It has been a tough week for equity holders and those being long emerging market currencies. Macro data published from the Eurozone proved recession could be on its way. Knowing that the ECB has few (and not so powerful) weapons to fight it, the market reacted with a massive sellout. The volatility on the USD also increase this past week, which had its effect on all financial instruments (some say the swinging dollar was caused by the liquidation of large USD position by large hedge funds). The Polish Zloty remains sensitive to external factors but also local macro data negatively affected the currency. The CPI index (yearly basis) in September stood at -0.3% while Core CPI increased by 0.7%. Wages increased by 3.4% but it was less than the market expected. The outflow of capital from emerging markets was also observed on the Polish bond market, which instantly affected (increase) yields of government bonds. Have the MPC reacted to slow by cutting interest by 50bp on its last meeting? Of course it did. Even Morgan Stanley in its study confirms that by classifying the Polish central bank as one of the most dovish in the world (along with the ECB, BoJ, National Bank of Hungary and National Bank of Peru). The best course of action will be another interest rate cut on the November meeting. We will see if the MPC has the guts to do it.

The effect of all the mentioned factors above is clearly visible on the EUR/PLN daily chart. On Tuesday, the market broke through the 4.19 resistance level and continued ascending throughout the whole reaching its next target – 4.23. Now it all depends how PLN bulls behave. If they give up and the EUR/PLN breaks the resistance, it will target 4.25. A corrective movement could take the market back to 4.21. Such scenario is supported by the stochastic oscillator showing the market is currently overbought. Yet again, external factors have powerful effect on the PLN during the last couple of weeks so we cannot rule out further depreciation of the Polish currency._20141017152951.png)

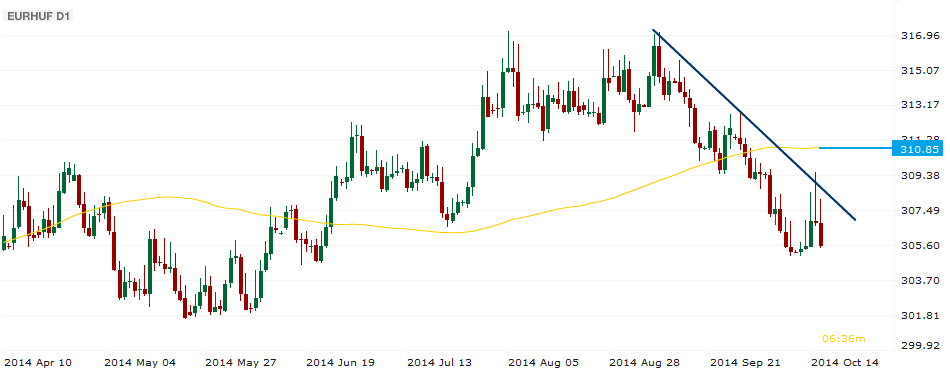

Hungarian Forint (EUR/HUF) – Waiting for NBH's rate decision

Last Friday Hungary’s third-quarter inflation data confirmed that it may be necessary to maintain the base rate at its current level even up to the end of 2015 in order to reach the inflation target. Ádám Balog, Deputy Governor of the NBH the central bank does not consider restarting the easing cycle as a viable option. However it is difficult to forecast how monetary council will react for the lower-than-expected CPI data (-0.5% yr/yr). Until the next rate decision (28th of October) we are very skeptical about the further downtrend on the Forint charts. Next news what we need to discuss are the downgrades at the three foreign-owned bank in Hungary. Fitch Ratings has downgraded Hungary’s Kereskedelmi és Hitelbank Zrt's (K&H) and Erste Bank Hungary Zrt's(EBH) Long-term Issuer Default Ratings (IDR) to 'BBB-' from 'BBB'. The rating agency also affirmed CIB Bank Zrt's Long-term IDR (CIB) at 'BBB-' and revised the Outlook to Stable from Negative. Carry traders should keep their eyes open because this is the first bigger premonitory signs of FX loan conversion. Fitch's report said "government interventions in the banking sector, including most recently the imposition of additional losses on retail loans, amplify country risks for banks operating locally."

On the daily chart we can affirm that the news held back the buyers. EURHUF was close to the yearly low but the 305 levels stopped the Forint bulls. If the pullback will continue next week, and the Euro bulls will break the blue trendline EURHUF could touch the 310 levels which is the 100 Daily SMA. We are expecting weaker Forint for the next week so carry traders should wait for an intensive break out.

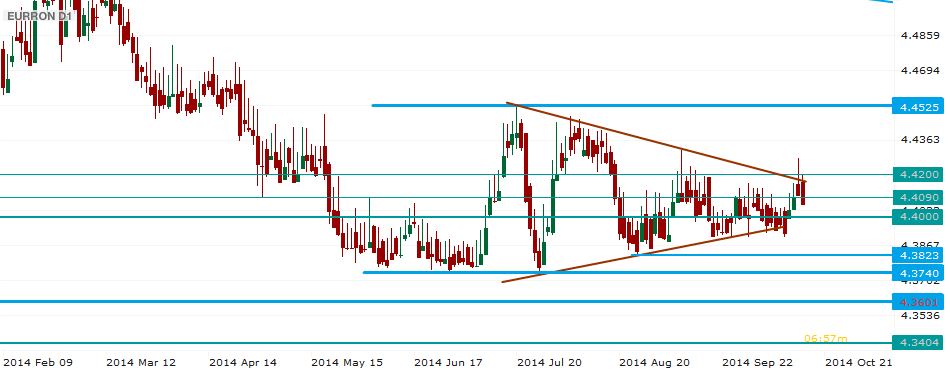

Romanian Leu (EUR/RON) – On the path to readjustment

Having withstood most of the turmoil of the last few weeks the Romanian Leu eventually started to move. There were only a few bad days on the stock market locally, a pale glimpse of the downplay in some European latin names but the storm cannot be without effects on the “peripheral” currencies. An with the Fed threat of higher rates first, than sudden risk adjustment on the global scene, a bit of capital flight only followed naturally. Just that the RON played its role as a relatively easygoing market, with small percentage adjustments. The looming presidential elections are not necessWe view the market gradually continuing to grind higher, while the National Bank is likely cheering a weaker RON (long complained about the strength of the currency). That told, steps are likely to be limited, probably below 4.45.

The technical analysis points to a false breakout on the upside, yet the market stayed above the 4.4000. If the market resumes its push, with an intermediate confirmation of a close above 4.42, a target on the upside of 4.45 is reachable over the medium term, whereas the longer aim may be towards 4.47. On the downside the support is a familiar set of levels such as 4.3823 and then 4.3740 and then 4.3601

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.