The gross domestic product (GDP) is the monetary value of all finished goods and services produced within a country in a specific time period. It is also the most common measure of a nation’s overall economic activity or the size of economy. More and more economists recognize the flawed character of GDP (for example, it includes only final goods and services; overstates the consumption; it assumes that government spending is productive; it treats imports as something negative; it excludes household work, and so on), but governments, central banks, financial analysts and investors still think it is possible to frame the whole economy in just one number. This is why the GDP growth is still closely followed, also in the gold market.

The literature discerns two channels of GDP’s influence on the price of the shiny metal: the income-consumption channel and the safe-haven channel. Let’s start with the former. The reasoning goes as follows: when the economy grows fast (as opposed to slowly or declining), people’s incomes and purchasing power rise (and respectively: stagnates or decreases), so does the demand for gold. We are skeptical about this alleged relationship, because – as we showed in the July Market Overview – the gold price is not significantly driven by the consumer demand, but by investment demand (consumers are price-takers, not price setters, hence they buy more when the prices decrease and vice versa).

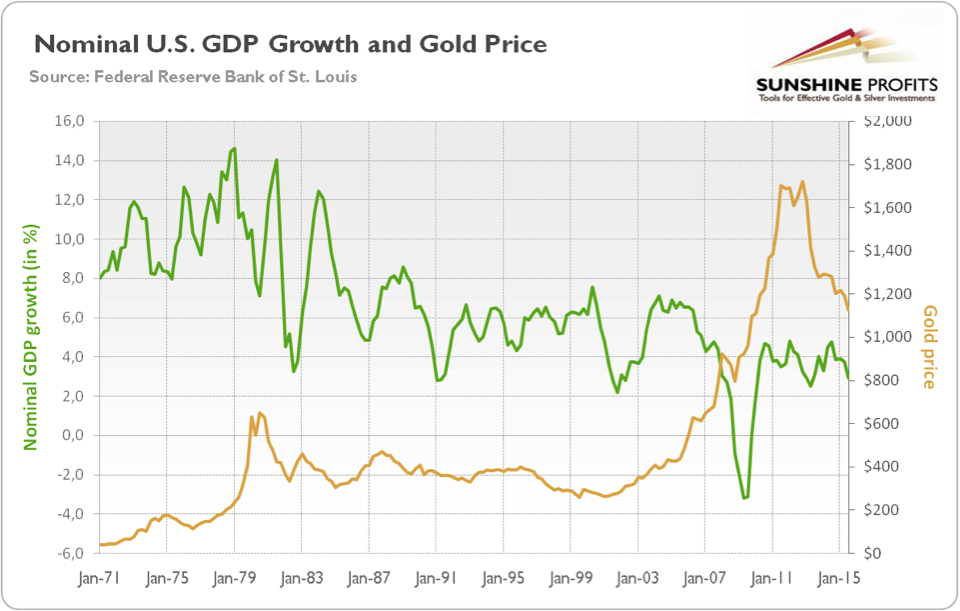

According to the safe-haven channel, GDP indicates the economic health of a country, while gold is a non-confidence vote in the U.S. economy. Hence, there should be a negative correlation between GDP growth and the price of gold. When the economy expands, investment demand (attracted by the safe-haven character of the shiny metal) falls, and vice versa. Let’s analyze the chart below, which presents the nominal U.S. GDP growth and the price of gold (we chose nominal, not real growth, because we compare it with nominal gold prices).

Chart 1: Nominal U.S. GDP growth (green line, left scale, year-over-year changes in percent) and gold price (yellow line, right scale, London P.M. fixing) from 1971 to 2015.

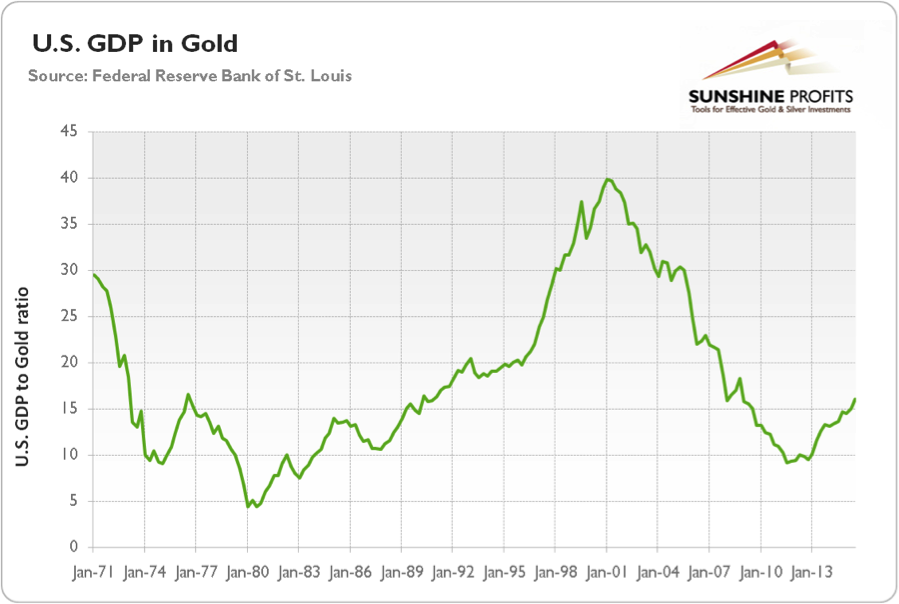

As one can see, the price of gold was rising in the 1970s, while GDP growth was declining only during a few years during that decade. In the 1980s and the 1990s, the pace of economic growth was quite high and stable, so gold remained in the secular bear market. In the 2000s, the price of gold was rising both during rises and falls in the pace of GDP growth. And in the 2010s, the shiny metal was again in the bear market, despite the unimpressive economic recovery of the U.S. Although, it seems that there is no clear relationship between gold prices and GDP growth, we shouldn’t come to the conclusions too quickly. The chart below presenting the nominal U.S. GDP divided by the price of gold, paints a somewhat different picture. As one can see, the U.S. GDP to gold ratio was negatively correlated with the price of gold: the U.S. GDP in relation to the price of gold was declining in the 1970s and 2000s, and rising in the 1980s, 1990s and 2010s.

Chart 2: U.S. GDP to gold ratio from 1971 to 2015

However, investors should remember two things. First, GDP is a lagging and often revised indicator. This is why whether the GDP is above or below market expectations (i.e. the surprise component of the news) is more important than the number alone. Whereas, gold (as every currency in general) is a leading indicator, which quickly incorporates investors’ expectations about the future outlook. Therefore, gold does a much better job in predicting recession. For example, the price of gold signaled the high probability of the Great Recession as early as in the fourth quarter of 2005, while GDP declined (i.e. the GDP growth became negative) not earlier than in the third quarter of 2008 (officially recession started in December 2007).

Second, GDP is a very aggregate and complex measure of the economic production of a country. The index itself is often not relevant for investors, who are usually interested in comparative analysis between different sectors and asset classes. This is why GDP growth may affect the gold market in completely different ways. Much depends on its trend, sources of its growth (e.g. when GDP is boosted by monetary stimulus or government fiscal deficits, the gold price may also rise) and how it will affect the Fed’s actions. Usually, strong GDP growth warrants restrictive monetary policy (this is why sometimes gold prices fell on strong U.S. GDP data), providing this is not a jobless growth. This is one of the reasons why the Fed maintained its unconventionally ease stance (which later turned out to be negative for the gold market), even though the Great Recession ended in June 2009 and overall economic activity exhibited signs of recovery.

To sum up, there is a negative correlation between the price of gold and the ratio of the U.S. GDP to gold price. It makes sense, given the fact that gold is a non-confidence vote in the U.S. economy and a currency competing with the greenback. However, since GDP is a very complex and aggregate lagging indicator, the relationship between these two variables should be taken with a grain of salt.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the price of gold, we invite you to read the December Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.