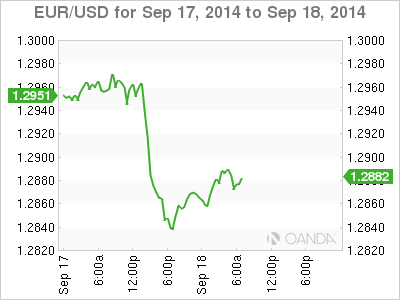

After limited movement for more than a week, the euro took a hit late Wednesday after the Federal Reserve policy statement. EUR/USD has steadied on Thursday, as the pair trades in the high-1.28 range in the European session. Taking a look at Thursday's releases, the ECB announced its first Targeted Long Term Refinancing Option (TLTRO) of 82.6 billion euros. In the US, there are three key events on the calendar - Building Permits, Unemployment Claims and the Philly Fed Manufacturing Index. As well, Federal Reserve Chair Janet Yellen will deliver remarks at an event in Washington.

The US dollar gained close to 100 points on Wednesday following the Federal Reserve statement. The Fed statement reaffirmed that interest rates would remain ultra-low for a "considerable time" after the asset purchase scheme (QE) ends next month, but surprised the markets in hinting that once a rate hike was introduced, rate levels could move up more quickly than expected. As expected, the Fed trimmed QE by $10 billion/month, and the remaining $15 billion/month is scheduled to be phased out in October.

In an effort to combat deflation in the Eurozone, the ECB announced the results of its first TLTRO. This lending program aims to bolster the economy by increasing bank lending to the real economy. The ECB said that the take-up by European banks amounted to 82.3 billion euros, which was well short of estimates that ranged from 100-300 billion. Still, it's too early to declare the program a failure, and traders and investors will have to wait till the next TLTRO in December before reaching conclusions as to the scheme's success.

US inflation data was worse than expected on Wednesday. CPI, the primary gauge of consumer inflation, came in at -0.2%, its first drop since October. The estimate stood at +0.1%. Core CPI followed suit with a flat reading of 0.0%. This was the first time the index failed to post a gain since October 2010. The weak numbers follow disappointing manufacturing inflation data. PPI, a key event, dipped to just 0.0%, a 3-month low. The estimate stood at 0.1%. Core PPI slipped to 0.1%, down from 0.2% a month earlier. This matched the forecast. Low inflation continues to be a concern and could delay an interest rate hike in 2015.

Earlier in the week ,German ZEW Economic Confidence, a key event, slipped to 6.9 points last month. The indicator has now dropped over nine consecutive months, down from a high of 62.0 points back in November. Eurozone ZEW Economic Sentiment followed a similar downturn, coming in at 14.2 points, its eighth straight decline. The German indicator managed to beat the estimate of 5.2 points, but the Eurozone figure was well short of the forecast of 21.3 points. The weak data points to weak confidence in the German and Eurozone economies, which does not bode well for the slumping euro.

EUR/USD 1.2880 H: 1.2907 L: 1.2849

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.