AUD: Private sector credit gain 0.4% but slightly below 0.5% expected

CNY: China issue a warning to global nations to not interfere with its internal affairs.

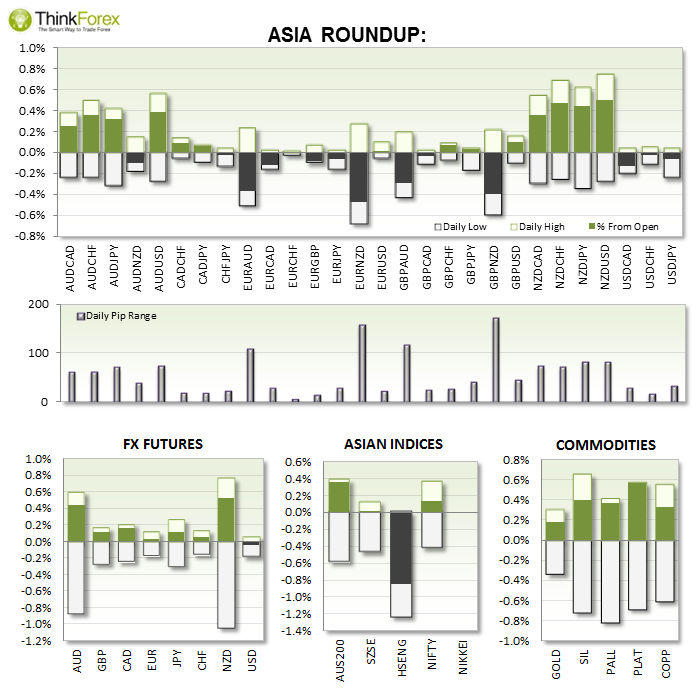

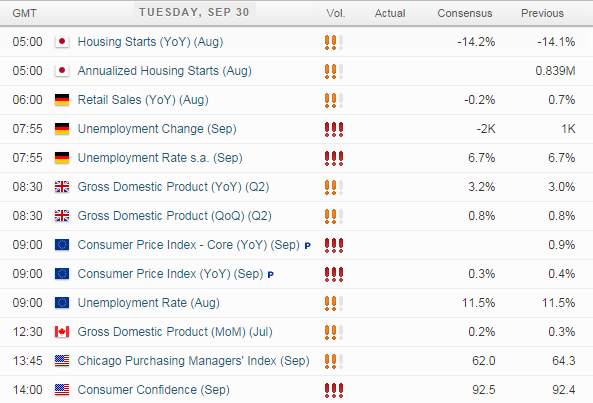

UP NEXT:

GBP: With GDP expected to tick up then failure to deliver could be GBP bearish.

EUR: Data from Europe tonight is the prelude to the important ECB Press conference and Rate Decision on Thursday. Any strength in tonights figures will releive a little pressure from ECB to outlay a firm QE program. However traders are heavily positioned to the short side in hope of stimulus from the Central bank leading up to Thursday, so if we see strong numbers tonight try not to get too carried away on the long side.

CAD: View today's post for a breakdown

TECHNICAL ANALYSIS:

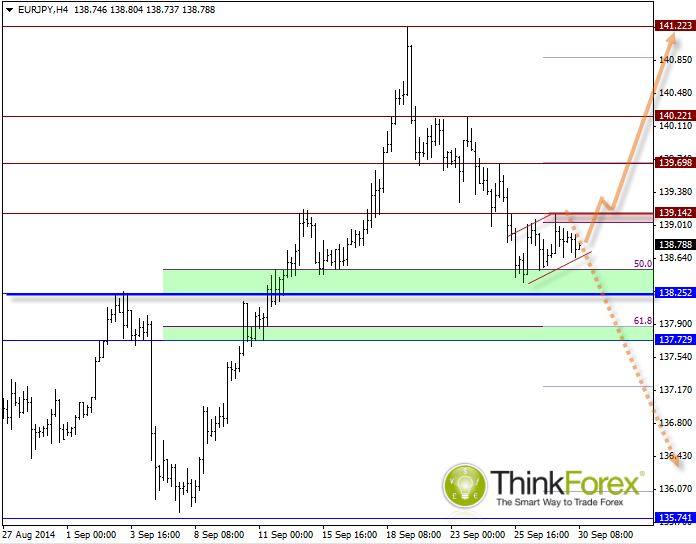

EURJPY: Catalysts are approaching

With tonight's growth data warming us up for ECB action on Thursday we should see a breakout this week.

Technically I suspect price will remain above 138.25 support for the following:

- D1 has produced a Morning Star Reversal pattern with increased volume to suggest buying at these levels

- Price action from the 141 high appears to be corrective (potential double Zig-Zag / Double 3)

For this scenario to play out we would require string growth from Eurozone along with no action from ECB on Thursday (resulting in short covering).

The counter analysis highlights potential for a bearish flag which if confirmed would target 136. For this scenario we would require poor GDP growth and a string plan for QE (to weaken the Euro).

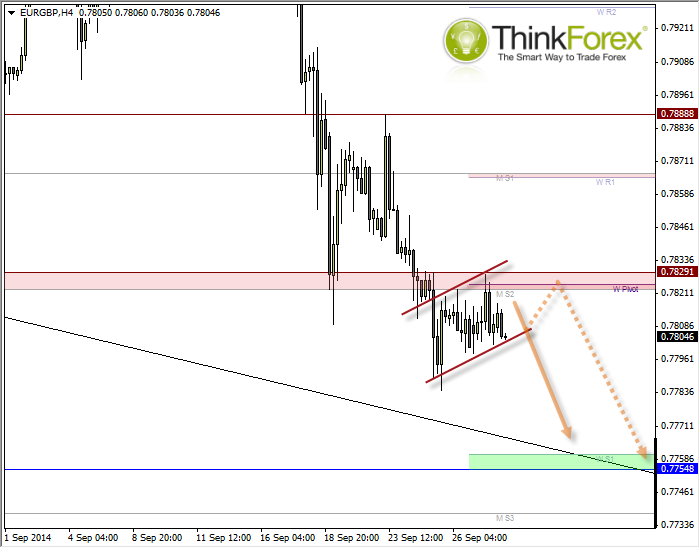

EURGBP: Bear flag below string resistance

We have data from Eurozone and UK tonight so this significantly increases the odds of a movement. Price is within an established downtrend on higher timeframes and has respected resistance around 0.7820, whilst trading within a potential bear flag formation.

We also have a clear profit objective around 0.77.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.