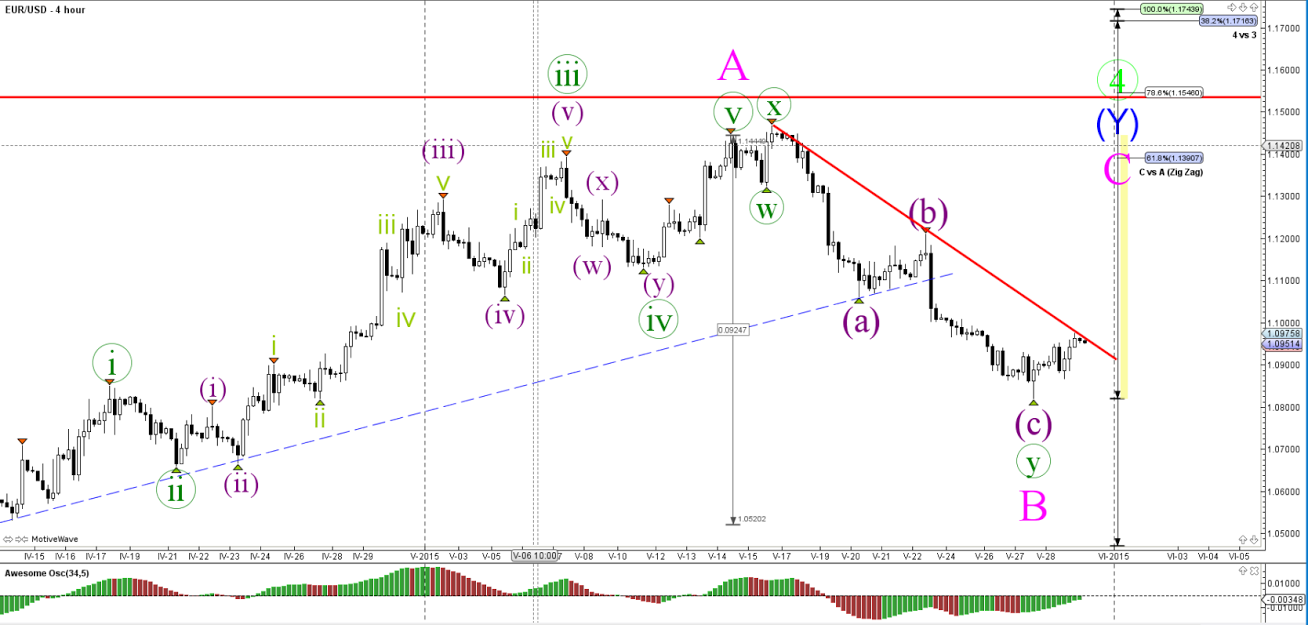

EUR/USD

4 hour

The EUR/USD has been labeled with a completed wave C (purple) and wave B (magenta), although price needs to break above the resistance trend line (red) for a confirmation of that wave count.

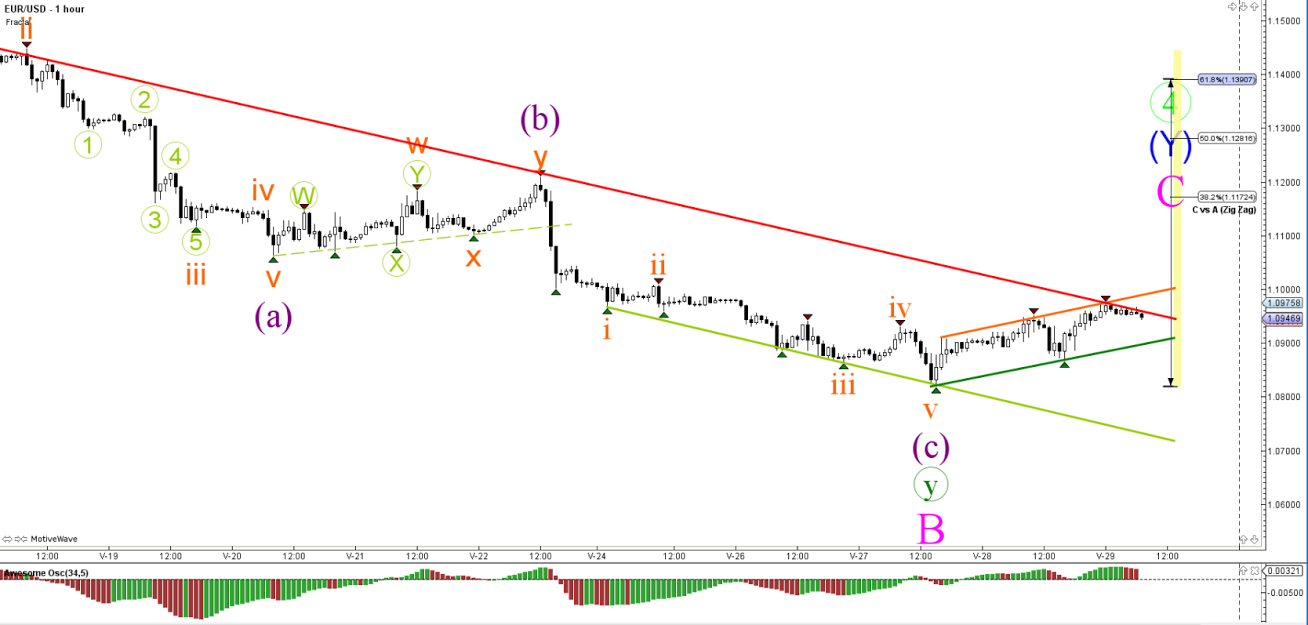

1 hour

The EUR/USD remains in a downtrend channel (red and light green lines) with a presence of a smaller bear flag (green and orange trend lines). The support (green) and resistance (red) are important lines whether the down trend continue or whether a reversal is more likely.

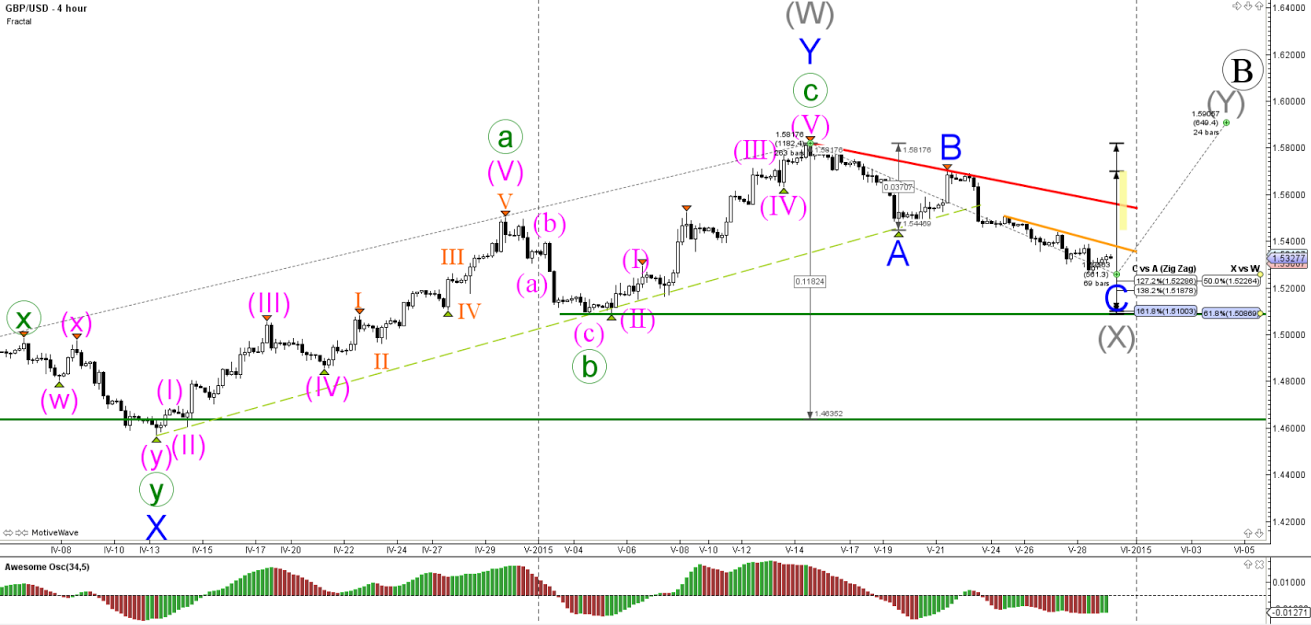

GBP/USD

4 hour

The GBP/USD has approached the confluence of support between 1.5250 and 1.51 (50%, 61.8%, 161.8%, horizontal line), which could be a bouncing spot for wave Y (blue).

1 hour

The GBP/USD is also in a downtrend channel (orange lines) and seems to be building an ending diagonal which has wave 4 (blue) overlapping in the price territory of wave 1 (blue). The invalidation level of the diagonal is the top of wave 2 (blue), which also would mean a break of the channel.

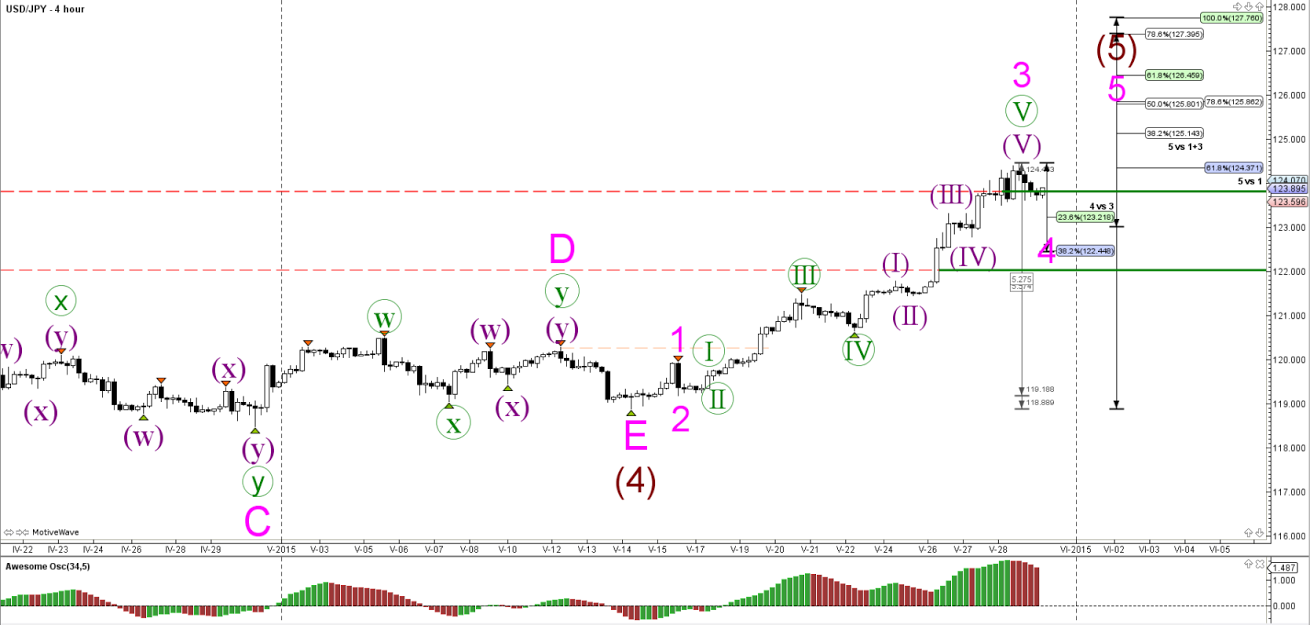

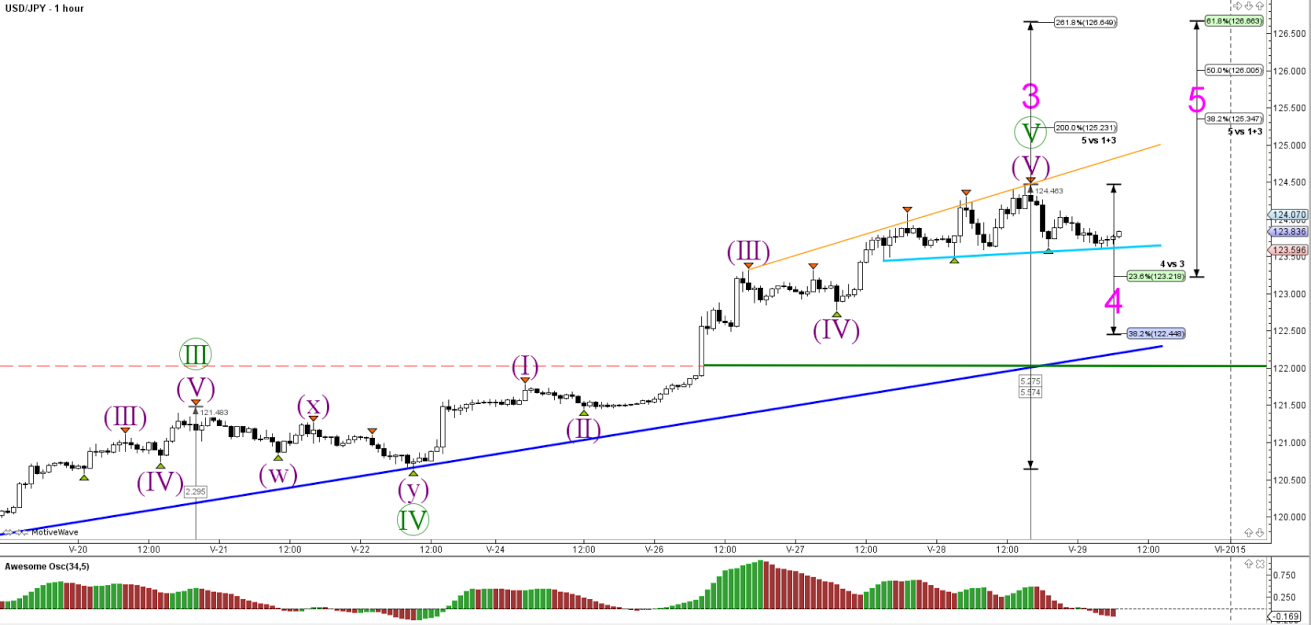

USD/JPY

4 hour

The USD/JPY’s value on the oscillator is retracing (red bars), which could be a first sign that a bigger wave 4 (magenta) retracement will occur (oscillator will get close to mid line in that case).

1 hour

The USD/JPY is most likely correcting within a wave 4 (magenta).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.