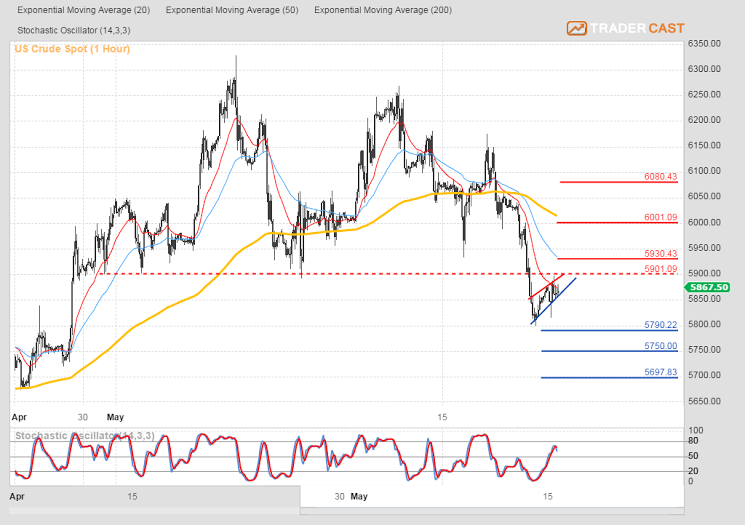

WTI Crude Bear Flag

At 15.30 we are getting Crude Oil Stocks in US.

Important POC at 59.00

Rejection at that level could target further downside support at 57.90 followed by 5750 and 57.30.

Upside is capped by resistance at 59.30 followed by 60.00 and 60.80.

Gold Pullback to retest 1205 support.

Resistance at 1216, 1224 and 1232

Support at 1200, 1191 and 1179.

S&P Trading Levels

Important POC at 2129 -2127 levels.

Confirmed Breakout higher could target resistance at 2135 followed by 2142 and 2147

Support at 2122 followed by 2117 and 2110.

Any discussions held, views and opinions expressed and materials provided during TraderCast sessions are the views, opinions and materials of Phillip Konchar alone. All information and materials provided are not independent investment research and are provided for general information purposes only and does not take into account your personal circumstances or objectives. These sessions or any materials provided are not and shall not be construed as financial promotion, nor are they (or should be construed to be) financial, investment or other advice upon which reliance should be placed. Phillip Konchar’s trading strategies do not guarantee any return and Phillip Konchar shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Spread trading is a leveraged product and carries a high level of risk to your capital as prices may move rapidly against you. It is possible to lose more than your initial investment and you may be required to make further payments. It may not be suitable for all customers therefore ensure you understand the risks and seek independent advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.