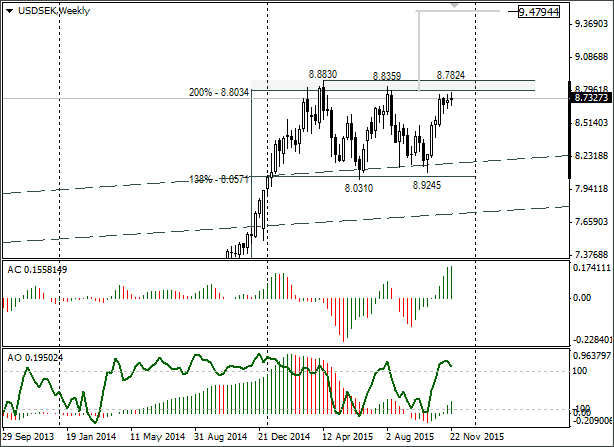

Trading opportunities for currency pair: a W-shape pattern is just about formed. If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. It has until April 2016 to reach the target. The interim target is at 9.3259 (March 2009 maximum). Growth will cancel if the weekly candle closes below 8.4933. Following a rebound from 8.83, I will be waiting for a return to 8.18 along the same W-shaped pattern.

Background:

The last USD/SEK idea I made came out on 26th October. The rate at that time stood at 8.4945. I was waiting for the dollar to strengthen to 8.8359 along the W-shaped pattern. The target still hasn’t been reached. In actual fact, the USD/SEK lifted to 8.7824.

As things are at the moment:

So what should we do if it reaches 8.8359? Market participants are expecting the US Fed to put up their rates. On the 4th December a US labour market report will be out. After the trading session closes on Friday, ready yourself for a break in the 8.88 resistance or the formation of an inverted candle combination (bounce from the resistance).

If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. The interim target in this case will be 9.3259 (March 2009 maximum). If we see a rebound from 8.83, I’ll be expecting a return of the rate to 8.18 along the same W-shaped pattern.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.