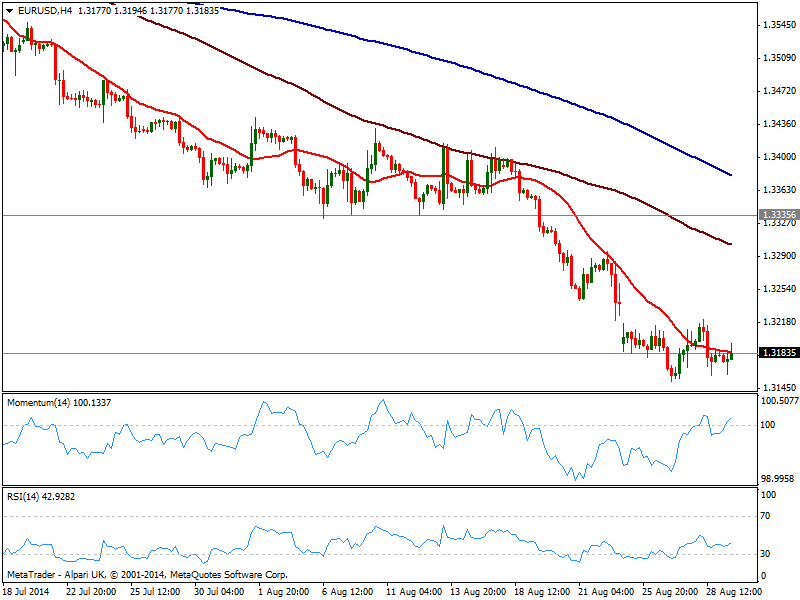

Technically however, it has been a week to forget so far with the EUR/USD confined to a 70 pips range between 1.3150 and 1.3220. The 4 hours chart shows price latest spike being retraced, with price below a flat 20 SMA. Indicators grind higher but momentum stands barely above its midline, and RSI flat in bearish territory, showing no actual strength. Consolidating near its year low, the risk on the pair remains to the downside, with a break below 1.3150 exposing the 1.3100/20 price zone. Steady gains above 1.3220 on the other hand, may see a recovery up to 1.3250 price zone, yet the most likely scenario for today is an extension of the consolidative range ahead of next week Central Banks and US employment figures.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.