Market Overview

There has been a strong reversal of sentiment in the past 24 hours. Equities have sharply fallen whilst the dollar has come under some corrective pressure. It will be interesting to see if this is just a near term blip or something bigger. There are two catalysts that could play a big part in this. Firstly amidst a pretty dour earnings season to date in the US, Apple has recorded a somewhat remarkable set of quarterly results (much of which has been driven by soaring demand for its products in China which was up 70% on a like for like basis). The knock-on impact this could have on the markets could be significant. Although Wall Street closed with sharp losses, Asian markets were broadly flat to slightly higher and European markets have started higher too.

The other factor is the Federal Reserve meeting today which culminates in a statement on monetary policy at 1900GMT. With central banks around the world almost queuing up behind one another to deliver dovish shifts (the central bank in Singapore was the latest to ease monetary policy overnight) all eyes will be on the FOMC to see what they come out with. There is an expectation of no major change to the statement although the usual debate over the wording of the length of time the FOMC will hold rates at record low levels with “patience” and “considerable time” still featuring. However if there is a subtle shift to a more dovish tone, in light of the oil price and global disinflationary pressures, then there could be a significant dollar correction and a short squeeze on pairs such as EUR/USD.

In forex trading there has been a slight rebound for the dollar after yesterday’s losses, with the greenback showing small gains against the majority of major pairs. The main exception is the Aussie dollar which has bounced on the back of Australian CPI data, despite the fact that inflation came in at 1.7% (1.8% had been expected).

Aside from the FOMC traders will be watching out for the US crude oil inventories which are announced at 1530GMT and are expected to dip back to 4.2m (last week jumped to record levels and which hit the price of WTI oil). There is also a rate decision from the Reserve Bank of New Zealand which is expected to keep rates flat at 3.5%.

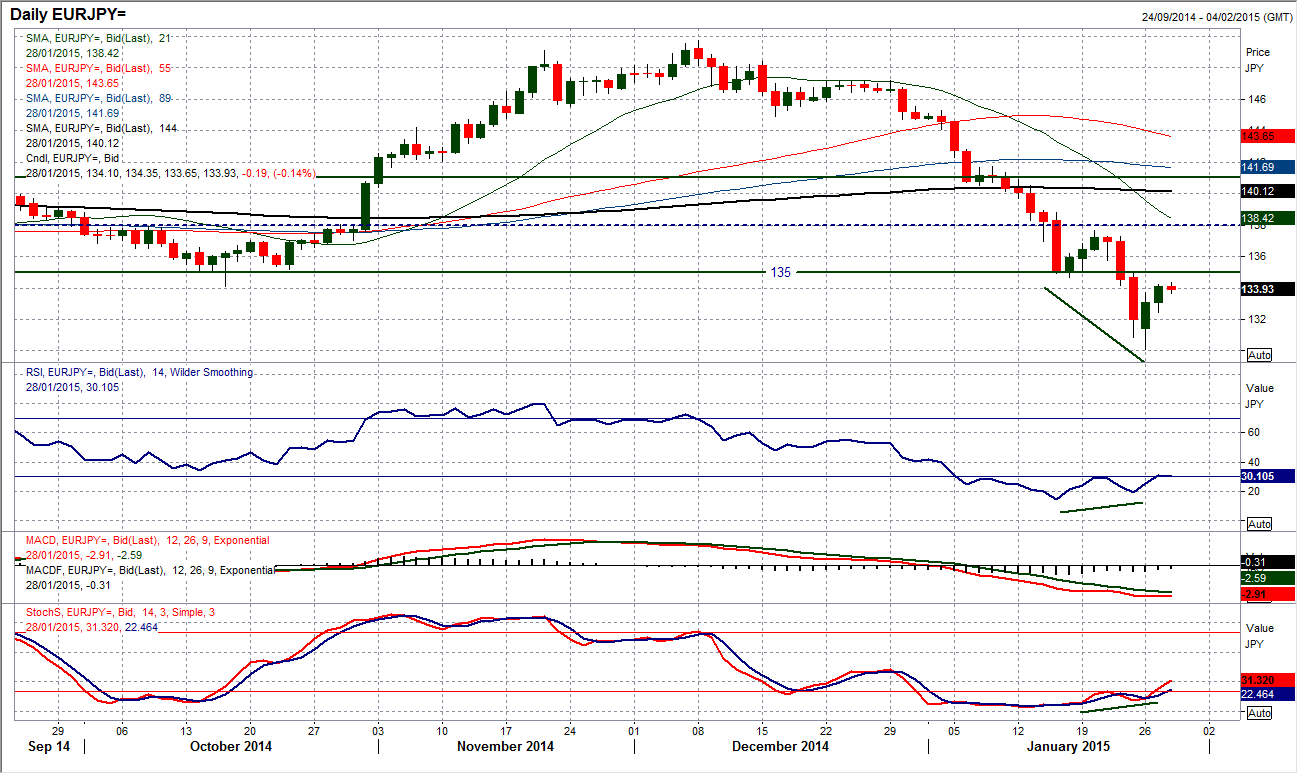

Chart of the Day – EUR/JPY

The breakdown of the big support at 135 was a key move. We are now seeing the pullback to the old key support and it will be interesting to see the reaction around this level of overhead supply. There have been two days of strong gains from the low at 130.10. These have been seen as a bullish divergence formed on the RSI (and to a lesser extent on the Stochastics). This suggests that the resistance around 135 is the key near term chart feature. If this rebound can make a decisive breach of 135 then the recovery bulls can push back towards the next reaction high at 137.60. The intraday hourly chart suggests that this is just another bear market rally, with the 200 hour moving average (currently 134.85) the basis of resistance. If there are any sell signals around the 135 resistance it could prove to be a good chance to sell.

EUR/USD

The technical rally continued yesterday as the Euro unwound some of its oversold excess that had built up following the monetary easing from the ECB. The daily chart is interesting as the momentum indicators are a little mixed. Whilst the RSI is showing a typical unwind of a bear market rally back towards 30 and the MACD lines are still in bearish configuration, the Stochastics have been bullishly diverging and have crossed back above 20. Now this improvement in the Stochastics alone is not enough to believe that this technical rally will turn into something more major but it is interesting to see that not every indicator is forecasting the plummet of the euro. However the tighter downtrend line over the past 6 weeks comes in at $1.1500and it does still look as though this rally is likely to come under selling pressure once more. The intraday hourly chart shows a small base pattern above a neckline of $1.1295 which targets $1.1490, but a rebound towards the old key support which is now resistance at $1.1460 is more likely. Bear market rallies tend to undershoot their upside targets so it will be interesting to how far this one goes before the sellers return.

GBP/USD

There was also a strong rebound on Cable yesterday which has allowed the technicals to unwind far more than the Euro. The RSI and Stochastics have both shot higher in the past couple of sessions as sterling has rallied around 350 pips in three days. This could now be a key near/medium term crossroads. The RSI is at 45 (the big rallies within the downtrend have tended to get to the mid to high 40s on the RSI before the sellers return). The 21 day moving average (currently at $1.5187) has also been a good basis of resistance through the downtrend. Furthermore, the intraday hourly chart shows an interesting pivot level around $1.5200 which has been a key near term ceiling over the past two weeks. So if these factors can be overcome then there could be more legs in this recovery. There is intraday support in the band $1.5060/$1.5120. The resistance of the primary downtrend on the daily chart comes in at $1.5360.

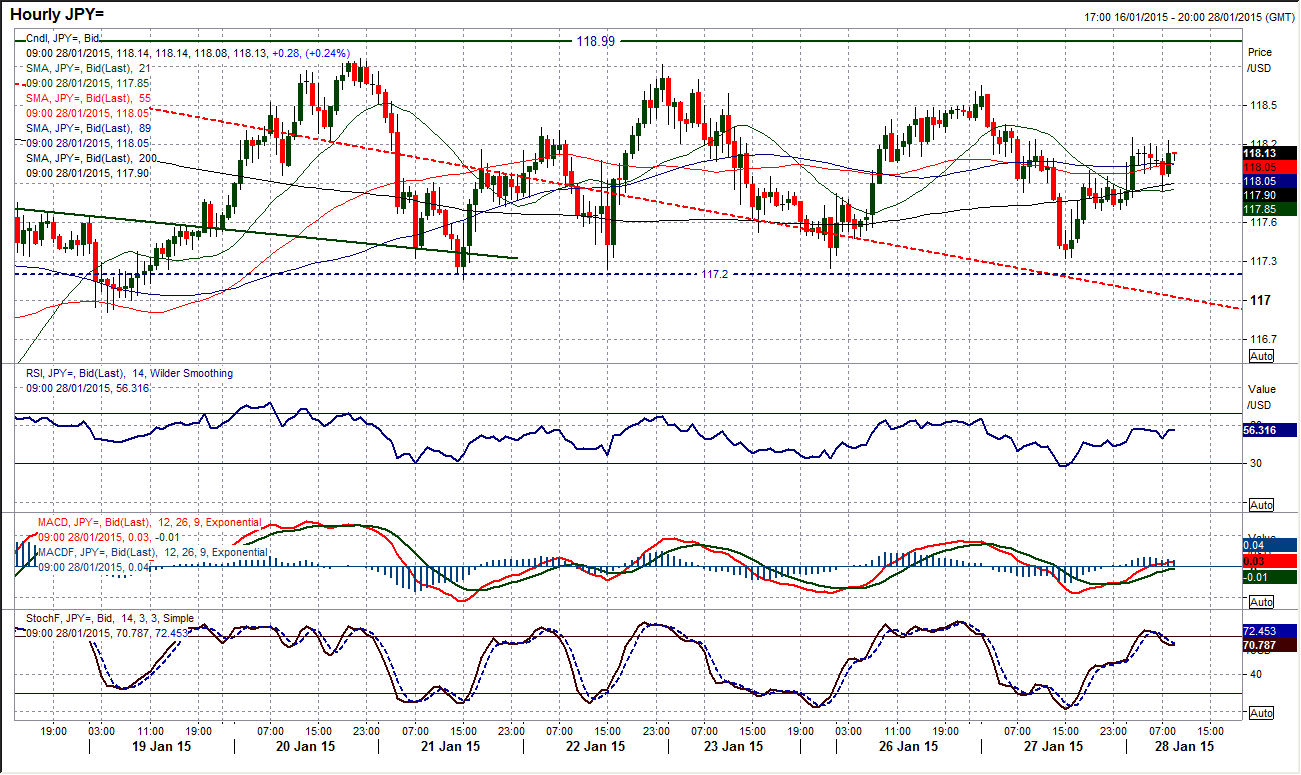

USD/JPY

The neutral outlook on the daily chart continues to run with moving averages flattening off and momentum indicators ever more benign. Something needs to happen fundamentally as the technicals are doing very little on a daily basis, perhaps it will be the FOMC monetary policy tonight that can be the catalyst? Intraday we continue to see this band between 117.20/119 over the past week and a half. Playing the classic signals on the RSI is still a viable strategy (ie. buying at 30, selling at 70), but with moving averages increasingly flat the outlook here is also becoming ever more neutral. The latest rally off the range lows (and RSI at 30 yesterday afternoon) is already threatening to run out of steam. There needs to be something now that gives everyone a push and a decisive move either above 119.00 or below 117.20.

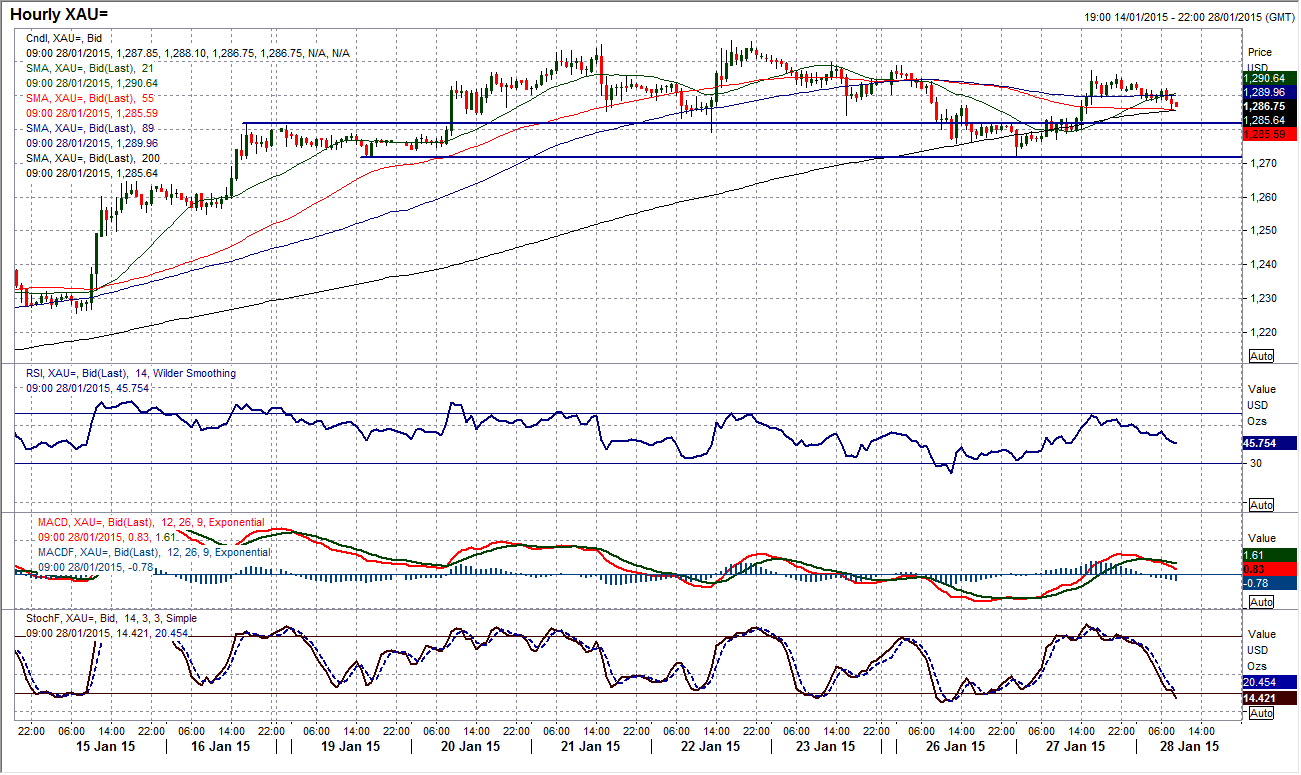

Gold

The rebound on gold yesterday showed an interesting resolve for the bulls. In the face of what had become mounting indicators of a correction the bulls have held on to retain the bullish outlook. However this is not to say that the prospects of a correction have entirely vanished. The ideal medium term scenario would be a nice drift back towards the breakout support around $1255 where the bulls can take hold again for the next leg higher. That is what the intraday hourly chart had been threatening before yesterday’s rally. The interesting factor about the rally was that the support at $1271.85 which I have been looking at as the final confirmation of the correction setting in, was never breached and so confirmation was never given. Today’s trading will be interesting as it seems as though there is a barrier around $1300 and there have been two days of successive lower highs (yesterday’s high was at $1297.50) and lower lows (yesterday’s low was $1272.30). The prospects of a near term correction remain unless there can be a sustained move above $1300. Initial support comes in around $1282 before $1271.85.

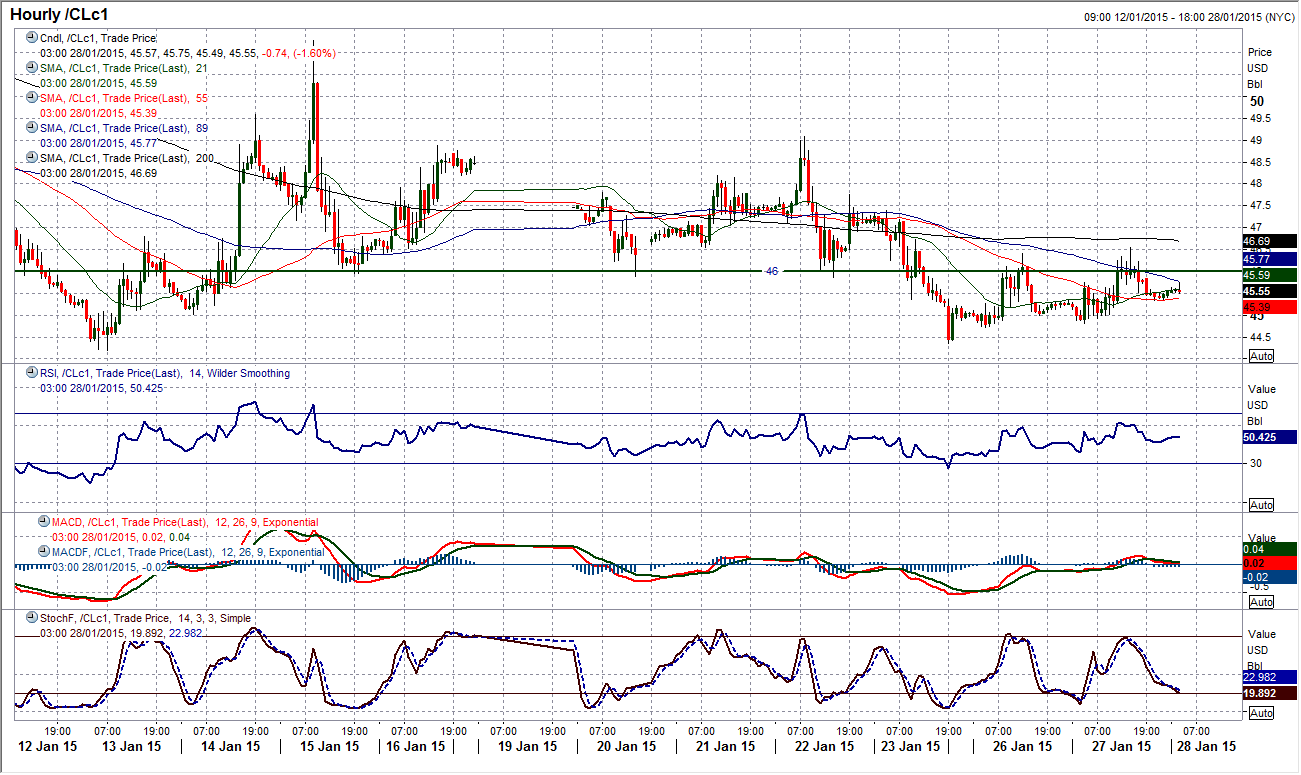

WTI Oil

WTI is becoming rather rangebound now as the buyers have once more returned to prevent a test of the key near/medium term low at $44.20. Although the price is trading within the lower half of what is becoming a 3 week trading range, there is an admirable intent to prevent yet another downside break. It will be interesting to see exactly how long this lasts for, but in such trading conditions it becomes a viable strategy to use classic RSI buy and sell signals to play the range. Certainly this is working at the moment (and is likely to continue whilst the range continues). There is still a pivot around $46 which can be used as a near term line in the sand. A consistent trading below would suggest the bears are looking to retest the $44.20 low, whilst a consistent move above this level would improve the near term outlook for a move back towards $47.75 resistance.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.