In our past article “US Dollar Outlook into FOMC Meeting on March 16“, we argue that the Fed is likely going to stay put and temper the rate hike expectation and this action should cause U.S. Dollar weakness.

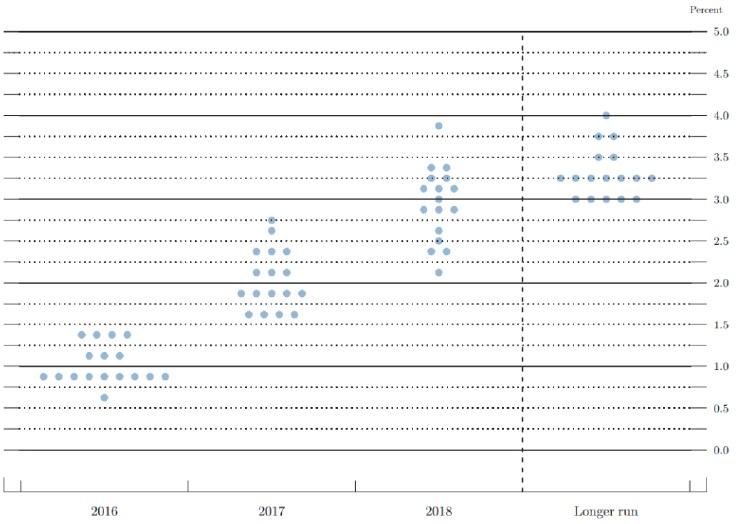

It happened as expected with the Fed last Wednesday lowers the median 2016 dot to two hikes from four hikes. The Fed cited international risk and global financial condition posing downside risk. Below is the new dot plot for 2016 and beyond.

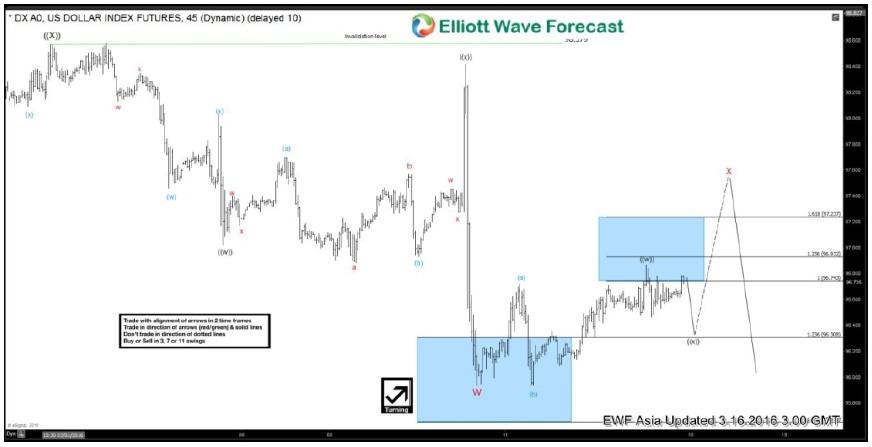

The dovish view by the Fed resulted in broad U.S. Dollar weakness. Below is the 4 hour Elliottwave chart before the FOMC Meeting on March 16 and based on the sequence, we were also looking for more downside.

After FOMC meeting, we’ve seen a broad based U.S. Dollar weakness resulting in stronger Yen and stronger Euro. In Japan and Euroarea, headline inflation rate is very low and thus strong appreciation in their currencies is not welcomed. Similarly, Australia and New Zealand are also fighting low inflation, and both central banks have indicated they are open to ease further if necessary. Thus, the question is whether this decline in USD is a temporary move or whether this is the start of something bigger and longer lasting.

It seems that there’s a limit to this U.S dollar weakness because either 1) Other central banks likely respond by easing further or 2) weaker U.S. Dollar helps the U.S to close the output gap, and strong U.S. data will require the Fed to tighten the policy and thus reverse the U.S. dollar selloff. All this suggest that U.S. Dollar can resume the rally again once the post FOMC move runs out of course.

However, not all central banks equally have the tools to defend against their currency appreciation. Suppose U.S. Dollar selloff is temporary, we think Australia Dollar and New Zealand Dollar may have a better chance because their positioning is quite stretched with $AUD/USD having risen 11.7% since Jan 15, and $NZD/USD having risen 8.4% since Jan 20. Furthermore, the RBA and RBNZ still have plenty of traditional tools left with the interest rate still at 2% and 2.25% respectively.

$AUD/USD weekly chart above breaks and close below 2001 trend line support. Pair is currently retesting this line.

Unlike $AUD/USD which has broken and closed below the 2001 trend line, $NZD/USD weekly chart above has not retested the trend line from 2001. Pair can look to test it within 1 year.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.