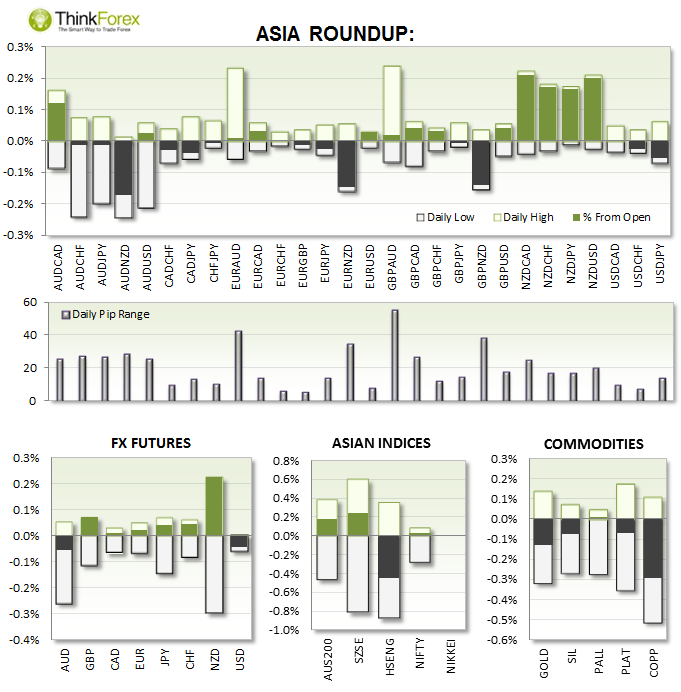

Australian building approvals contracted for a 4th time over the past 5 month to suggest a peak has been seen in the housing sector. The A$ was already fragile after strong US GDP data last night, with today;s data keepin it near 8-week lows. View today's post for details

Japan average cash earning y/y fall short at 0.4% vs 0.7% expected.

China Growth: CitiGroup upgrade their China growth forecast to 7.5% from 7.3% for 2014

UP NEXT:

European data takes the helm tonight with CPI flash estimates expected to be steady at 0.5%. With yesterday's bullish hammer on higher volume forming there is a technical argument for a bullish retracement. If we come in at 0.5% or more then we should see EURUSD retreat from the lows towards 1.3445 resistance.

Canadian GDP could provide further fuel to the bullish USDCAD if it falls short of 0.3% tonight. GDP has been expanding (slowly) for the past 4-month with the rate of acceleration declining. A positive number could see some profit taking and retracement on USDCAD but the trend remains increasingly bullish.

US jobless data may add a little volatility for those who cannot wait for tomorrow's NFP, but really the markets await tomorrow's employment data. If we fall short it may spur some profit taking from USD bulls.

TECHNICAL ANALYSIS:

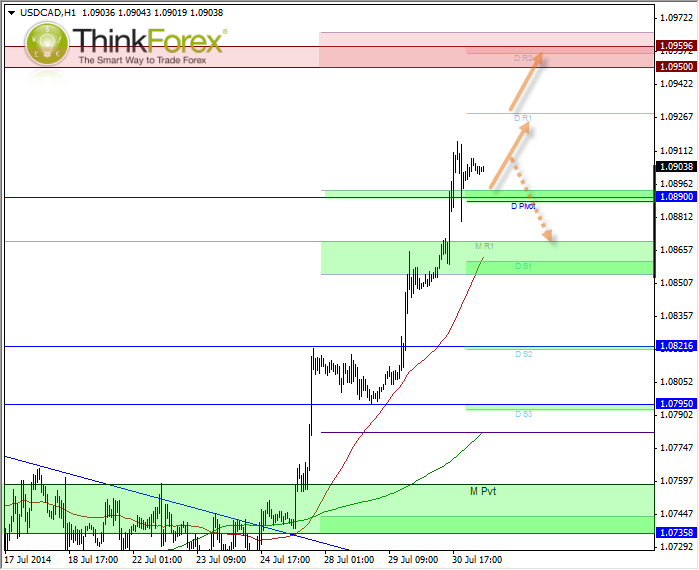

USDCAD: Seeking buy setups above 1.089

The Daily pivot is an obvious buy zone as this coincides with several other technical levels between 1.089-90. With US and CAD data out tonight (and I am favouring disappointing GDP from Canada) then I see no reason to buck the clearly bullish trend just yet.

​That said, poor data from US and good GDP data from Canada should see a quick reversal but I would only want to consider short positions below 1.089 (and not outstay my welcome).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.