You've heard the old saying sell in May and go away. It's a well-known investment strategy for stocks that encourages investors to avoid the seasonal slump and volatility in equities by selling in May and returning in the beginning of November. Interestingly enough, this strategy also works in currencies but not in the exact same ways. First, simply selling in May and returning in November doesn't work. In the past 10 years, the Dollar index was lower in value in November compared to May only 50% of the time - which means there's no discernible pattern at all. This similar behavior was also seen in euro and sterling.

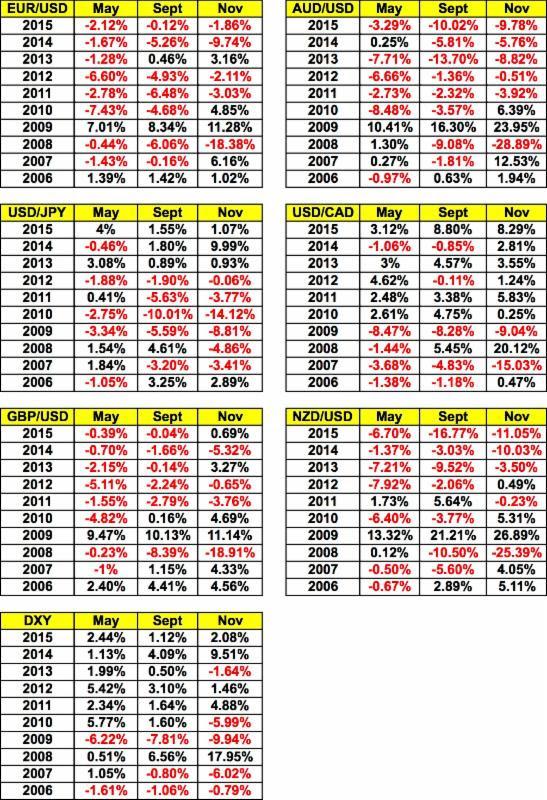

Instead, the strategy to consider is to sell EUR/USD and GBP/USD in the beginning of May and buy them back at the end of the month because these currencies declined in 8 out of the last 10 Mays. Unsurprisingly, buying the dollar (Dollar index) on May 1st and selling it on May 31st also netted gains 8 out of the last 10 years as well. Sellers of the Australian and New Zealand dollars on the other hand needed more patience. While the following table shows that AUD/USD fell 6 out of the last 10 years (and rose less than 0.3% in 2 out of the remaining 4), the best technique for both currencies is to sell in May and buy back when everyone returns from summer vacations in early September. There was no discernible pattern in USD/JPY but for USD/CAD, buying in May and waiting until November to sell was the best strategy.

Of course every year is different but there are many factors that could make the next few months difficult for investors and EUR/USD in particular. The U.K. referendum in June poses a major risk for all of Europe, the recent strength of the euro could curtail the region's recovery while the continued impotence of central banks could make investors dubious of the global recovery. There may also be new elections in Europe with Spanish leaders failing to resolve a political stalemate. The migrant crisis fueled nationalism across the continent and is beginning to reshape all of Europe. Many major currencies including euro saw strong gains between early March and late April so a correction in May would be natural.

As for what could drive the U.S. dollar higher in May? That's a tough one. The main catalyst is the May G7 Summit. At this stage, the only hope for the world is fiscal stimulus. If host country Japan unveils an aggressive package of new fiscal measures it will certainly help lift the dollar versus the yen but what the world really needs is o coordinated fiscal stimulus and unfortunately there's not enough political will for that to happen. Meanwhile, this morning's ISM manufacturing report is yet another piece of data in a string of softer releases cementing the market's confidence that U.S. rates will remain steady in June. This week's Non-Farm Payrolls report won't reignite demand for the greenback. The problem is not job growth but retail sales and business investment. So unless stocks climb to record highs, the next 2 payroll reports rise 275K or more, average hourly earnings increase consistently AND consumer spending exceeds 0.5% in April and May, they won't be tightening until September at the earliest. The dollar will rise when investors hit a capitulation point, realize that they've priced everything in and start to feel that the strong gains in negative rate currencies are unjustified. Central bank speak will also be important - when policymakers finally express their discontent with the rise in their currencies, their words could halt the rallies and drive the U.S. dollar higher in the process.

Meanwhile USD/JPY remains weak and we continue to view the currency pair as a sell on rallies. Japanese markets will be closed from Tuesday to Thursday for Golden Week so if USD/JPY drips below 106.00 don't expect any central bank action even though BoJ Governor Kuroda said they won't hesitate to add stimulus if needed.

The main focus tonight will be on Australia and the Reserve Bank's monetary policy announcement. At their last meeting the RBA left rates unchanged and said, "Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy." Investors interpreted these comments to mean discomfort with the current level of the currency and sent AUD tumbling lower as a result. There's a small subset of investors looking for the RBA to ease this month because CPI declined in the first quarter and activity slowed according to the PMIs. However according to the following table, consumer spending rebounded, business confidence improved, the unemployment rate declined and market indicators ticked upwards. So like many of their peers, the RBA may wait and see how the economy performs in the next month before taking additional action. The New Zealand dollar also traded higher while lower oil prices kept USD/CAD above 1.2500. No economic data is scheduled for release from Canada tomorrow but New Zealand has its dairy auction. NZD/USD surged above 70 cents today and is now trading within arms reach of its April 0.7054 high.

_20160502203942.jpg)

Sterling also climbed to fresh multi-month highs versus the greenback. While no economic reports were released today, the PMI manufacturing index is due tomorrow. If manufacturing and service sector activity grow at a faster pace, GBP/USD could reach 1.4800 but weak numbers could mark a near term top for GBP/USD which is still struggling to close above its February high of 1.4670.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.