Polish Zloty (EUR/PLN) – Złoty will be under pressure

It has been a calm week for the Zloty, compared to the previous ones. The Polish currency traded in a rather narrow, 4.35 – 4.38 range. The week started well as the published unemployment rate for June declined to 8.8%. Good news? Sure, but we have to keep in mind the strong effect of seasonal (summer jobs) factors. The Zloty caught the attention of Mark Mobius, manager of the Templeton Emerging Markets Fund, who stated he still sees depreciation potential for the PLN, especially against the USD. Why? Mobius mentioned the low interest rates environment. With this, he sees a chance for increase in exports and does not see the risk of the credit rating downgrade (unless debt to GDP extends over standard safety limits). On the other hand, the perspectives for the Zloty are not so bad. The economy is not falling apart and there is positive global sentiment. Yields on 10y government bonds remain at a steady low 2.9%. Still, the PLN is not gaining as it could. The conflict around the Constitutional Court which increases political risk. This has to be solved if the government wants to avoid an intervention of the European Commission. So to summarize, the Zloty has both upside and downside potential. Not an easy trade, huh?

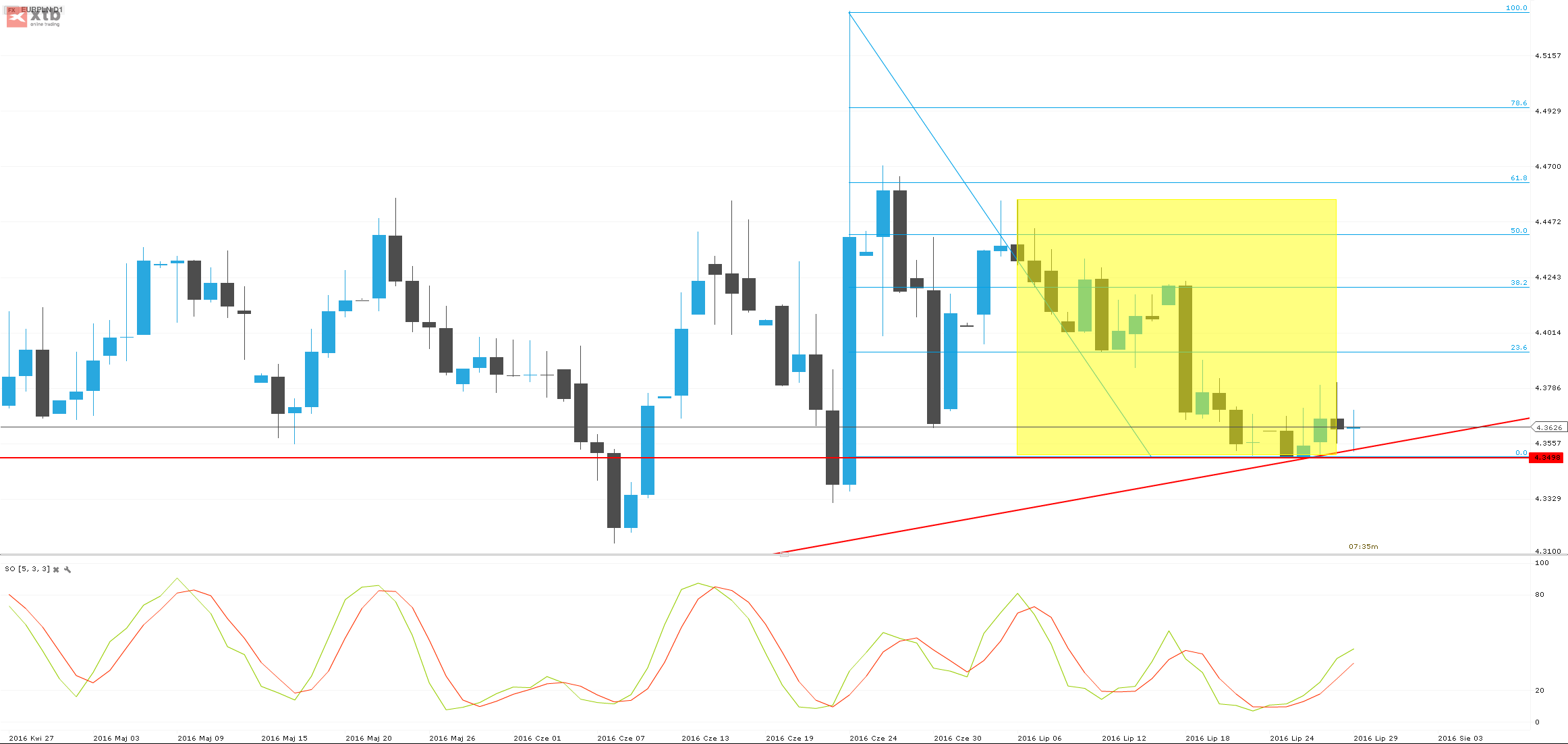

As we see on the daily chart, the EUR/PLN began the week by trying breaking the crucial 4.35 support. Being unable to do so, it rebounded to reach its weekly high of 4.38. What are the scenarios that we can expect? The stochastic oscillator is not giving a clear signal but we can guess the market is slightly oversold. If so, we should expect a depreciation of the Zloty and the EUR/PLN first targeting 4.3950 and then possibly 4.42. If the 4.35 support is broken, the closest targets are at 4.33 and then at 4.3150.

Pic.1 EUR/PLN D1 source: xStation

Romanian Leu (EUR/RON) – Moderate oscillations

The Leu has had a dynamic summer, until now, moving at a cruising speed at close to 4% per month, something that may be slow for some other currencies, but is not negligible in RON’s case. A correction of the recent strengthening is what we saw this week, mostly on a calming of speculative and seasonal inflows, as macro data has been less supportive: building permits fell by 9.5% in June over the same period in 2015, while the 0.2 point drop of the unemployment rate to 6.4% was not enough to reassert the RON’s position. It may have something to do with the arrest of one of the NBR’s top officials or maybe with concern over the fiscal position further ahead, after the stimulative effect of the aggressive tax cuts fades away. While we see risks to the upside over the medium term, EUR/RON may be looking for a wider range over the next week, bordering 4.45 as well as 4.48, at least as long as stock markets maintain their somehow ”rich” valuations in the developed markets.

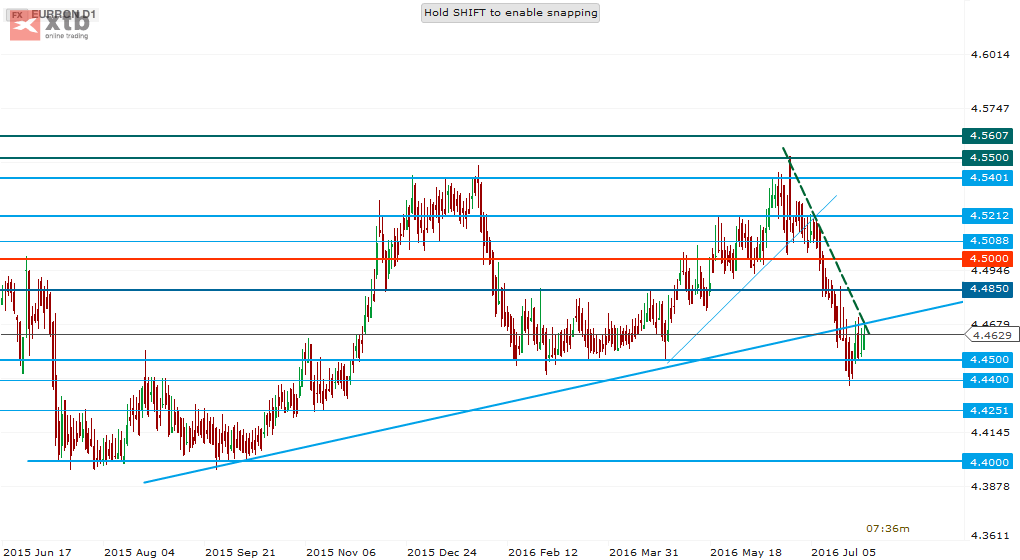

Technical overview presents us with a fresh downtrend and a retest of the previous longer-term uptrend now offering resistance at about 4.4700. The pair seems to be seeking a new, wider range, as the 4 week-old slide may have lost steam. A break above the previous uptrend line could bring us toward 4.4850, while support can be found at 4.4400 and 4.4251.

Pic.2 EUR/RON D1 source: xStation

Adam Narczewski, CFA, PRM – Deputy Regional Director XTB

Balazs Balogh – Market Analyst XTB Hungary

Claudiu Cazacu – Chief Strategist XTB Romania

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.