ASIA ROUNDUP:

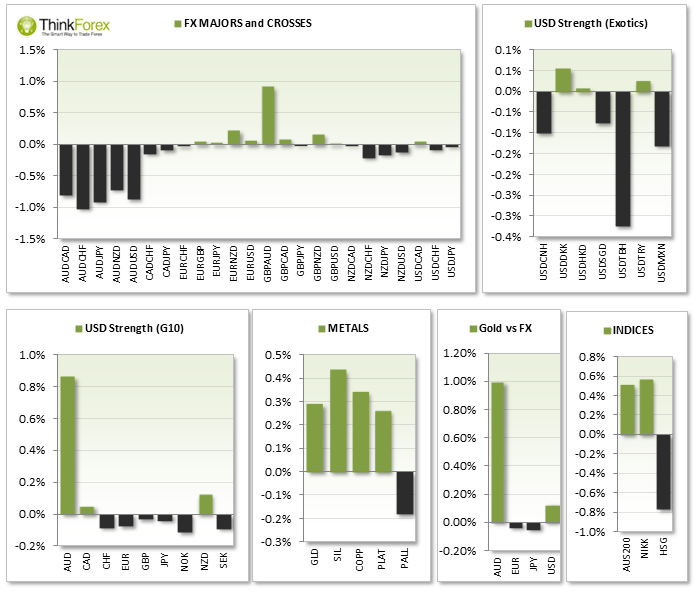

A$ sold off sharply across the board following today's disappointing CPI figures, after spending most of the session climbing higher in anticipation of good numbers.

Chinese Flash PMI followed shortly after to provide an extra blow for the Aussie crosses and Hang Seng as it confirmed a 4th consecutive number below 50 to suggest industry contraction. Whilst it came in above expectations at 48.3 vs 48.0 it wasn't enough to stop the declines.

NZD credit card spending y/y is up 8.1% to show consumer confidence is increasing

NZD Lamb exports fall but value has increased

UP NEXT:

GBP Bank rate and asset purchase votes will be announced. Whilst voting members have been consistently unanimous to keep policy fixed a change in these numbers could cause a stir in the markets tonight and increase speculation of rate increases this year

Last month's French Flash PMI was at it's highest level, and the first time above 50 in nearly 3 years. A reading above 51.9 would be strong for Euro.

German Manufacturing PMI follows shortly after and whilst is has seen 2 consecutive months below forecasts it has been in contraction (above 50) since July 2013. A reading above 53.90 would also be string for the Euro.

US Equities Futures have opened and held on to recent gains, seemingly not too shaken by today's Chinese Data.

Pairs to Monitor: EURGBP, GBPUSD, EURUSD, USDCHF

TECHNICAL ANALYSIS:

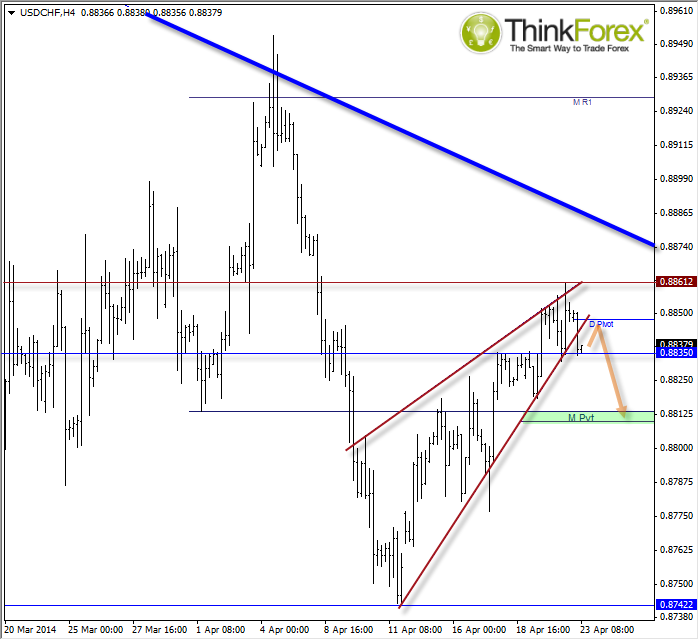

USDCHF: Confirmed bearish wedge; Initial target 0.8813

Yesterday's analysis worked out well as it hit both our lower timerame short target and higher timeframe bullish target, respecting the key levels of S/R along the way.

We appear to have broken out of the bearish wedge and now trading beneath the daily pivot. Scalpers could consider bullish setups towards the daily pivot.

A break above 0.8845 (Daily Pivot) opens up a run back to the 0.886 highs.

Bearish setups below the daily pivot could be considered for a bearish leg down to 0.8825 and 0.8813

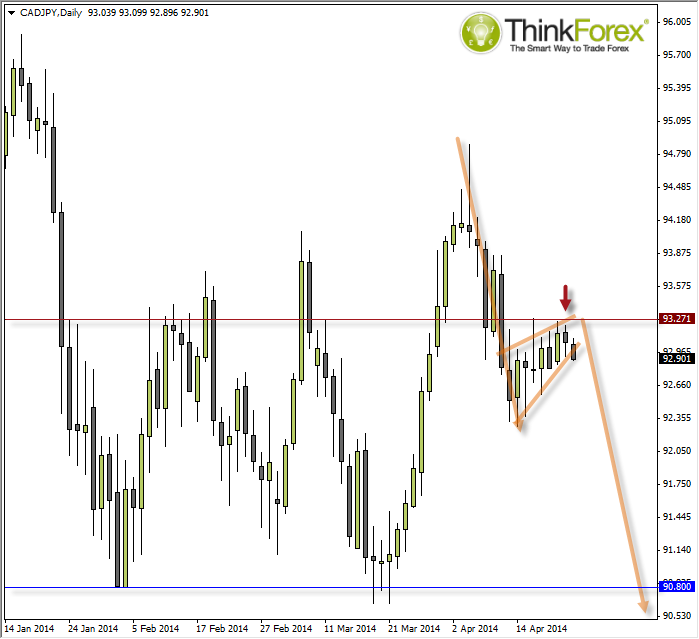

CADJPY: Bear flag below resistance

As this is on the daily chart this leaves more time to plan your entry.

The price action is oscillating wildly between a $5 range and currently mid-way between this range. Yesterday produced a Hanging Man Reversal below resistance level and now trading beneath yesterday's low.

The potential flag projects a target around the 90.0 lows; however the pattern would have to be reconsidered above 93.3 resistance.

Flags are particularly messy patterns to trade, so an option is to trade on lower timeframes in direction of the bearish target, seeking trend on H4, H1, or H15 etc.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.