Good Morning Traders,

As of this writing 4:20 AM EST, here’s what we see:

US Dollar: Down at 95.090 the US Dollar is down 317 ticks and trading at 95.090.

Energies: October Crude is up at 50.03.

Financials: The Dec 30 year bond is up 20 ticks and trading at 157.01.

Indices: The Dec S&P 500 emini ES contract is down 19 ticks and trading at 2001.75.

Gold: The October gold contract is trading up at 1150.70. Gold is 64 ticks higher than its close.

Initial Conclusion

This is a mainly correlated market. The dollar is down- and crude is up+ which is normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and Crude is trading up which is correlated. Gold is trading up which is correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded higher. As of this writing all of Europe is trading higher as well..

Possible Challenges To Traders Today

- Import Prices m/m is out at 8:30 AM EST. This is major.

- FOMC Member Lockhart Speaks at 9:10 AM EST. This is major.

- Wholesale Inventories m/m is out at 10 AM EST. This is major.

- FOMC Member Evans Speaks at 1:30 PM EST. This is major.

Currencies

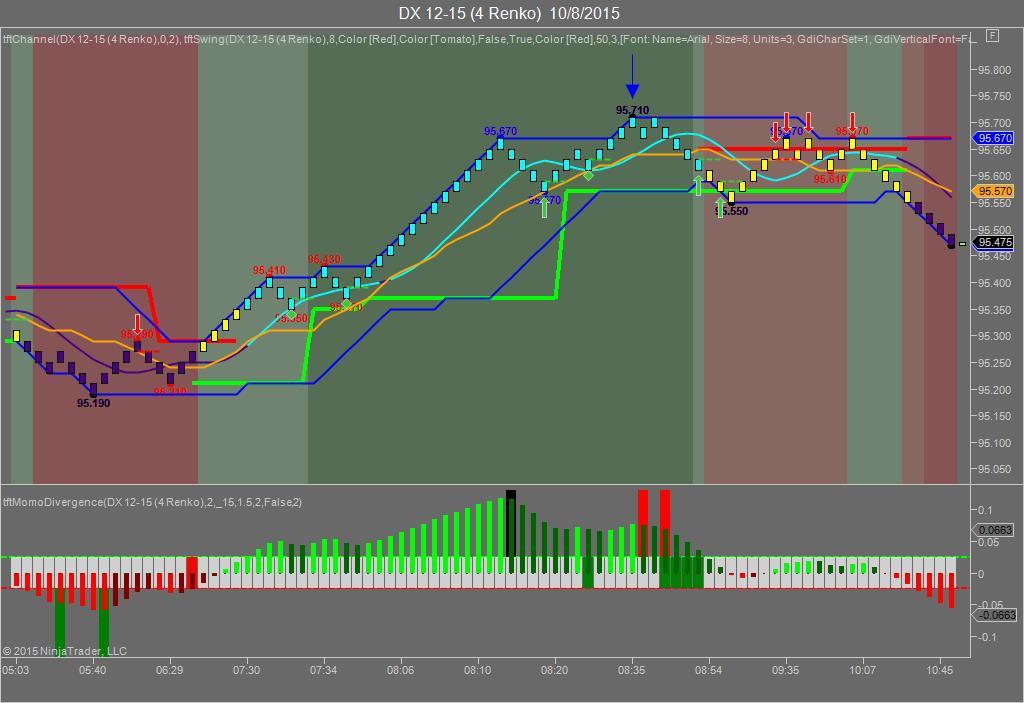

Yesterday the Swiss Franc made it’s move at around 8:35 AM EST after the Unemployment Claims came out. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at around 8:35 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 8:35 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

USD to Swiss Franc

Charts Courtesy of Trend Following Trades built on a NinjaTrader platformBias

Yesterday we said our bias was to the downside as Crude and the Bonds were trading higher. Initially the markets opened and traded lower but that was before the FOMC Meeting minutes came out. The Dow closed up 138 points and the other indices gained ground as well. Today we are dealing with a mainly correlated market however it’s correlated to the downside. Hence our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday the markets traded higher based on the FOMC Meeting minutes from their last meeting. It seems as though the Fed was more concerned with the Chinese slowdown and the impact that had on the markets and decided to hold off on any hikes. The Fed voted 9-1 to hold rates as opposed to raising and this to me makes perfect sense. We’ve long held the belief that this recovery is tepid at best and it wouldn’t take much to slow it down. Raising rates at this point will slow it down and have an adverse effect on business borrowing, consumer spending, Auto Sales, New Home Sales and Mortgage refinancing. If anyone wanted to throw a monkey wrench into this “recovery”, raising rates will accomplish that feat. In the meantime the market liked what it heard and the indices shot higher.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.