeks stocks and USDZAR have tended to peak around the same time.

Short term market idea: USDZAR has fallen back from highs above 10.00 in the last two trading sessions; this could help stocks to stage a short term recovery.

Key levels to watch in S&P 500:

Resistance: 1,645, 1,655, and then 1,675.

Support: 1,635 – daily pivot, then 1,615,

Source: Bloomberg and FOREX.com

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.