RBI policy meet

RBI governor has declared that he's done with raising interest rates since any price spike in farm products would now be seasonal, and is ready to lower them if there are signs of the accelerated easing of price pressures. SLR cut of 0.50 percent and increasing the limits on foreign remittances is an indication of the trend towards normalcy for Indian currency markets.

Our View: It is upto the government to control prices of living essentials. Higher base price effect of last year will bring down headline inflation. It is the inflation outlook which will determine interest rate. The Budget will be the key for the short term.

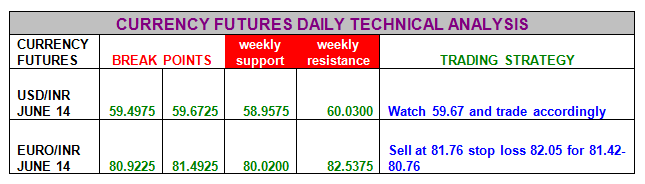

Usd/inr June 2014: A break of 59.67 will result in 60.10 and 60.36. Initial support is at 59.49 and there will be sellers only below 59.67

Euro/inr June 2014: It needs to trade over 80.90 to target 81.36-81.76. Initial support is at 80.90 and there will be sellers as long as euro/inr trades below 8090

Gbp/Inr June 2014: It needs to trade over 100.05 to target 100.20-100.75. Initial support 99.61 and there will be another wave of selling only below 99.61

Jpy/Inr June 2014: It needs t0 trade over 58.05 to target 58.56-58.88. There will be sellers only below 58.05 today.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.