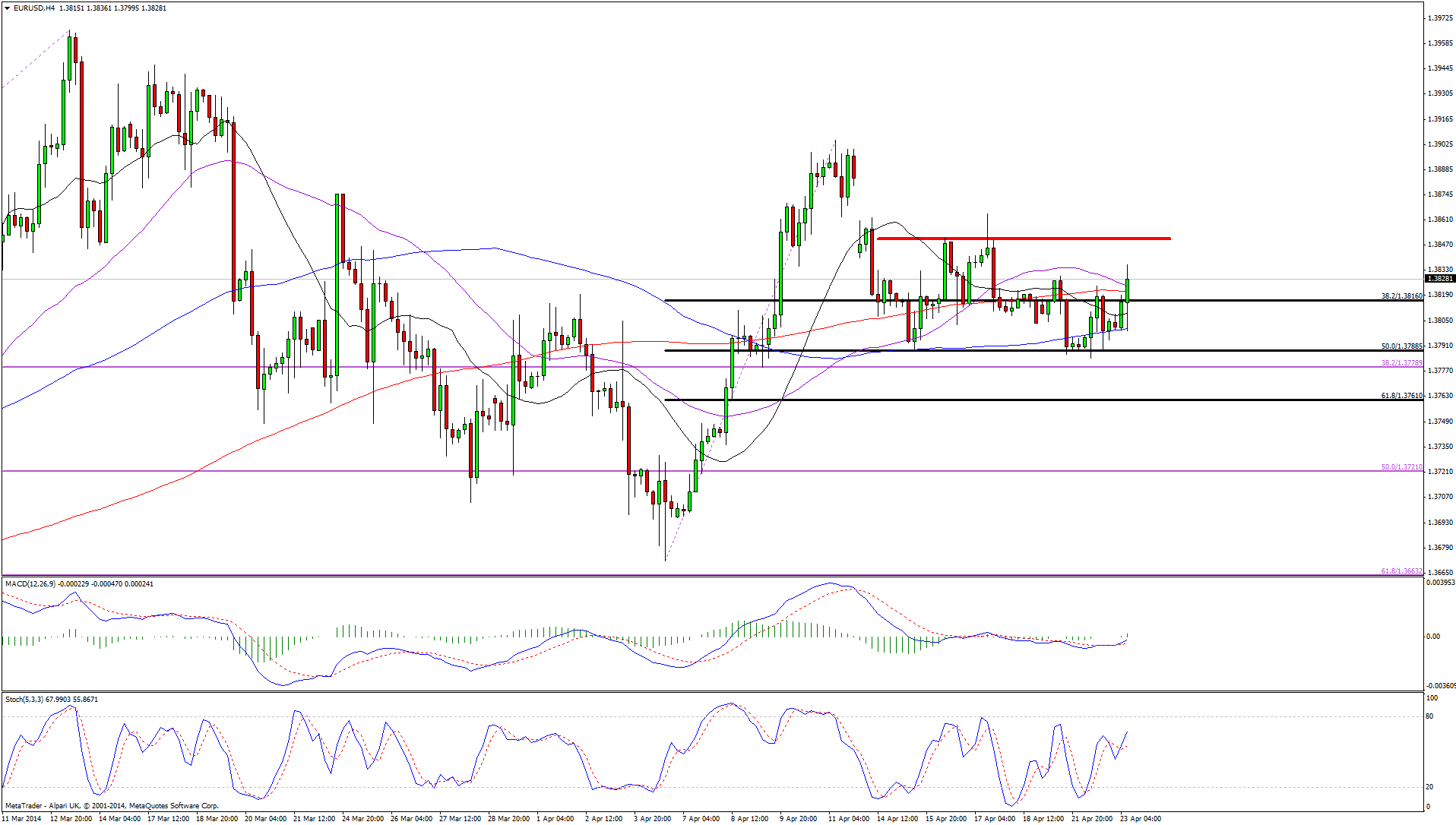

EURUSD

The euro is looking a little more bullish against the dollar again, but the lack of momentum is a concern. Not only did the pair fail to make a new higher during the previous rally before correcting, the bounce off the 50 fib level wasn’t very convincing. Clearly 1.40, not far above the current level, is a major psychological level and is making traders a little cautious as we approach it. Should we break above that level, we could then see more aggressive buying. For now I expect the caution to continue with mild gains being made. The 4-hour chart shows an imperfect double bottom forming with the neckline around 1.3850. A close above this level could prompt the next surge in buying with the target being just above 1.39, based on the size of the formation. This coincides roughly with the previous resistance found on 11 April.

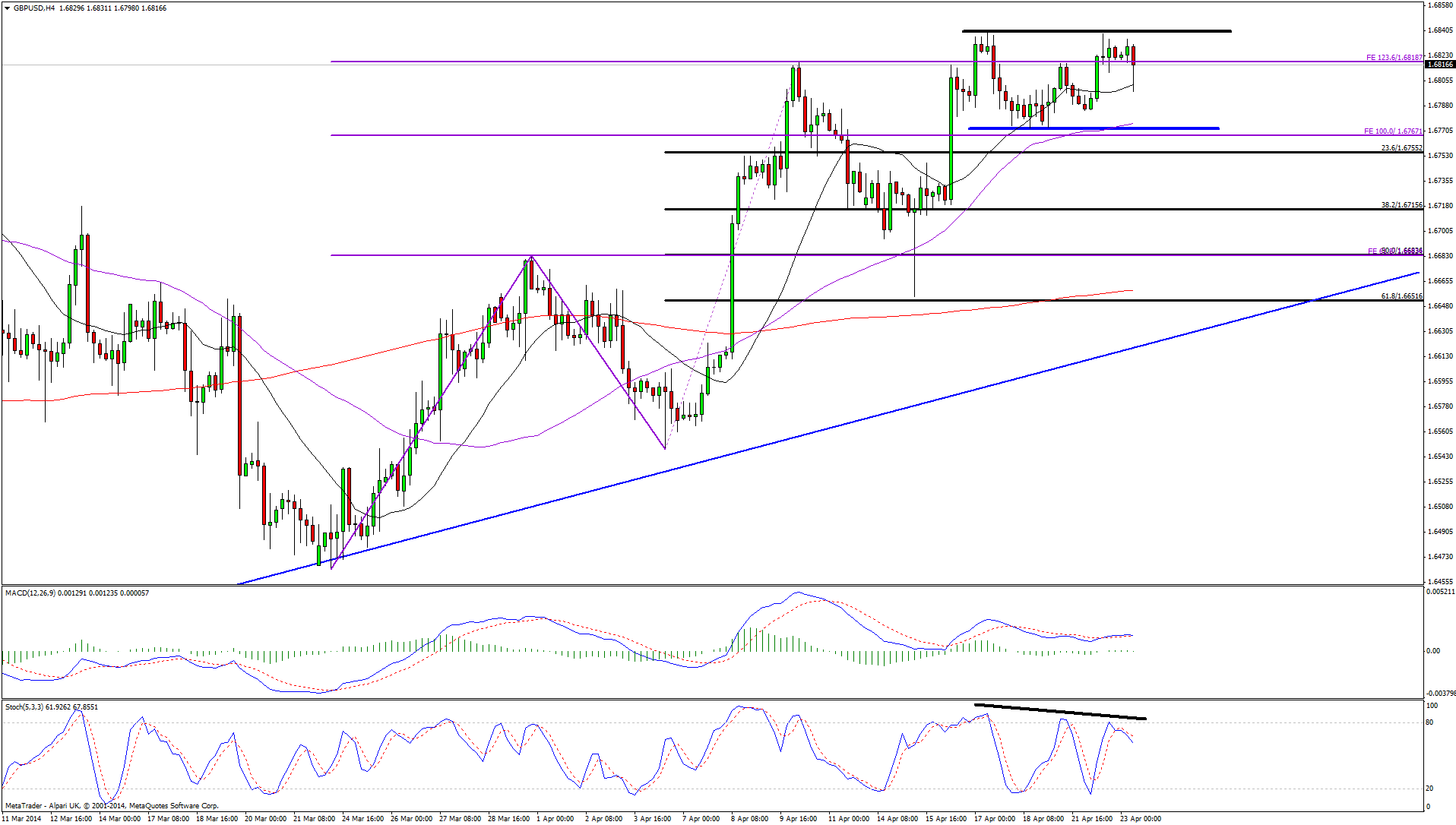

GBPUSD

Sterling is really struggling around 1.6820 right now having reached the 123.6 fib expansion level, which happened to coincide with a previous resistance level, dating back to 17 February. Numerous attempts to significantly break through this level have failed which suggests the bullish move may be running out of steam. This can also be seen on the 4-hour chart where the pair has been testing previous highs while momentum, as seen on the stochastic, is being lost. This bearish divergence could be an early warning of a more significant correction in the near term, although as always this is only a secondary indicator so further confirmation of this will need to be seen. This could come from the pair breaking through the previous support around 1.6772, with further confirmation coming from the pair making lower highs and lower lows. For now though, the pair appears stuck in a tight range between 1.6772 and 1.6840.

USDJPY

This pair remains range bound at the moment and yesterday’s doji candle at the top of the range suggests this is not going to change. The ADX continues to hover around the 20-level which supports the continuation of this range bound trading. We’ve already seen some selling early in the session which suggests once again that we’re going to see another move back towards the bottom of the range. That said, it may not reach the support that it has previously, with an ascending trend line having now penetrated the trading range. Significant support could now be found around 101.60. Should we see this it could point to a breakout to the upside over the next month or so, with further resistance then being found around 103.50, previous resistance. For now, the pair appears to have formed a small double top on the 4-hour chart and is currently finding support along the neckline. A break of this should prompt a move towards 102.25 based on the size of the formation.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.