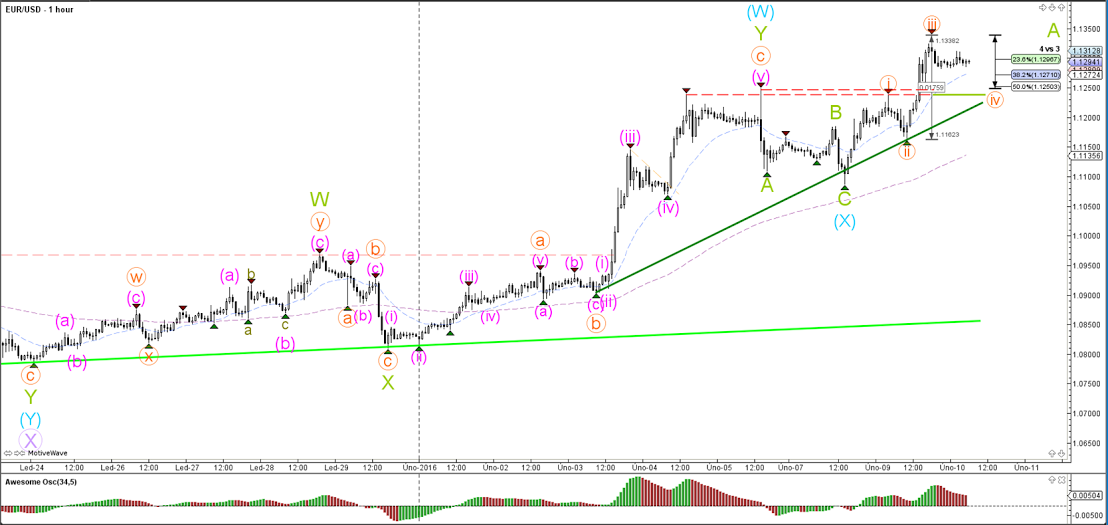

EUR/USD

4 hour

The EUR/USD completed the wave X (blue) and broke above resistance levels (dotted red) yesterday. It is now at the 61.8% Fibonacci target, which is a break or bounce spot. A bullish continuation could price head towards the next Fibonacci target and daily resistance (red).

1 hour

The EUR/USD seems to be in a wave 4 (orange) now after completing the first 3 legs earlier this week. Price cannot retrace deeper than the 50% Fibonacci without invalidating the current wave count.

GBP/USD

4 hour

The GBP/USD is currently in a contracting triangle (orange/green). The Cable respected the 50% Fibonacci level of wave X (blue), but if price makes a bearish turn then the 61.8% and 78.6% retracements still represent support levels. This wave count is invalidated when price breaks below the support trend line (green).

1 hour

The GBP/USD break above the resistance trend line (orange) would change the current bearish wave count to a bullish one. A break above resistance confirms the completion of wave X (blue) at the most recent bottom. A bearish bounce could see price fall towards the Fibonacci targets and trend lines (greens), which represent support levels.

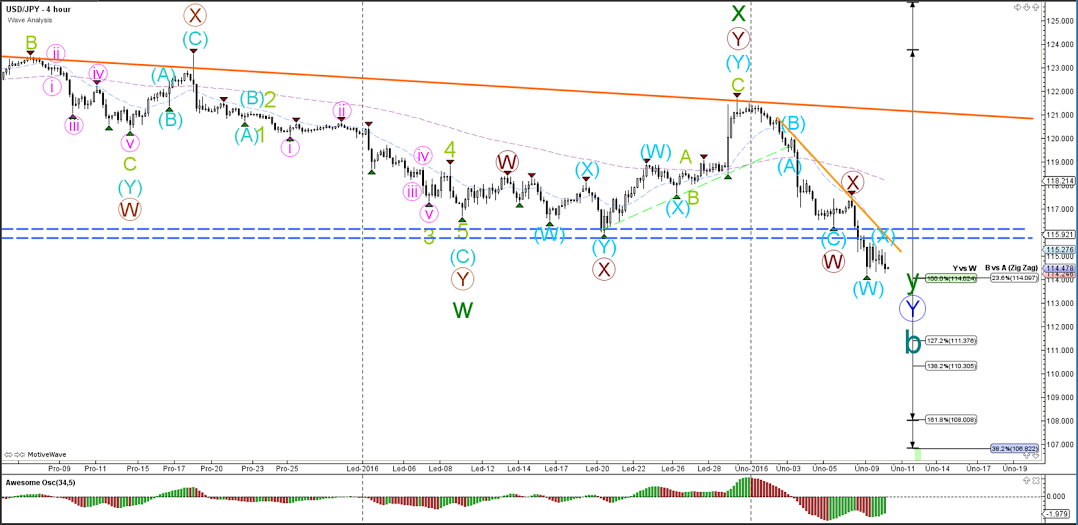

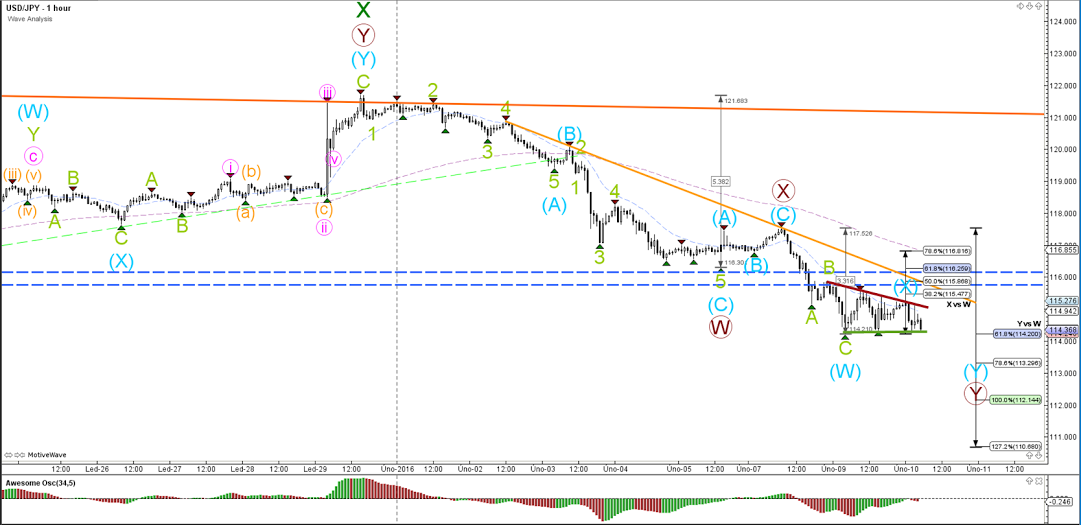

USD/JPY

4 hour

The USD/JPY has broken the long-term daily and weekly horizontal support levels (dotted blue). Price has reached Fibonacci levels which have caused price to stall. A break below the Fib levels could see price fall further lower. A bounce at the Fibonacci levels could indicate a potential completion of wave B.

1 hour

The USD/JPY is building a contracting triangle (trend lines) in between the broken support and Fibonacci target.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.