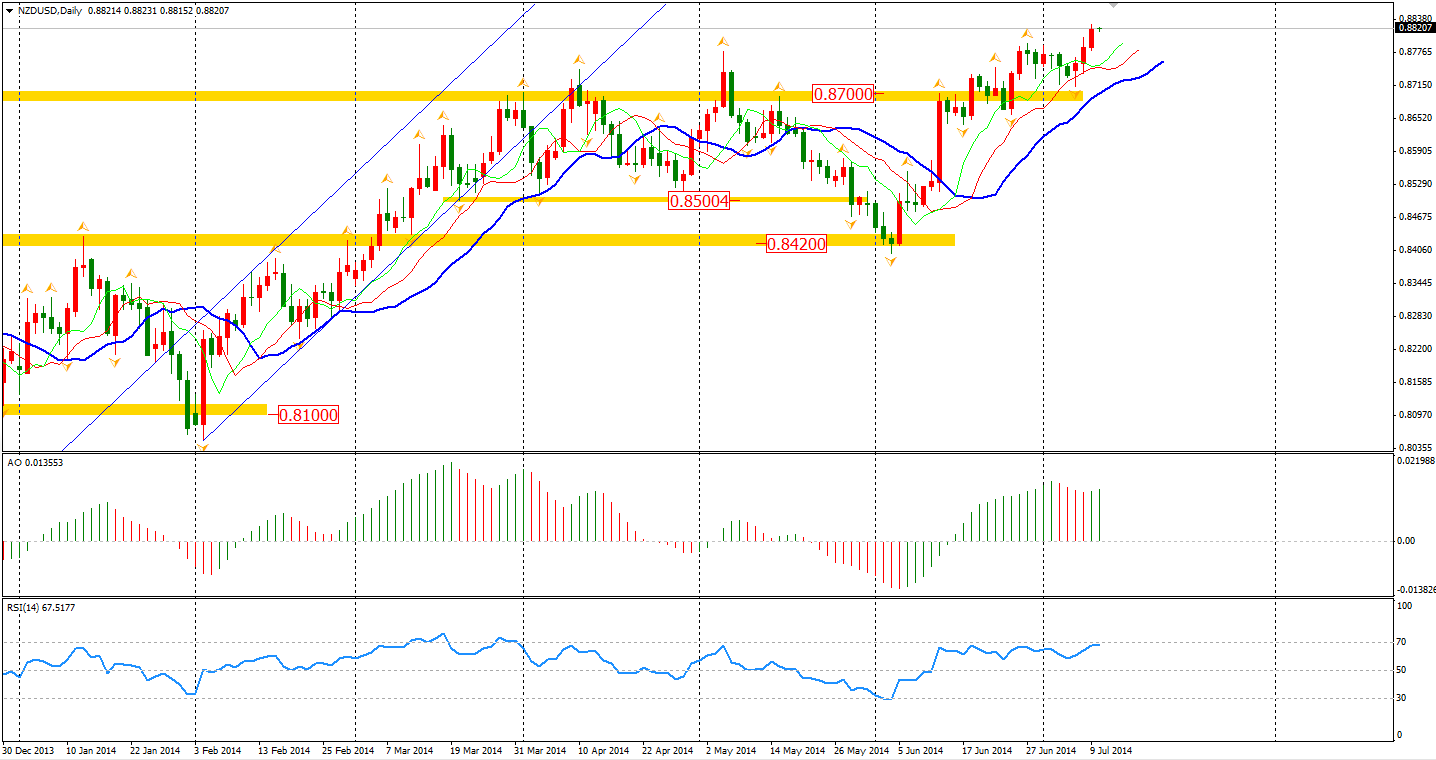

Hope you’re all enjoying the World Cup while very few trading opportunities have been popping out recently. The Kiwi hit a fresh high on Wednesday, which was sadly the only noteworthy breakout in this quiet Forex market.

The Federal Reserve published FOMC Meeting Minutes earlier this morning mentioning that officials had agreed at their June policy meeting to end the central bank’s bond-buying program by October. The Fed has been tapering their purchases of Treasury bonds and mortgage-backed securities in incremental steps since January and has said they expect to end the easing later this year.

Today was the first time they have mentioned an end date.

The Fed officials still maintain their forecast that the U.S. economy will accelerate in Q2. They expect the employment market will remain stable and inflation is recovering. The optimism was a little surprise to the market, but the impact was limited. The Dollar continued its weakness after the minutes were released, probably relieved by raising interest rate not discussed by the committee.

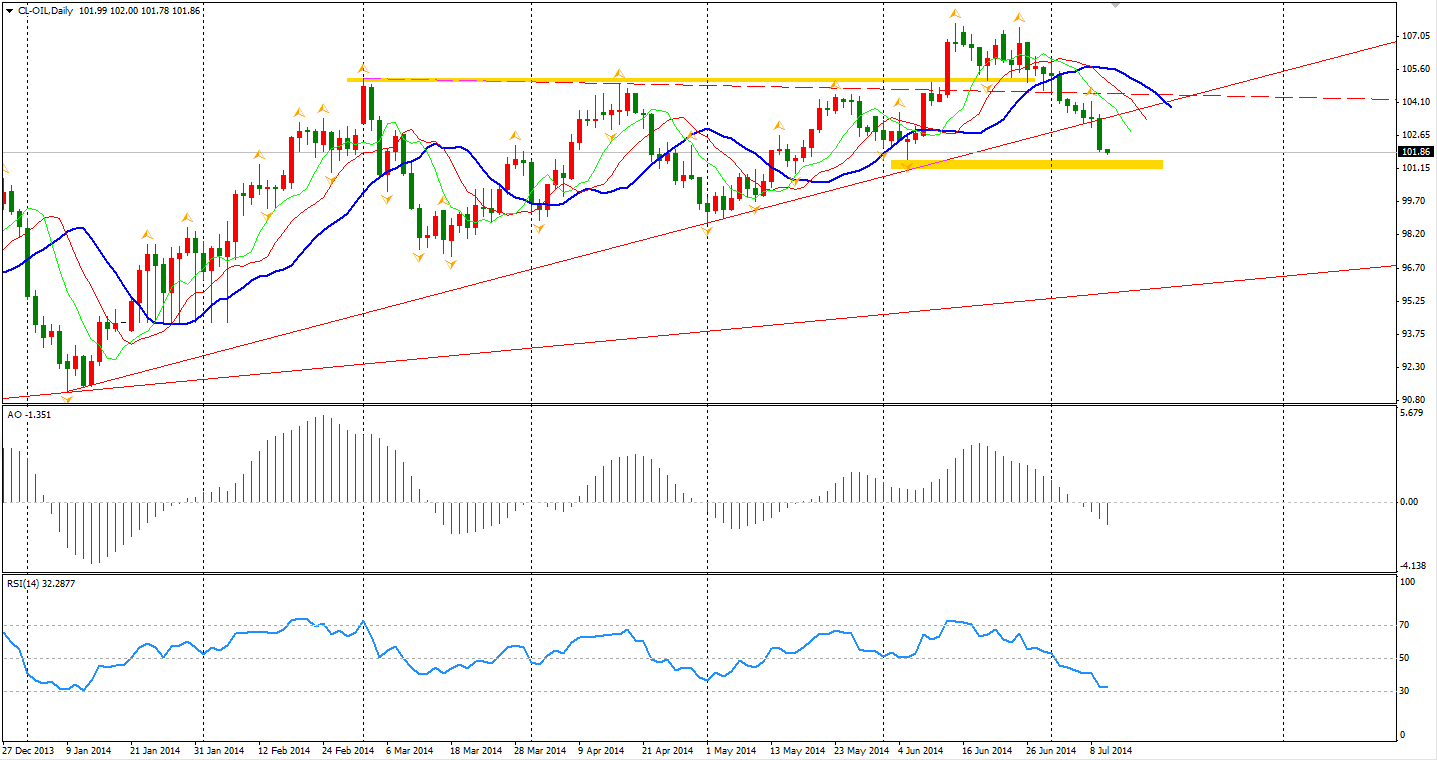

Oil futures declined on the reported resumption of Libyan crude production and a bearish report on U.S. stockpiles, which were probably the best mover last night. It may move down to $100 and test this integer level.

The Asian market closed lower yesterday led by Chinese and Australian stocks. They were following the weak performance of U.S. markets and dampened by Chinese soft inflation rate. The Nikkei Stock Average lost 0.08%. Shanghai Composite closed 1.23% lower to 2039. Australian ASX 200 was down 1.06% to 5452. In European stock markets, the FTSE closed 0.3% lower, the DAX rebounded over 1.35%, and the CAC was up 0.4%. U.S. stocks bounced as the minutes relieved the concerns of interest rate rising. The Dow Jones Industrial Average gained 0.47% to 16985. The S&P 500 edged 0.46% higher to 1973, while the Nasdaq Composite Index rose 0.63% to 4419.

On the data front, Unemployment Rate will be released at 11:30 AEST. China Trade Balance will be released sometime today. The focus of market may be the BOE statement at 21:00 AEST. Also, U.S. Unemployment Claims is worth noting at 22:30.

MXT Global Pty Ltd ACN 157 768 566 AFSL 428901. Trading derivatives and forex carries a high level of risk to your capital and should only be traded with money you can afford to lose. Ensure you read our FSG, PDS and Terms & Conditions, and seek independent advice, to fully understand the risks, before deciding to enter into any transactions with MXT Global. The general information on this website is not directed at residents in any country or jurisdiction where such distribution or use would contravene local law or regulation.

Company disclaimer for reports:

#The views and content above are Anthony Wu's own and do not reflect the views of MXT Global.

The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, analyses, prices or other information is provided as general market commentary and not as investment advice.

MXT Global does not warrant the completeness, accuracy or timeliness of the information supplied, and shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content.

No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.#

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.