Market Overview

The dollar certainly had a significant wobble yesterday after the weaker than expected readings on the ADP employment report and also a fifth straight month of decline on the ISM Manufacturing. The immediate concern is over what this could mean for Non-farm Payrolls tomorrow, however also the concern for the upcoming earnings season and across how it impacts on the potential for a Fed rate hike. The main beneficiaries were the commodity prices which resulted in big jumps in gold and oil. Equity markets took the news reasonably negatively but Wall Street managed to claw back some losses into the close. The S&P 500 ended the day down 0.4%. Asian markets however were strong with the Nikkei up almost 2% despite a slightly stronger yen. European markets have started their last trading day of the week in slightly positive territory.

Forex trading shows that the dollar is still under pressure, with the euro looking to push back above $1.0800, whilst the Swissy and the Kiwi dollar are also performing better today. Traders will be looking out for UK Construction PMI at 0930BST which is expected to fall slightly to 59.5 (previous 60.1), which is around 7% of the economy so could have a slight impact on sterling. The US trade balance at 1330BST could impact on the dollar with a slight improvement to -$41.2bn expected (from -$41.8bn). The weekly jobless claims are also at 1330BST at are expected to rise slightly to 285,000 (last week 282,000).

European markets will be closed for Non-farm Payrolls tomorrow. This could mean that trading today becomes fairly muted into the close due to the uncertainty of not wanting to be positioned over the data and then not being able to react on Monday either. That means that Tuesday could be volatile though.

Chart of the Day – EUR/GBP

The slide in the price in the past few days has changed the outlook back towards a more negative slant. The original move above £0.7300 had been significant in improving the outlook, but this has since become a pivot level that has been the borderline between the euro improving and deteriorating once more. The concern is that the momentum indicators have rolled over with the RSI failing under 60, the MACD lines under neutral and a crossover sell signal on the Stochastics. These are all suggestive of a bear market rally with any rebound being seen as a chance to sell. The hourly chart shows the £0.7300 pivot level very well , but also the role that the now falling 89 hour moving average is playing currently at £0.7282. Whilst under the £0.7300 I see the outlook as corrective for a test of the recent low at £0.7218 and then the reaction low at £0.7147.

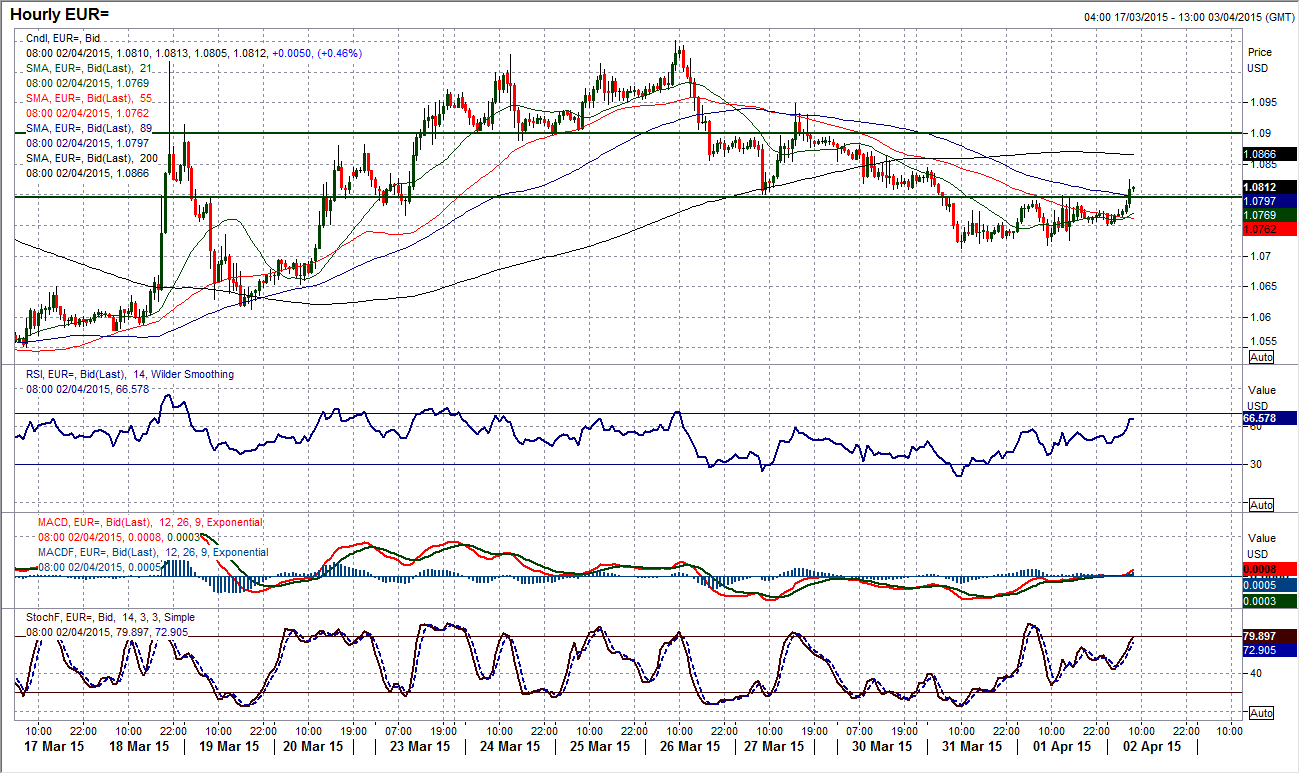

EUR/USD

The daily chart still shows a bearish drift following on from the bearish key one day reversal on 26th March. The weaker than expected US data yesterday meant that the dollar was under pressure again, but for now the euro is still not really making too much headway. The resistance at $1.0800 had held back the euro twice yesterday (on first the ADP employment and then the ISM data) but the early European session today is seeing further pressure building as the euro has just initially broken through the resistance. However, there still needs to be a decisive move for the bulls to gain any real confidence. Even then, whilst trading below the previous breakdown at $1.0900 there will still be an outlook of selling into the strength as I continue to expect further weakness in the euro in the coming days and weeks. The bulls will point to the near term support at $1.0712 which is intact which is protecting subsequent lows such as $1.0617, however I see this as a temporary consolidation before further downside.

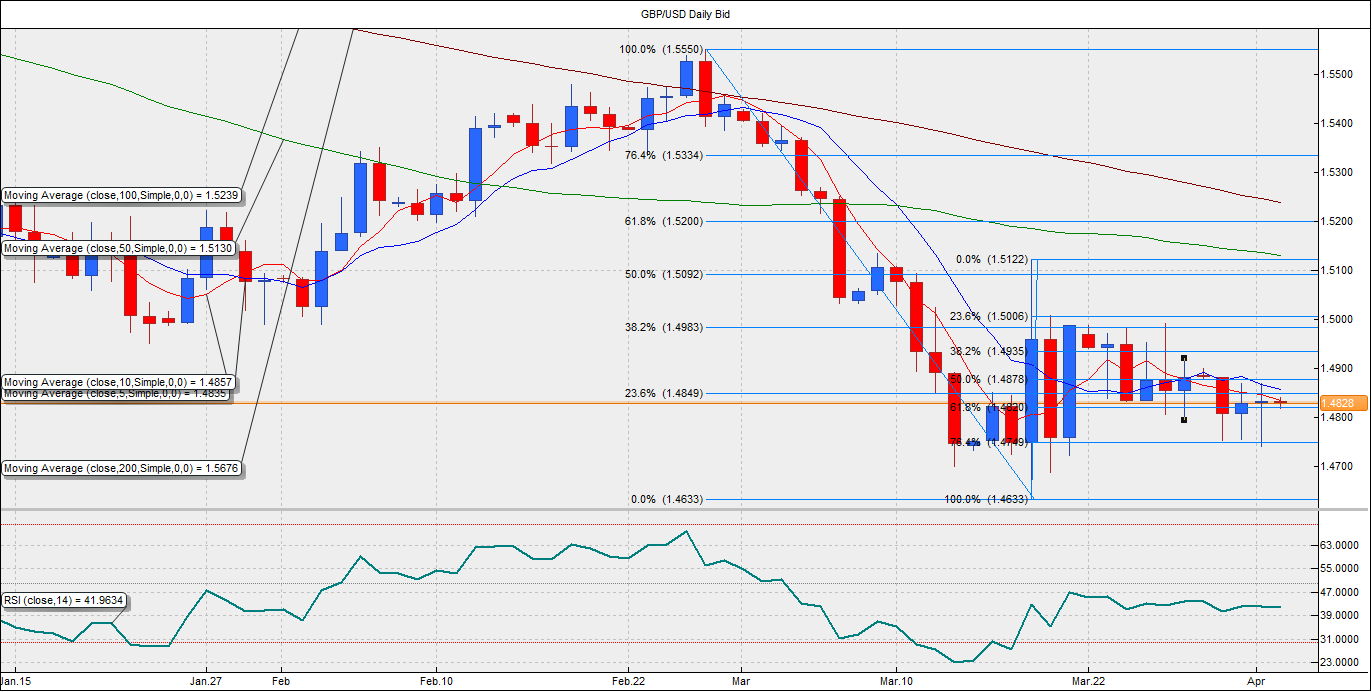

GBP/USD

The outlook continues to remain a concern for sterling. A bearish drift continues albeit without any significant impetus behind the selling, there is still very little for the bulls to be hopeful of, although perhaps a couple of consecutive doji candles could be taken to denote near term uncertainty. The falling 21 day moving average is still seen as a basis of resistance, currently falling at $1.4900. The momentum indicators have rolled over and remain negative but also suggest that if the bears do get going again then there is plenty of downside potential. Intraday moves were data dependent yesterday with a significant sell-off after UK Manufacturing PMI and then a rally on the ISM data. However the net impact has been that Cable remains under pressure. There are a couple of lower highs that have been posted under the band of resistance at $1.5000, which have left further barriers to gains today, at $1.4870 and $1.4920. The hourly momentum indicators have unwound and shows renewed downside potential for a retest of $1.4737.

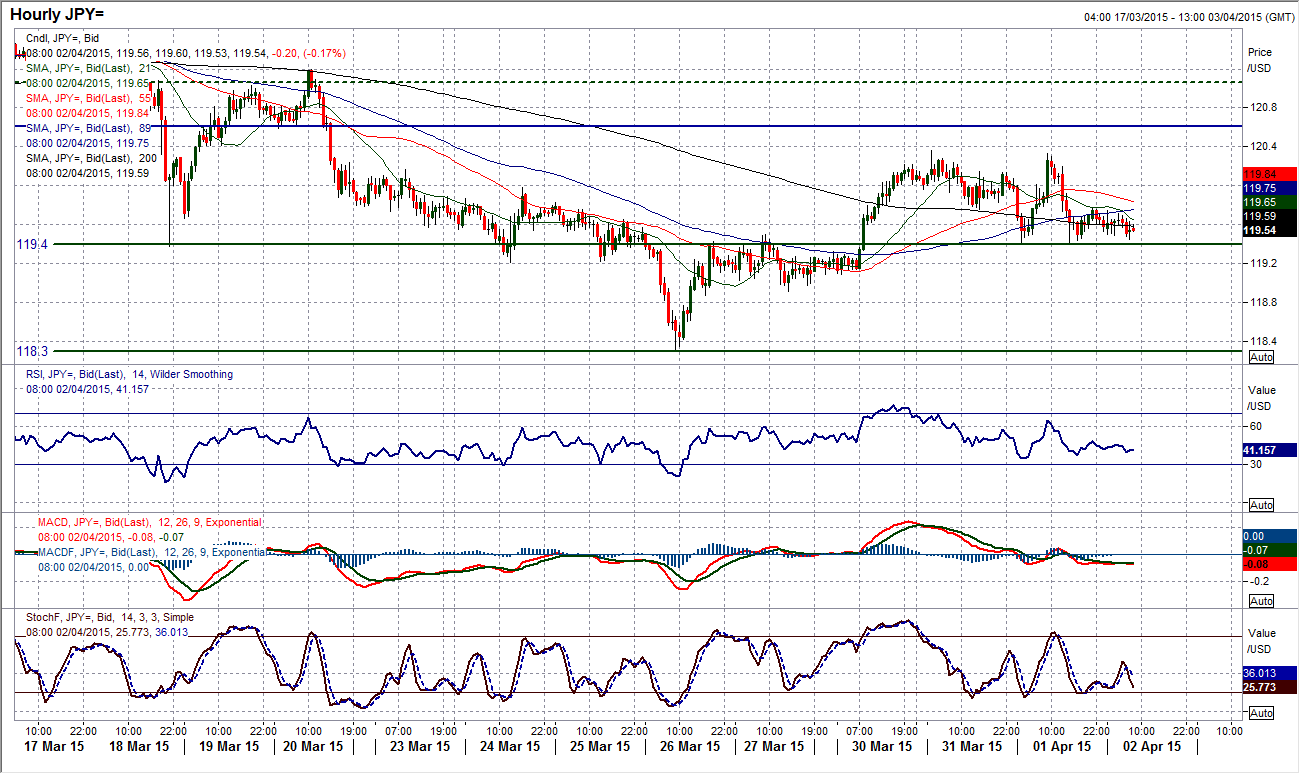

USD/JPY

The uncertainty on the daily chart continues as a couple of slightly negative candles have kept the reins tight on the bulls. Momentum indicators remain neutral and with the moving averages flattening it is becoming increasingly difficult to string more than two or three sessions together in the same direction. The intraday hourly chart shows that the pivot level at 119.40 is increasingly important near term, currently as a basis of support. The weak US data yesterday saw the support tested again yesterday but once more with the dollar under pressure today the pivot is back under pressure. I remain slightly bullish above 119.40 but if this level were to be breached then I would be bordering on turning more negative again.

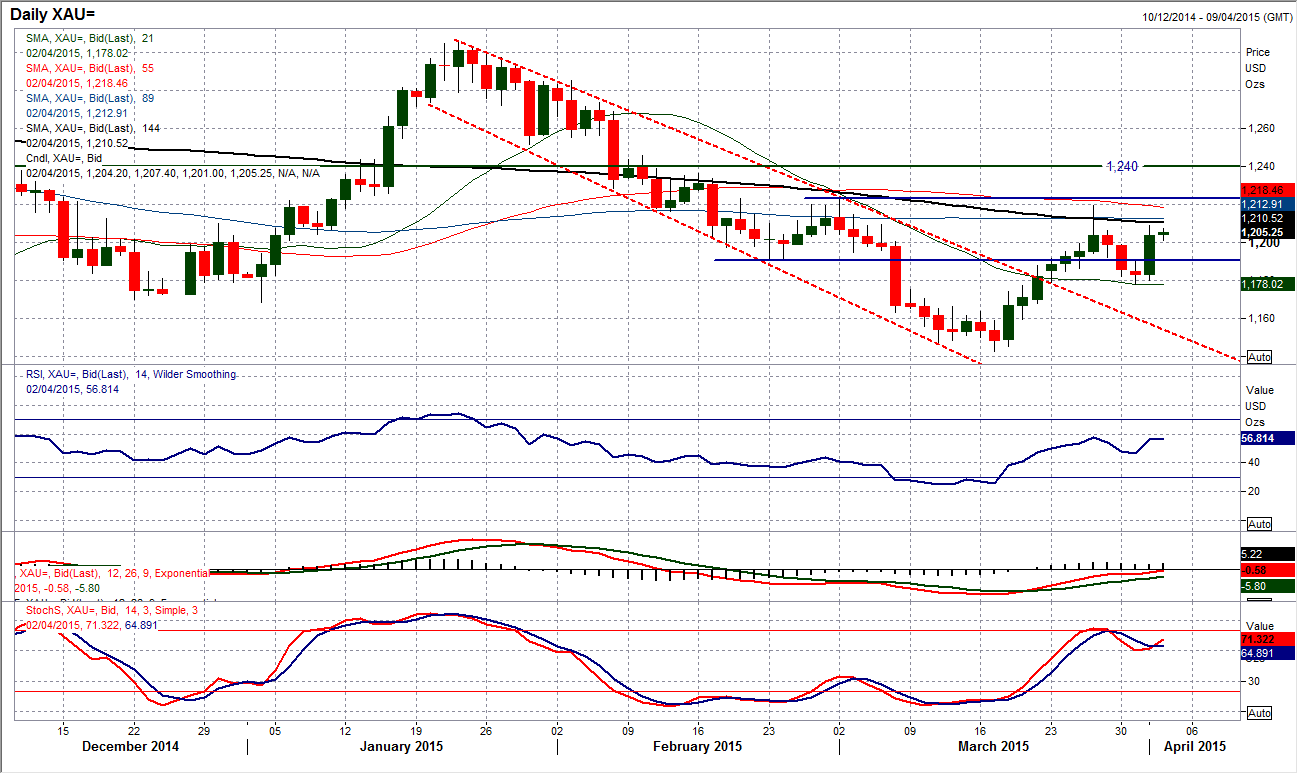

Gold

The movement on the gold price yesterday just shows that you need to be close to the economic data for successful near term trading. The weak technicals were trumped by the reaction to the dollar negative newsflow (ADP and ISM) which saw gold jump significantly. On a medium term basis the outlook has not really changed though, with the strongly bullish candle still trading under the resistance left at $1219.40 which still seems to be a key medium term high. The momentum indicators have picked up by whilst the MACD lines continue to trade below neutral and RSI is below 60, I would still prefer to see rallies as a chance to sell. The intraday chart shows that bounce peaked yesterday at $1208.90 the price has started to drift. The bulls will point to the support which is beginning to form just above $1200 as the price has consolidated. The intraday outlook has certainly improved with the rally but the key move will come with Non-farm Payrolls tomorrow. Support comes in around $1191and then $1178. A close above the high at $1219.40 would completely change the outlook once more.

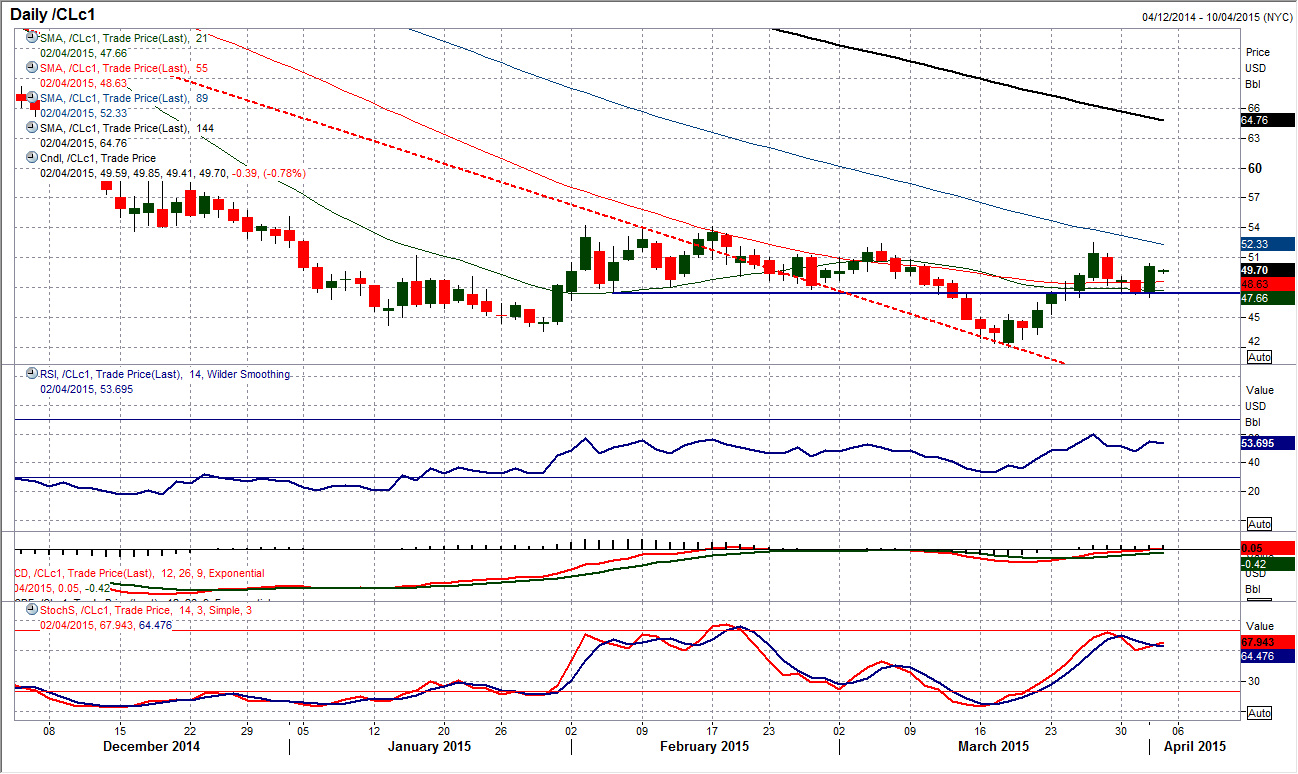

WTI Oil

Commodity prices took great delight in the weaker than expected US data yesterday and WTI was not one to miss out. A sharp rally was seen which turned a slight loss into a gain of over 4% on the day. This move significantly improved the outlook of WTI and actually completed a bullish outside day on the daily chart. This is a move that now needs to be backed up by further gains today in order to confirm the turnaround in near term sentiment. At this stage I do not see this as a game changer. I continue to see a volatile consolidation in WTI in the coming weeks which will be characterised by continuous rallies and corrections with no real trend emerging. This latest move is coming with momentum in neutral configuration and the nearer term moving averages broadly flat. The intraday chart shows a resistance around $50 so this would be a first barrier to overcome. A decisive move with support above $50 would re-open the $52.48 high. There is now a band of near term support between $48.70/$49.20.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.