Yellen gives nothing away

Investors prefer to wade out the month

German debt print record low yields

Bring on ECB and NFP

It appears that the global investor is showing little reaction to Fed Chair Yellen’s second day of testimony on the hill yesterday. She provided no new hints on the timing or pace of interest rate hikes, but reiterated the message that rate increases are likely later this year as the U.S economy improves. Across the various asset classes a much calmer tone has returned to the market since a deal was struck to extend Greece’s international bailout. Prior to that, investors had to contend with weeks of volatility. Speculators are certainly missing the unpredictability as it brings far less market opportunities. Investor and dealers now return to being data dependent, tied from one economic release to another. Do not be surprised to see Greece slip off the radar, remain hidden in the background until their next key events that are coming in April and May.

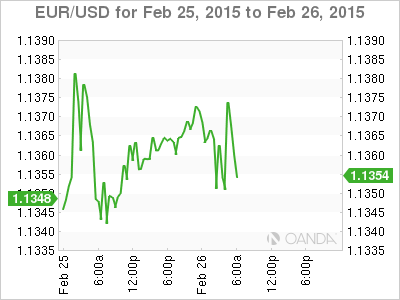

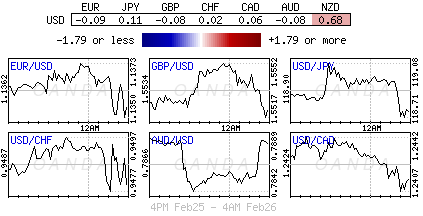

Euro waits on QE

In Europe, investors are preparing for the start of the ECB’s bond buying program next month. Both equities and bonds are been driven higher in anticipation. German bund yields currently straddle new record lows with debt maturities up to seven-years trading in ‘negative’ territory. The 19-member single currency continues to trade in a narrow channel (€1.1325-1.1400), oblivious to any noise, even this morning’s better eurozone data that provides further support for economic recovery. It seems that dealers prefer to wade out the remainder of this short month and are settling in for the wait ahead for next week’s ECB meeting and non-farm payrolls data. The inability for further action will have some investors considering switching their EUR shorts for EUR funded carry trades as they look for a “bang for their buck.”

Germany Powers Ahead

Data released by the ECB showed lending to the private sector may be nearing a turning point after almost three-years of declines. Compared with the same month last year, lending to the private sector declined -0.1% in January after falling -0.5% in December. Scarcity of credit and lack of confidence has always been a key factor holding back investment. Germany, Europe’s powerhouse economy continues to provide some solid numbers. Labor market data from the region revealed that the number of jobless people fell by a seasonally adjusted -20k this month, twice as much as last months fall of -10k. The adjusted jobless rate in February remains unchanged at +6.5%. Euro supports like lower unemployment numbers, it aids consumer spending.

U.K, Slower but Steady

In the U.K the latest GDP figures released this morning will not be ringing anyone’s alarm bells regarding the strength or sustainability of the UK economy’s recovery. The second estimate of Q4 GDP has arrived on forecast and confirms that the recovery slowed at the tail end of 2014. Some would suggest that it has become “better balanced.”

The preliminary estimate of a +0.5% quarterly rise in GDP was left unrevised. But the new expenditure breakdown shows that net trade made a + 0.6% contribution to quarterly GDP growth – the most in 24-months. The BoE’s Governor Carney should be happy to see that British exporters are starting to overcome the obstacles presented by weaker euro-zone demand and the pound’s strength (£1.5535).

Nevertheless, not all sterling bulls should be happy with today’s U.K investment numbers for Q4 2014. An unexpected reported negative U.K business investment (-1.4% vs. +1.9% expected), the lowest in six-years, will be a blow for some of the pound supporters. The bulk of the negativity can be blamed on the fall in oil prices. A lower crude price has certainly pressured the North Sea extraction industry to cut down spending on infrastructure. If we believed all Central Bankers, fall in energy prices is only a temporary situation. Today’s economic headlines do highlight that the U.K’s recovery has cooled somewhat in Q4 when compared to earlier in the year. Nevertheless, the U.K has still managed to outperform all the other countries in the G7 for last year and many are still sticking to their convictions for strong Q1 for this year.

Perhaps we should be looking at the power of political uncertainty to be the elephant in the room when discussing U.K growth for 2015. If there remains sustained political uncertainty after the May general election in the U.K, the potential to lose some of that economic traction magic should certainly increase.

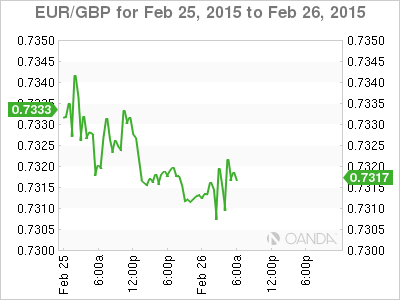

A divergent BoE and ECB monetary policy outlook has been weighing on EUR/GBP (€0.7315). A risk of a BoE early hike and an ECB QE program in full swing has managed to push the cross to test new seven-year lows in the overnight session (€0.7305) and cable to print new two-month highs (£1.5554). Intraday, sterling continues to find support just below the psychological £1.5500 handle and ahead of £1.5480. Resistance remains atop of the overnight high. Against the EUR, buyers of GBP remain stacked around yesterday’s high €0.7345 while sellers of the pound appear below the figure (€0.7300) first time around.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.