Hourly

Yesterday’s Trading:

The euro/dollar ended up closing down yesterday. The euro lost 160 points after the Fed published its press release. The Federal Reserve decided to leave the interest rate unchanged in a 0.0%-0.25% range. In the text announcement, a phrase about the effect of global problems on US inflation was removed.

The next FOMC meeting is set for 15-16th December, 2015. Following this meeting, an announcement will be made, in addition to economic forecasts and a press conference held by Janet Yellen.

Main news of the day:

09:00 EET, UK housing index from Nationwide;

10:55, German labour market data;

12:00 EET, European economic sentiment and consumer confidence indices;

13:00 EET, UK retail sales from the Confederation of British Industrialists;

14:30 EET, US initial unemployment benefit applications and GDP for Q3;

15:00 EET, German CPI;

16:00 EET, US incomplete housing sales;

16:10 EET, FOMC member Lockhart to speak.

Market Expectations:

There’s a decent whack of news out today. The key event of the day for all currencies is the US’ Q3 GDP report. The 1.0807-1.0838 target zone from previous trading ideas for the EUR/USD is still in force. Since the euro flew off the chart in the evening, I expect a correction after the minimum is updated. The EURUSD’s fall is set to continue on Friday.

Technical Analysis:

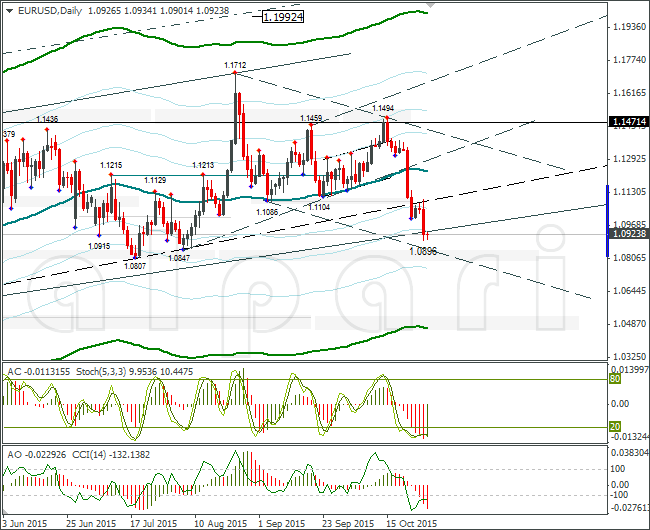

Intraday target maximum: 1.0945, minimum: 1.0880, close: 1.0920;

Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar rate has rebounded from the D4. The euro is currently being quoted around 1.0896. On my forecast I’ve gone for a renewal of the minimum so that bull divergence will form between the AO indicator and the price. After which, we could well see a correction to 1.0945. Could the euro rebound immediately? It could, but if US GDP data is higher than expected, the euro will fall and the forecast will be no longer valid.

Daily

The euro/dollar is nearing the 1.0807-1.0818 price zone (27th May and 20th July minimums). Fed comments shot the euro down. Taking into account that the ECB still wants to expand QE and lower deposit rates, in the near future the euro should reach the targets. Now to the Weekly.

Weekly

The line has been broken. Now onward and downward to 1.0818.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.