On the fundamental front, this coming week is a busy one with many key data releases giving an updated look at global growth.

In Australasia, Japan’s key quarterly Bank of Japan (BoJ) Tankan survey (Thursday) will be reported along with last month’s retail sales, household spending and unemployment. A host of September Purchasing Managers Index’s will be released globally, the most important being Thursday’s China Caixin PMI.

From a Central Bank’s perspective, the Reserve Bank of India (RBI) will release the results of its monetary policy meeting. While in the U.K, investors will get to analyze the final estimate of the economy’s Q2 GDP.

However, the ‘piece de resistance’ will be this Friday’s U.S. employment figures release (NFP +202k and +5.1%), as investors will be looking for clues on when the Federal Reserve will finally get to kick start rate normalization policy.

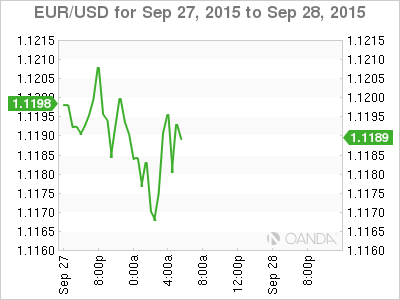

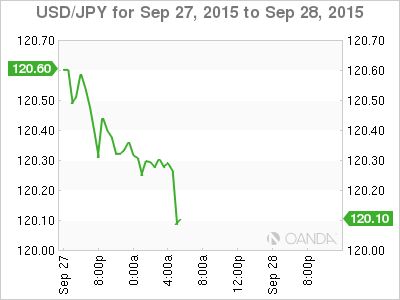

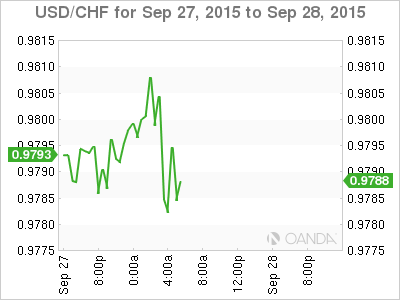

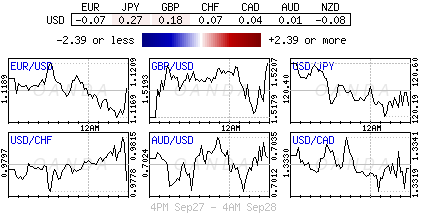

Market remain at odds with Fed: Despite the Fed’s Ms. Yellen keeping the door ajar for interest rate hikes this year, Capital Markets continues to look for improvements in the U.S. employment landscape, together with any signs of stability in the slowing Chinese economy to be convinced that a rate increase remains on the table before year-end. Notwithstanding the hawkish comments from the Fed Chair last week, fixed income sees only a +11% chance of a hike next month and +35% for December. Until there is more rate clarity, the major currency pairs are likely to remain confined to their recent ranges.

A stronger than anticipated final revision to U.S. Q2 growth on Fridays went some ways to support the Fed’s first rate increase in a decade. The final GDP print was raised to +3.9% from +3.7% in the preliminary reading and +2.3% in the advance data, with the additional strength coming from the services component of consumer spending. Yield differential trading continues to provide the greenback with overall support. However, the prospect of a cooling pace of growth in Q3 is making sure that the dollar does not get to run away from its competitors just yet. For the greenback to kick on to the next stage, rate normalization is required.

U.S Political impasse could become a Q4 problem: Under intense pressure from conservative GOP members, U.S House Speaker John Boehner will leave Congress next month. The annual threat of a U.S government shutdown was again on the cards. With Boehner’s departure, for now it ensures a short-term funding resolution will be passed. However, in the medium term, there are fears in the market that a more conservative “speaker” may use the upcoming debt ceiling issue to force a governmental shutdown in late Q4. If so, this will have negative implications for the U.S economy and the Fed’s policy objectives.

Lagarde not so sure anymore: Over the weekend, the IMF’s head, Ms. Lagarde effectively flagged a downgrade to global growth, calling the +3.3% 2015 GDP objective set three-months ago no longer “realistic.” She said developing economies’ growth is picking up, however, emerging markets are slowing at a faster pace. The twin challenges of China and the Fed have certainly intensified the fall of EM currencies. The spotlight is now firmly on the weakest economies central banks to be aggressively proactive. Investors should expect EM Central Bankers to become more aggressive to stem regional capital outflows.

Advance economies are not immune to negative sentiment: Global equities remain under pressure as concerns over China continue. Overnight, published reports indicate that Chinese industrial profits contracted by their largest amount in a number of years, with the Stats Bureau blaming rising input costs and the decline in the Yuan. A marked slowdown in the world’s second largest economy continues to be the reason why the market is prudently adjusting global growth forecasts downwards and reason enough why fixed income dealers remain at odds with the Fed’s rate normalization timetable.

Political event risk is getting louder: Escalating Syria standoff brought forth notable weekend developments and commentary. France is expanding its campaign against ISIS to Syria from Iraq. While Russia’s Putin is seeking a “coordinated framework” to fight ISIS.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD flat lines above mid-0.6700s ahead of Australian jobs data

AUD/USD attracts some dip-buyers on Thursday, around the 0.6820 region. Against the backdrop of the RBA's hawkish stance, the upbeat market mood acts as a tailwind for the pair. That said, persistent concerns over an economic slowdown in China, along with a modest USD uptick, cap the upside as traders await Australian employment figures.

NZD/USD advances to near 0.6200 due to risk-on mood, Fed interest rate decision awaited

The NZD/USD pair edges lower to near 0.6200 during the early Asian session on Thursday. The recent GDP data revealed that New Zealand's economy shrank again in the second quarter, suggesting the depths of its economic malaise.

Gold price stalls post-FOMC pullback from all-time peak; lacks firm intraday direction

Gold price oscillates in a range on Thursday and consolidates the previous day's post-FOMC rejection slide from the $2,600 mark or a fresh record high. Persistent geopolitical risks, along with signs of economic trouble in the US and China, lend support to the safe-haven metal.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.