Good afternoon, dear traders. Here we consider the XAU/USD behavior on the daily chart. Optimistic data on the U.S. Unemployment Claims came out last week: 284,000 claims compared to the estimated 307,000. This positive data allows continuing the Fed monetary policy tightening by making the U.S. currency more attractive for investment. Investors anticipate the results of the Fed meeting today, and keep getting rid of defensive assets (gold, silver) by investing in the U.S. stocks and currency. This leads to the fact that at the moment the bearish trend on gold prevails, which has all of the fundamental background for its maintaining: the U.S. economy indicators are steadily improving.

At the moment, we can see on the daily chart that the price is consolidated close to the monthly downtrend line. There is a high probability of a weekly support breach, especially when the Parabolic SAR moves along the D1 trend line. DonchianChannel also made a reversal into the red zone. The oscillator signal movement can be considered as the only alarming factor: the model is circled in red on the chart. We expect that you should wait for the RSI-Bars support breach in order to open a short position on XAU/USD with confidence. The mark at 1287.61 dollars an ounce serves as the key level, which is confirmed by the DonchianChannel support and fractal. Risk limitation is to be placed at 1325.53. This value is strengthened by the trend line, Parabolic historical values and Fractals.

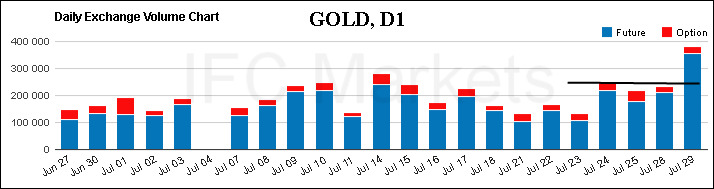

The daily volumes of the gold futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. We can observe the confirmation of the downtrend: trading volumes rose and outperformed the mark of 300,000 claims. You can monitor trading volumes for this currency pair by clicking here.

The bearish trend has a possibility to reverse due to unexpected fundamental factors. The U.S. Federal Open Market Committee (FOMC) is going to make a prearranged statement in the evening. If the monetary policy tightening is not confirmed despite the expectations for it to be established, then, of course, we can expect the price reversal into the weekly trend channel area. A long position can be opened above the resistance at 1345.37. After one of the orders being executed, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.