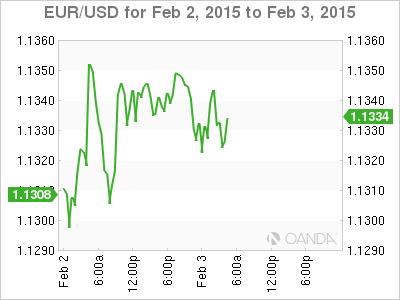

The euro has been listless for the past week, and the trend continues on Tuesday, as EUR/USD trades quietly in the low-1.13 range. On the release front, it’s a quiet day. Spanish Unemployment Change came in at 78.0 thousand, beating expectations. In the US, today’s highlight is Factory Orders. The markets are bracing for a sharp decline of 1.8%.

With the new Greek government looking to renegotiate its debt, Greece and its international creditors will have to reach some accommodation over Greece’s EUR 320 billion bailout program. European Commission President Jean-Claude Juncker has offered an olive branch to Athens, saying he is willing to scrap the troika mission, which represents the European Commission, ECB and the IMF and governs the bailout. However, he ruled out writing off any part of Greece’s debt. The new Greek government has stated it wishes to remain in the Eurozone but does not want to accept more bailout funds under the present agreement. Germany, which essentially calls the shots with regard to the bailout, has taken a hard line as it doesn’t want the Greek situation to set a precedent for other Eurozone members who have received bailouts. It is early going in this newest Greek saga, and the plot is sure to thicken.

US Advance GDP for Q4 disappointed, posting a gain of 2.6%. The markets had anticipated a gain of 3.0%. Still, market sentiment towards the US economy remains positive, underscored by the Federal Reserve statement last week, where the Fed noted solid growth in the economy. The Fed remains on track to raise rates later in 2015, and the dollar will likely benefit as speculation continues over the timing of a rate hike.

Spanish releases continue to impress. Unemployment Change rose by 78.0 thousand, well below the estimate of 83.4 thousand. On Monday, Spanish Manufacturing PMI improved to 54.7 points in January, up from 53.8 points a month earlier. Last week GDP for Q4 posted a respectable gain of 0.7% in Q4. At the same time, deflation remains a serious concern, as CPI fell 1.4%. in January.

EUR/USD 1.1331 H: 1.1354 L: 1.1292

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.