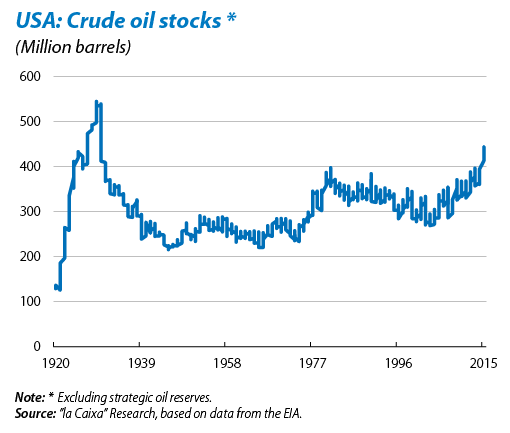

In a low-price environment (largely due to excess supply) with expectations of price increases in the future, some producers prefer to store part of their crude oil and wait for prices to rise before putting their stocks on the market. Consequently, today's abundant supply of oil has resulted in a significant accumulation of stock in most OECD countries, with the International Energy Agency estimating that stocks will be at an all-time high in OECD countries by mid-2015. However, as these stocks increase, so do storage costs as the cheaper storage facilities fill up, reducing the economic incentive to continue accumulating reserves. This smaller return could encourage some of the supply previously allocated to storage pending price rises to come onto the market, which would push down prices.

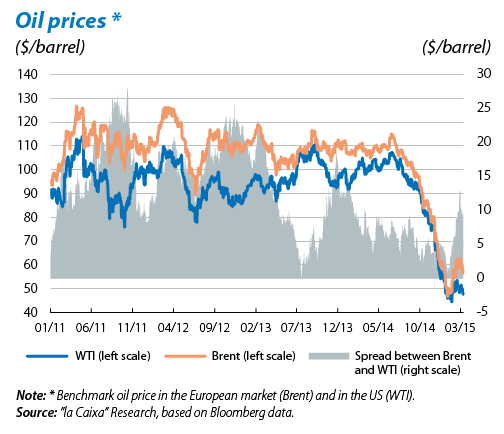

One notable fact within the current context of stock accumulation has been the larger amount of stocks amassed by the US compared with the rest of the OECD regions. The market's reaction to this sharper rise in US stocks has been swift. The spread between the Brent price and its US counterpart, West Texas Intermediate (WTI), has once again widened (see the second graph). While in 2014 the Brent price was 6.5 dollars above the WTI price on average, since mid-February the spread has been around 10 dollars.

A combination of different factors explain this larger accumulation of stock in the US, one of the main ones being the slow adjustment of US crude production. Although investment in the sector has dropped off sharply in recent months, production, which seems to have more inertia than expected, has continued to increase and is now at its highest level since the 1970s. Another factor also pushing up crude stocks is the fact that the country's oil refining capacity has been temporarily interrupted. It should be noted that US petrol firms cannot export crude (but can export refined products), a restriction that dates back to 1973 when the country was affected by an embargo imposed by numerous oil-exporting countries in retaliation for the US supporting Israel in the Yom Kippur war. Two circumstances lie behind this current interruption in oil refinement. Firstly, the maintenance that most US refineries carry out at the beginning of each year (this takes place in the second quarter in the rest of the OECD regions). Secondly, the biggest strike seen by US refineries in 35 years, affecting 12 refineries responsible for 15% of the country's oil refining capacity.

In short, the sharp increase in stocks is leading to doubts regarding the trend in oil prices in the short term. That is why we must be cautious in stating that the market has bottomed out and the possibility of further drops in price cannot be ruled out. Nonetheless, it is true that, in the medium term, the readjustment in the supply due to lower investment in the oil industry should help prices to recover.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.