As of the end of June this year, the Chinese total debt to GDP ratio has risen to 251%, according to the Standard Charter, showing that the leverage of the Chinese economy is growing along with the stimulus. The estimate was 147% at the end of 2008 when Beijing had just implemented an ambitious stimulus plan worth more than 20 Trillion RMB (about US$3.2 Trillion). It’s fairly clear to see the financial burden being correlated with stimulus and the central government has realized that the last policy brought serious problems to the economy. There’s now not much room for them to introduce further stimulus.

It is a worrisome sign though when the growth of debt is at double the rate of GDP growth for several years – a trend that is certainly unsustainable.

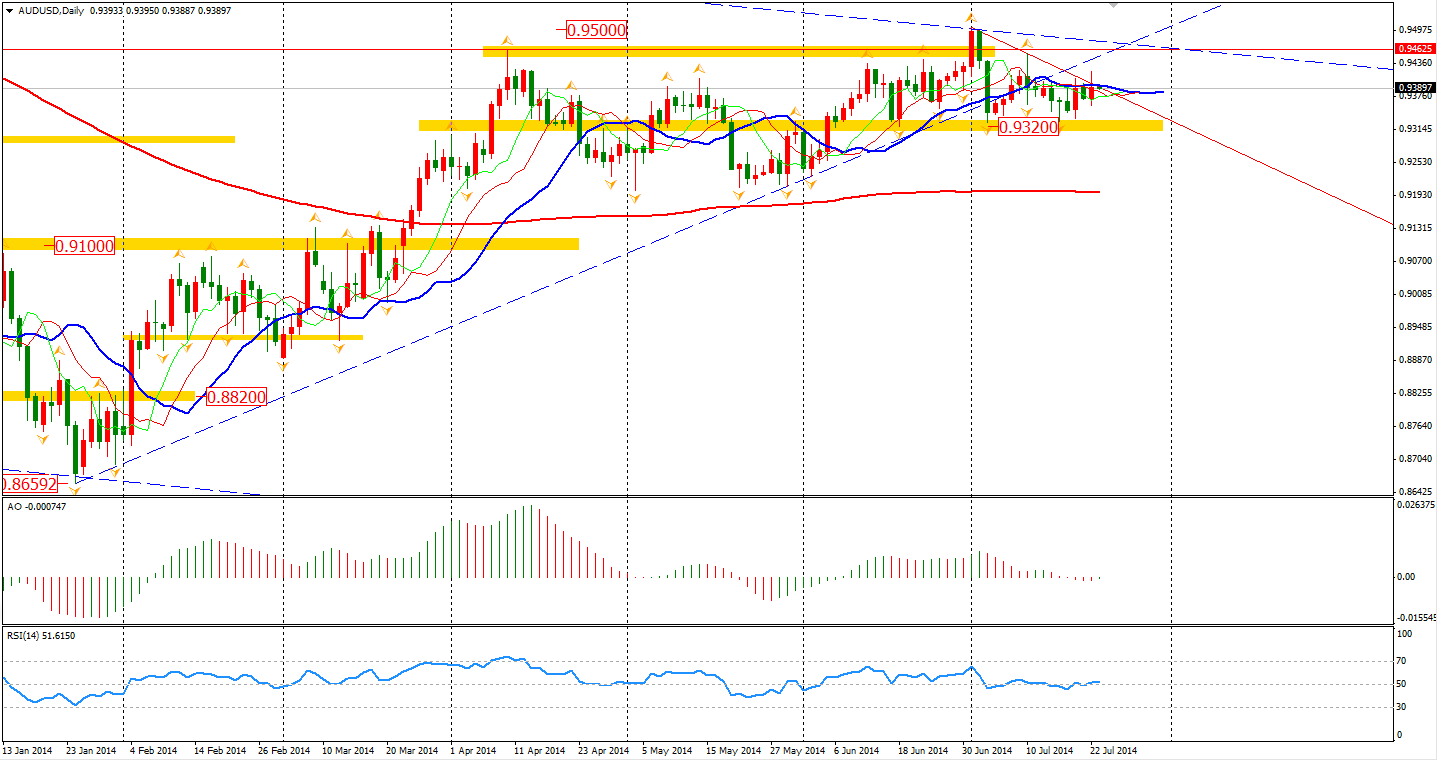

Nevertheless, the news did not affect the strength of Aussie. Traders who are shorting Aussie against the Dollar are probably disappointed with RBA Governor Stevens, who did not mention in his speech how the AUD is at a historical high level. The Aussie Dollar rose 0.22% to 0.9392. The close, though, was still below the short term downward trendline.

In the U.S, the consumer-price index rose 0.3% in June, which is the fastest pace in the two years. This data increased the market expectation of early interest rate rise pushing the Dollar slightly up against other major currencies, bar the Aussie.

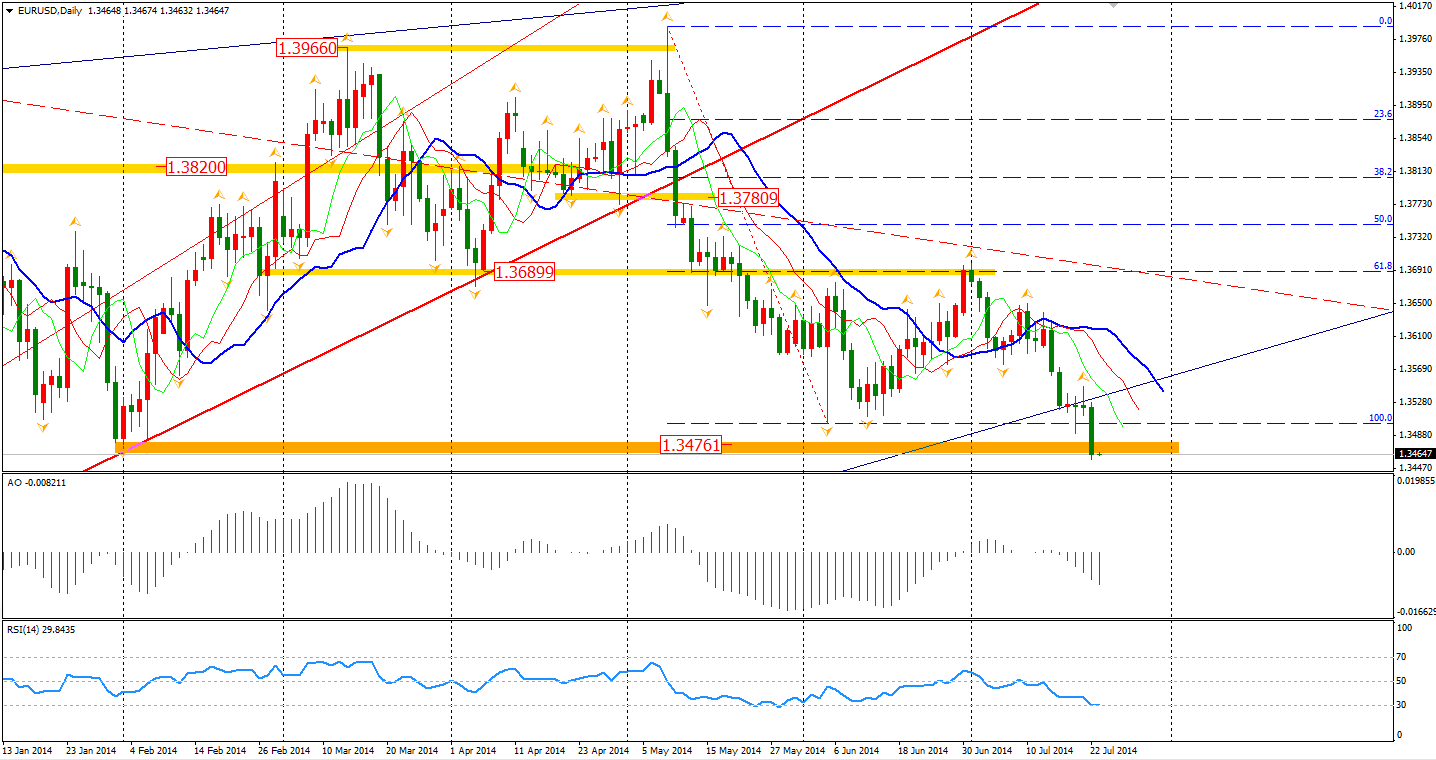

Euro was weak during the Asian and European session. After the CPI release, it fell further to a new low since November last year and broke the support level around 1.3480. We are close to confirm whether this is the breakout I mentioned yesterday.

Most of the Asian market made gains yesterday, as investors speculated on more stimulus policies in mainland China. The Australian ASX 200 rose 0.06% to 5543. The Nikkei Stock Average was up 0.62% whilst the Shanghai Composite surged 1.02% to 2075. In European stock markets, the FTSE closed 0.99% higher, the DAX rebounded 1.27%, and the French CAC was up 1.50%. U.S. stocks traded rallied on Tuesday on upbeat corporate earnings. The Dow gained 0.36% to 17114. The S&P 500 edged 0.50% higher to 1984, while the Nasdaq Composite Index rose 0.71% to 4456.

On the data front, local investors may pay attention to the Australian CPI at 11:30 AEST. The BOE’s Official Bank Rate will be at 18:30 and Canadian Retail Sales will be out at 22:30 AEST. Also, Euro Consumer Confidence will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.