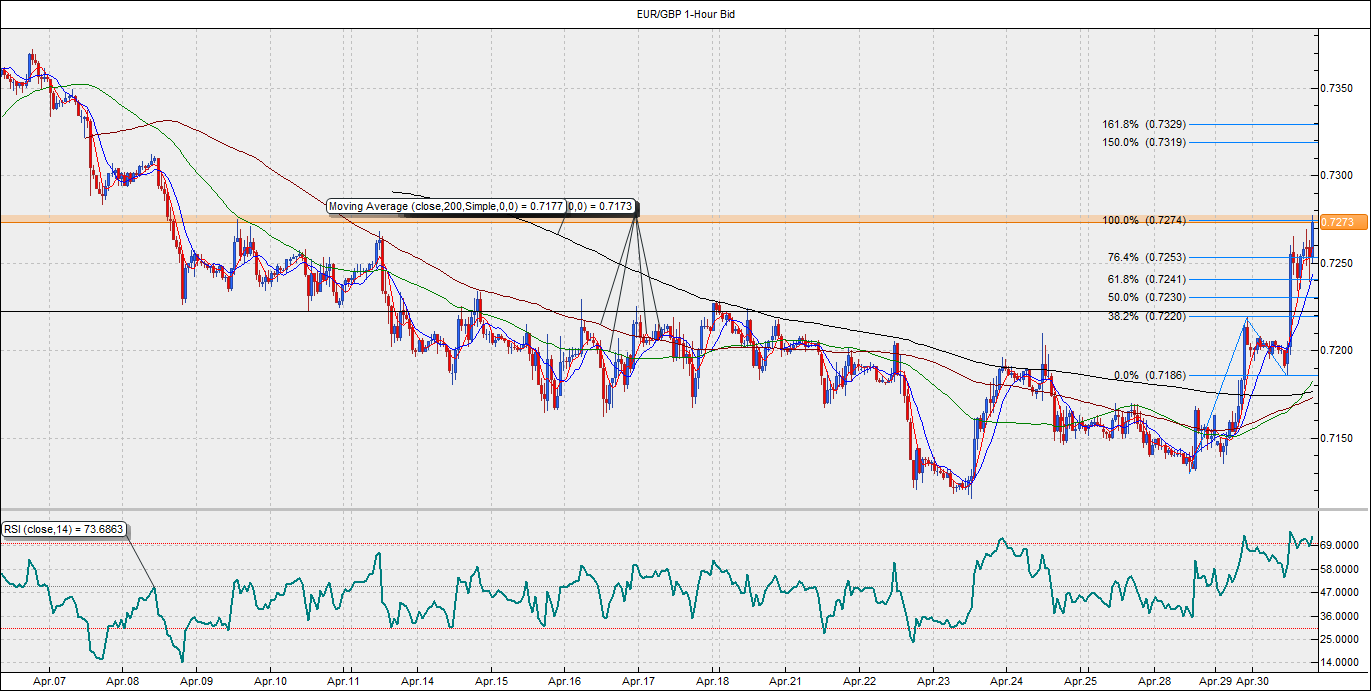

In this report, I detail a slight change in the view. Last week’s report had called for the next leg lower towards 0.7050 from 0.7250. However, I believe, the pair could continue to rise towards 0.7350-0.7400 by the next weekend. I offer the following rationale for the further gains in a week’s time -

GBP more vulnerable to weak data: The markets have largely ignored the fear of a hung parliament following the May 7 elections. The GBP/USD pair has rallied more than 900 pips mainly on account of a broad based sell-off in the USD. The developments in the UK economy had very little to do with the rally except the slightly hawkish Bank of England minutes released few days back. Amid all this, the election uncertainty took a back seat, a factor which was widely expected to cap gains in the GBP/USD around 1.5-1.52 levels.

Given the slowdown in the US first quarter growth rate, the markets are likely to focus on the developments in the UK. With elections scheduled on May 7th, the political uncertainty is likely to overshadow the economic data. This makes the British Pound more vulnerable to a weaker-than-expected economic data out of the UK. The four polls conducted in a single day earlier this week, showed no clear majority for conservatives or labors. The neck-to-neck poll outcome indicates it is very difficult for markets to anticipate the outcome of the elections. Hence, the election uncertainty is likely to take the center stage from now onwards.

The UK manufacturing PMI and services PMI report due in the next few days could provide some support to the GBP if they are encouraging. However, if both the data highlight a slowdown in the activity, the bearish effect on the GBP could be amplified due to presence of election uncertainty.

Euro relatively strong on recovery in German yields: The shared currency is likely to remain relatively resilient as compared to the Pound in case of a strong rebound in the USD. The Greece issue for the moment is out of the spotlight. This has triggered a sell-off in the German bond yields leading to unwinding of short EUR trades initiated for currency hedging by foreign investors. Though, I believe its effect has played out, the EUR would still remain resilient as the German yields are unlikely to dip to record lows in the next week. Moreover, Germany had negative yields on bonds maturing up to 8 years. However, the situation has changed now, with Germany having yields negative on bonds maturing up to 5-years.

The pair is likely to close today above its 50-DMA located at 0.7228. Sharp gains on Wednesday and today could trigger a technical correction tomorrow. However, the losses are likely to be restricted around 50-DMA at 0.7728. A break above 0.7274 could see renewed buying interest, thereby opening doors for 0.7319-0.7329. Further gains to 0.7350 are likely in case the pair manages to close above 0.7329.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.