Analysis for October 30th, 2014

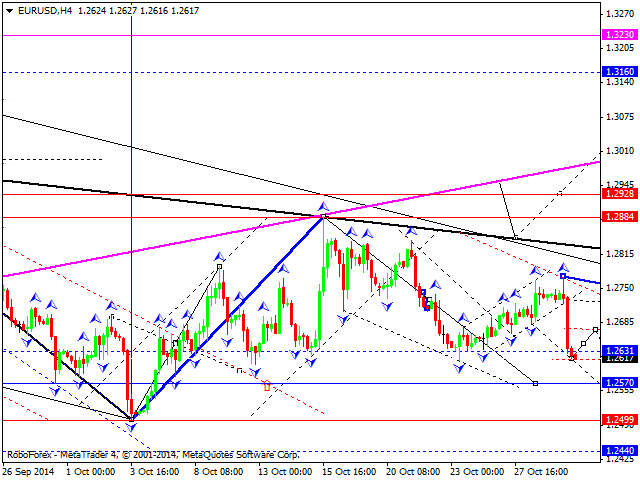

EURUSD, “Euro vs US Dollar”

Being influenced by the fundamental background, Euro has started forming another descending structure. We think, today the price may continue forming flag pattern with the target at level of 1.2570. Later, in our opinion, the market may consolidate and form a reversal pattern to continue forming an ascending wave. The first target is at 1.2930.

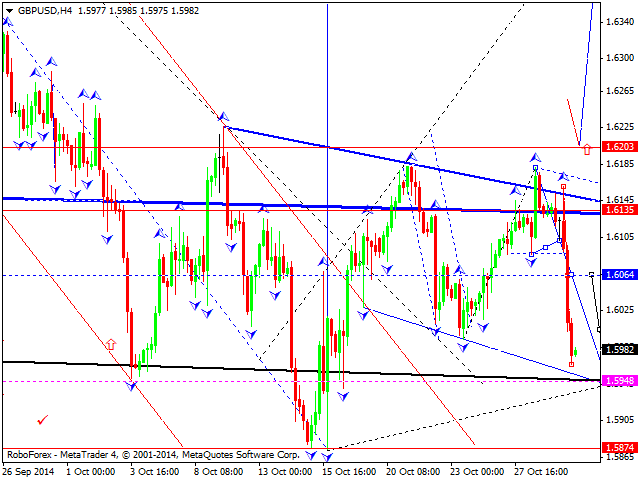

GBPUSD, “Great Britain Pound vs US Dollar”

Being influenced by the fundamental background, Pound has started falling. We think, today the price may reach level of 1.5950. Later, in our opinion, the market may consolidate and form a reversal structure for a new ascending wave towards level of 1.6200.

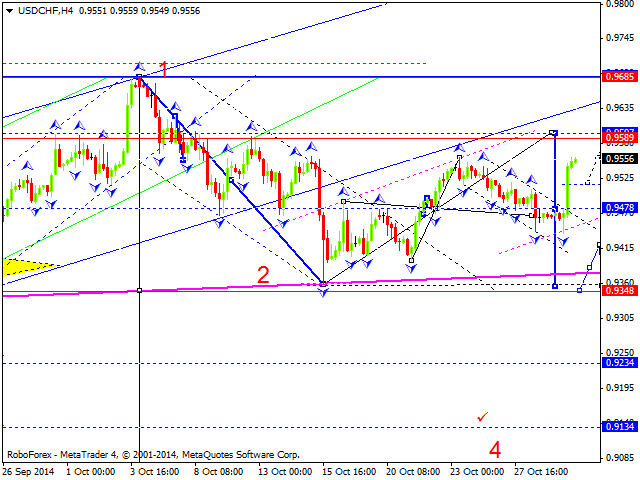

USDCHF, “US Dollar vs Swiss Franc”

Being influenced by the fundamental background, Franc is still forming flag pattern. We think, today the price may reach level of 0.9590. Later, in our opinion, the market may consolidate and form a reversal pattern. The pair is expected to start forming another wave inside the downtrend. The first target is at level of 0.9350.

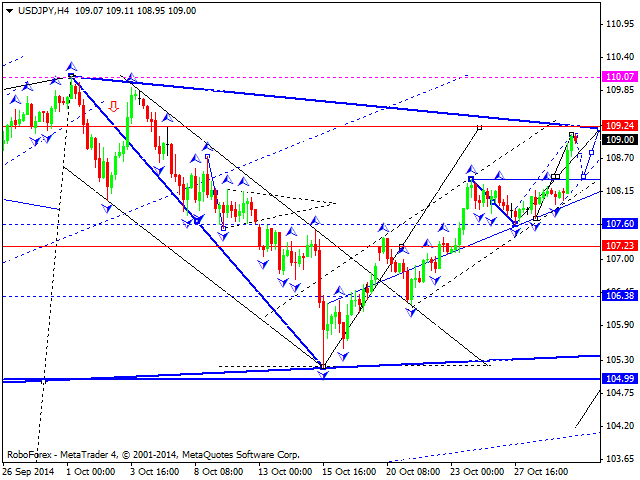

USDJPY, “US Dollar vs Japanese Yen”

Being influenced by the fundamental background, Yen has broken its consolidation range upwards. We think, today the price may reach level of 109.24. Later, in our opinion, the market may consolidate and form a reversal pattern to continue moving inside the downtrend. The first target is at level of 105.00.

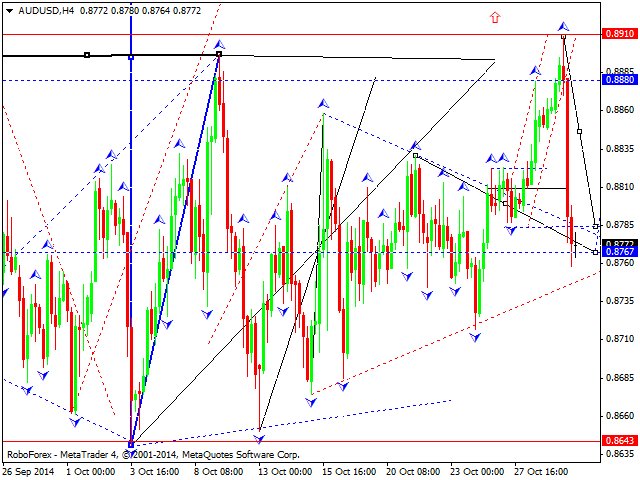

AUDUSD, “Australian Dollar vs US Dollar”

Being influenced by the fundamental background, Australian Dollar has fallen and reached level 0.8767. We think, today the price consolidate and form a reversal pattern. The pair is expected to form another ascending structure with the target at 0.8910.

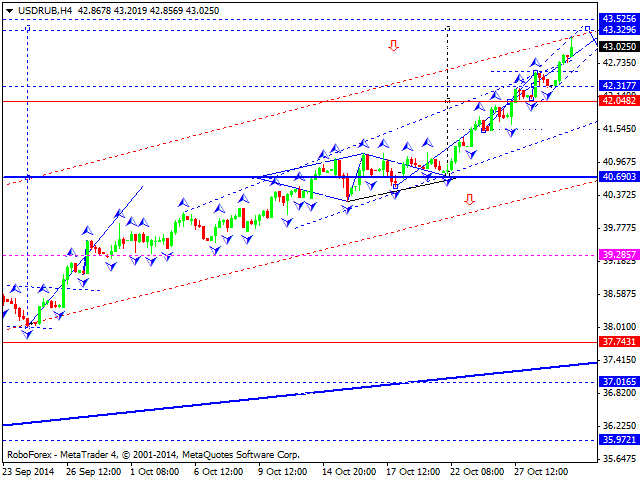

USDRUB, “US Dollar vs Russian Ruble”

Ruble is still moving inside an ascending structure. We think, today the price may reach level of 43.33 and then form a new consolidation channel. The pair is expected to fall towards level of 42.00 and then start another ascending movement with the target at level of 43.53.

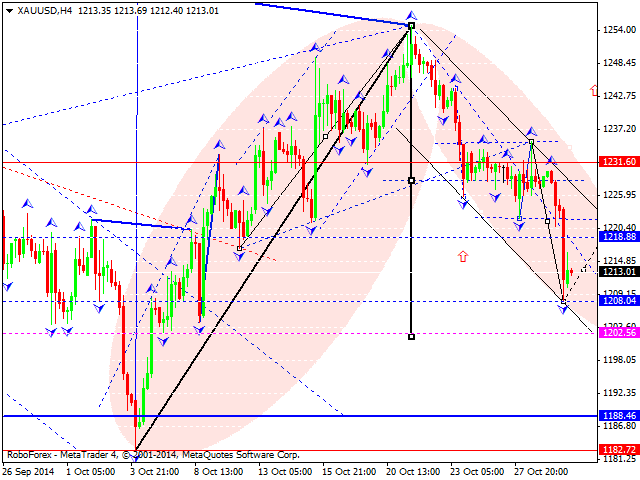

XAUUSD, “Gold vs US Dollar”

Being influenced by the fundamental background, Gold has broken its consolidating channel downwards and right now is forming a descending structure with the target at 1202.60. Later, in our opinion, the market may consolidate and form a reversal pattern. The instrument is expected to grow to reach the target at level of 1260.00.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.