GBP/USD at 7-Year Lows; New Zealand at the Lowest Inflation Since 1999; U.S. CPI Ahead

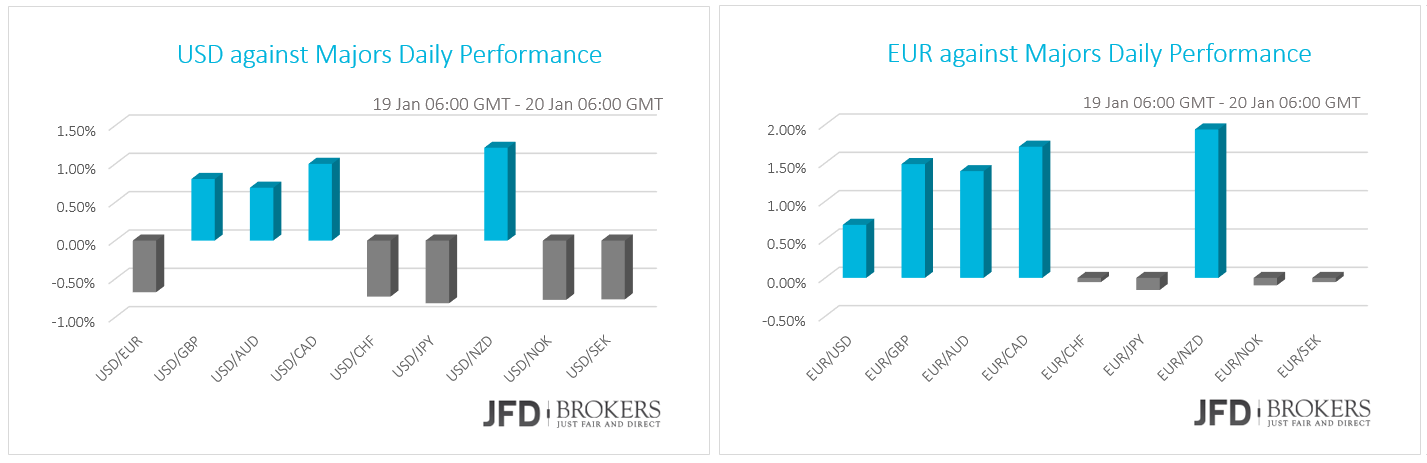

The greenback was traded mixed against its other counterparts on Tuesday and early Wednesday in the absence of important economic indicators while the euro was broadly higher due to good economic data. The New Zealand dollar plunged against the U.S. dollar following the disappointing Fonterra auction and inflation data. The British pound tumbled by BoE Governor Mark Carney comments. The IMF has cut the forecast for the global growth for one more time! It expects the global economy to expand by 3.4% this year followed by 3.6% in 2017, which means 0.2% less each year than the previous forecasts in October.

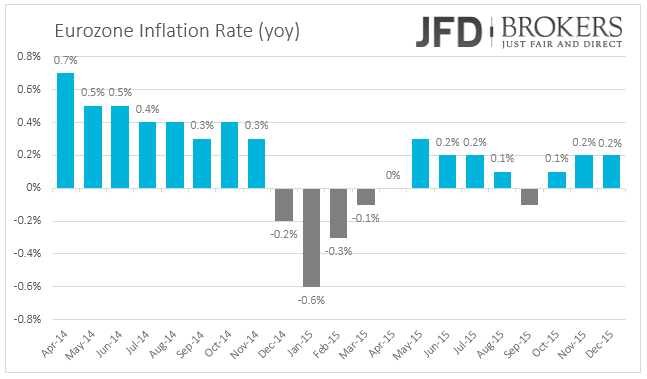

Euro mixed on Mixed Data

The shared currency was traded mixed against the major currencies on Tuesday and early Wednesday on mixed fundamental data. The annual inflation rate met the market’s forecasts. For the second consecutive month on December the consumer prices rose by 0.2% while, on a monthly basis, the rate returned back to zero from -0.1% before. The ZEW Survey overpassed expectations for Germany but disappointed in Eurozone. The German current situation rose up to 59.7 beating expectations to have been decreased to 54 and also above the last figure. The economic sentiment surpassed expectations as well but came out at 10.2 below December’s print of 16.1. In Eurozone, the economic sentiment dived to 22.7 from 33.9 before, the worst level has been since November 2014.

The EUR/USD is traded in a wide range between 1.0710 and 1.1060 since the beginning of November. It currently found support on 1.0860 slightly below the cross of the 200, 100 and 50-SMAs on the 4-hour chart and rebounded towards 1.0960. Today, the agenda does not include fundamental news coming out in Eurozone, however, the ECB meeting tomorrow followed by a press conference will increase the volatility of the pair. I would expect the pair to test again 1.0985 before it will drop again at the psychological level at 1.0900 which coincides with the 50 and 100-SMAs on the 4-hour chart. If the bulls manage to push the price above 1.0985, the next level to watch is the resistance near 1.1040.

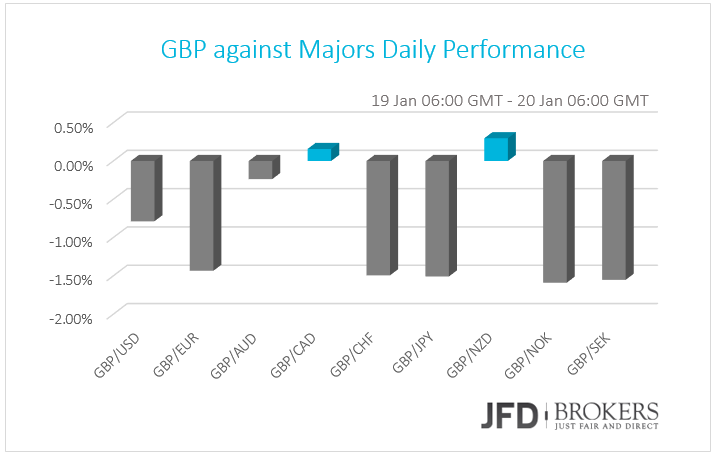

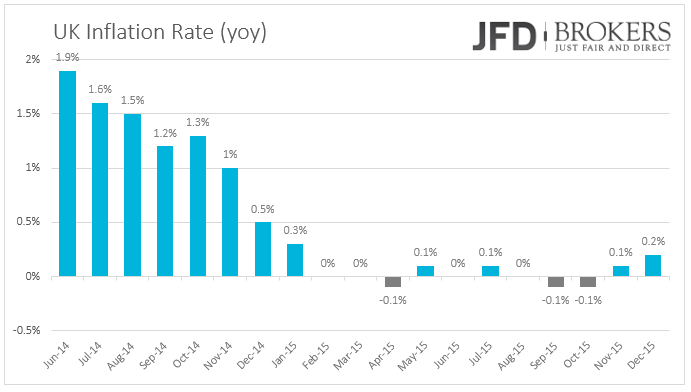

GBP/USD Tumbled at 7-Year Lows! Carney: Not Yet the Time for Rate Hike

The British Pound inched up against the other major currencies on Tuesday as the country’s inflation rate increased to the highest level has been in 2015 but later it tumbled to the lowest level has been since 2009 after BoE Governor Mark Carney speech. The consumer prices rose by 0.2% in December, in comparison with the same month the year before, following a year with that was hovering around zero. After January’s 2015 0.3% reading the UK economy was in a fight with deflation. This increase is likely to boost policymaker’s optimism for a rate hike later in 2016, even though it’s still too low.

The BoE Governor stated that “is not yet the time to raise interest rates”. Carney paid attention to the low inflation rate and the weaker than before world and UK growth. The central bank to raise the interest rates needs “cumulative progress” in core inflation, domestic cost pressures and the economic growth to support inflation rise back to bank’s 2% target. The next inflation and GDP reports will be significant for the first BoE rate hike since July 2007, before the global financial crisis. Today, the domestic unemployment report is coming out.

The GBP/USD is in the process to deliver the fourth consecutive negative weekly candle and is traded near 7-year lows. The pair is under heavy sell-off and dropped by 5.30% since the last week of December. There are no any signals that the sharp sell-off is about to end. The next level to test to the downside is 1.4060. If the aforementioned level fails to support the pair the next level to watch is 1.3660.

NZD/USD Plunged on Lowest Inflation Rate since 1999

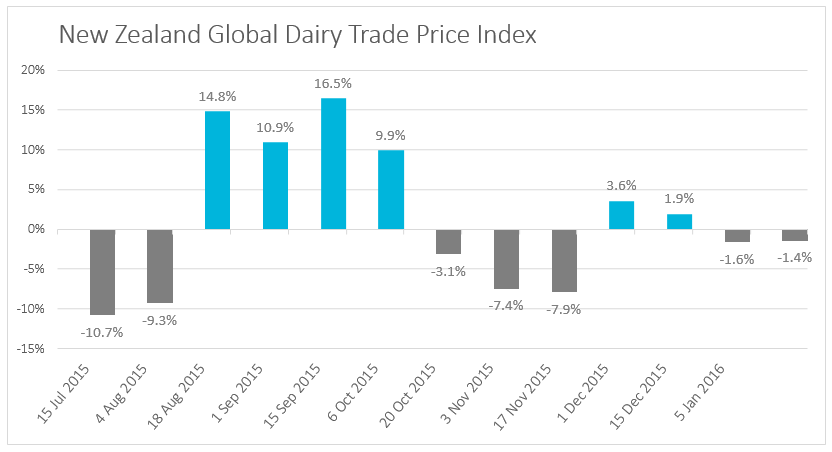

The New Zealand was rising against its U.S. dollar counterpart before the Fonterra auction but slumped after the dairy data and fell sharply following the weak inflation data. The dairy prices decreased by 1.4% for one more time. On the last global trade, on 5th of January, the prices dropped by 1.6%.

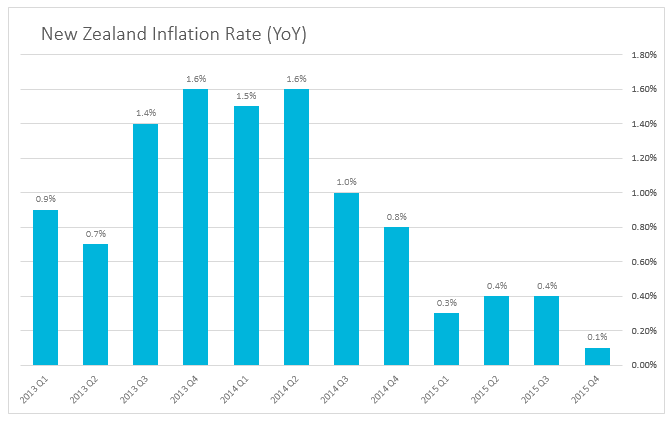

Overnight, the New Zealand’s inflation report unveiled that the country is experiencing the lowest inflation rate it has since 1999. The consumer prices in Q4 increased just by 0.1% from 0.4% before missing expectations to have remained at a stable growth.

The NZD/USD pair is set to deliver the fourth negative week in a row as all the data coming out are pushing it lower. I would expect the pair to depreciate further towards the strong support level at 0.6240. If the aforementioned level fails to support it, the next level to watch is 0.6110. Otherwise, it is likely to rebound at 0.6240 and rise towards the psychological level at 0.6500.

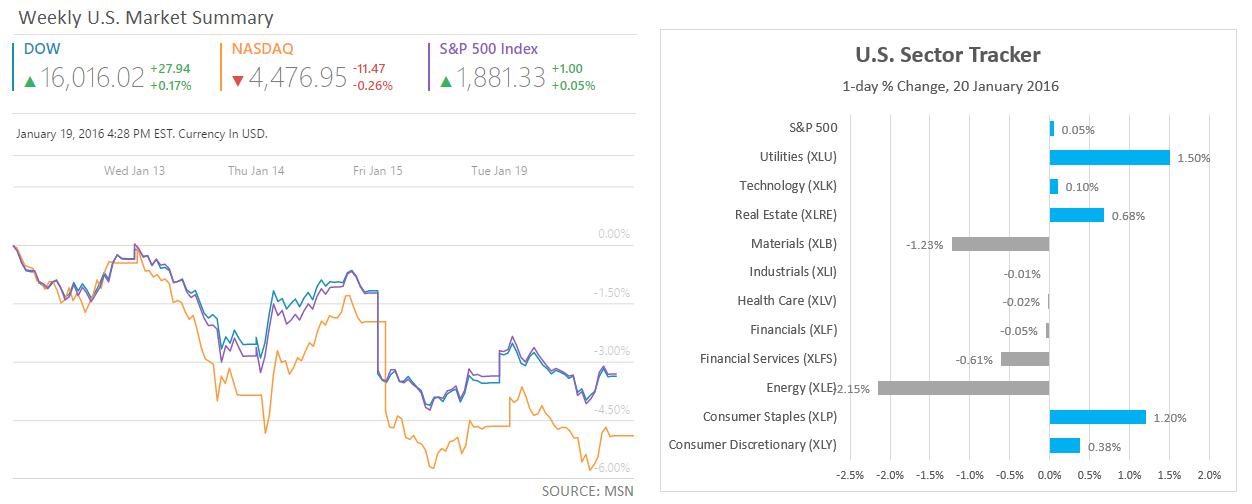

U.S. Indices Virtually Unchanged

The earnings period started and after a day off the U.S. indices ended the trading day virtually unchanged. All the three of them has very limited volatility. The Dow Jones Industrial Average and the S&P500 ended the day with gains of 0.17% and 0.05% respectively while the Nasdaq inched down by 0.26%. The worst performed stock sector was the energy that depreciated by 2.15%, as the oil continues to be slightly above $28.00 per barrel.

Economic Indicators

Today, there is a slew of important fundamental updates, including UK employment report, U.S. inflation rate and BoC policy meeting! At 09:30 GMT time, the UK Job report will be out. The ILO unemployment rate for the three months to November is expected to remain at 5.2% while the claimant count for December is forecasted to show that unemployed people increased by 2.5k from an increase of 3.9k in November. The average earnings are predicted to continue rising at a healthy pace above 2%.

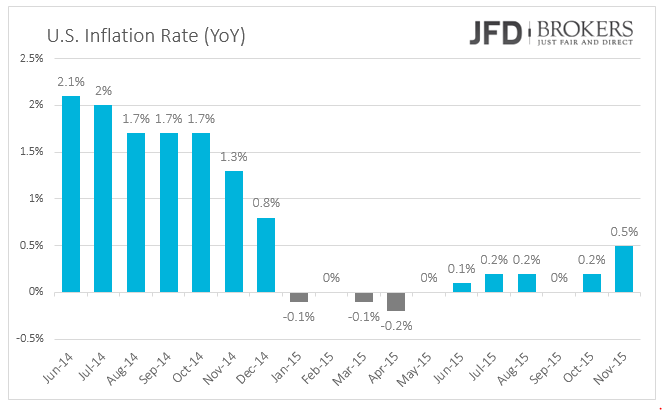

Going to U.S., the inflation rate is estimated to increase up to 0.8% from 0.5%, a step closer to the Fed’s target of 2%. If the expectations surpassed, the greenback will gain momentum. The building permits are expected to be at 1.200M in December from 1.289M before while the housing starts will increase to 1.197M from 1.173M.

A while later, attention is turned to Canada. The Bank of Canada will have its policy meeting and is expected to leave its benchmark interest rate unchanged. The policy statement will be out as well and will attract attention as the commodity currencies are badly affected by China’s slowdown and plunging oil.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.