Market Brief

EUR/USD’s price action has been flat lined for the last two days as the US were heading into the Thanksgiving holiday. US markets will be open today but the session will be shortened. However, mounting uncertainties about the outcome of the next ECB meeting on December 3rd translate into the derivative market. The one week implied volatility on EUR/USD soared to levels last seen in July - when Greece was in the eye of the storm - jumping to 16% compared with 9.40% on Wednesday. On the spot market, we believe that EUR/USD will tread water as investors will save some strength for next week big events (ECB meeting; ISM, ADP and NFP in the US).

In Japan, the unemployment rate fell to a 20-year low, to 3.1% in October from 3.4% in the previous month. This strong reading should prevent the BoJ from using a more hawkish language, keeping monetary policy on hold. However the picture is not that bright as inflation remained on subdued in the October, in spite of Kuroda’s unshakable optimism. Headline inflation came in at 0.3%y/y, beating expectations of 0.2% and previous reading of 0.0%. However, nationwide core CPI (i.e. Ex Fresh food) remained at -0.1%m/m, matching median forecast while the Ex food and Ex energy gauge fell to 0.7%y/y from 0.9% in September, missing median forecast of 0.8%. The Japanese yen strengthen against the US dollar with USD/JPY sliding to the bottom of its weekly range at around 122.30.

On the equity front, equities were heavily sold off in the Asian session as poor data from Japan weighed on investors’ mood while a few brokerages are being investigated after rumours of violations of securities regulation. The Japanese Nikkei was down 0.30% while the broader Topix index dropped 0.49%. In Hong Kong the Hang Seng paired losses, down 1.76%. Mainland Chinese stocks were the biggest losers of the Asian session with the Shanghai and the Shenzhen Composite erasing 5.48% and 6.09%. Finally, in Singapore equities were down 1.20% while in South Korea the Kospi edged down 0.08%.

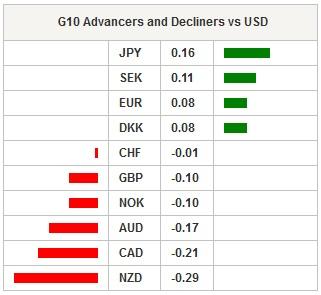

Commodity currencies were the biggest losers on the FX market as commodity prices dipped lower. Gold is down -0.33%, silver -0.97% while natural gas fell 2.65%. Crude oil prices were also under heavy selling pressure with the West Texas Intermediate sliding 1.88% while its counterpart from the North Sea edged down 0.81%.

Today traders will be watching inflation report from Spain; retail sales from Sweden; unemployment rate from Norway; consumer confidence from Italy; Q3 GDP growth from United Kingdom; consumer confidence from euro zone; mid-month inflation report from Brazil; Gfk consumer confidence from Germany.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 19883.94 | -0.3 |

| Hang Seng Index | 22093.44 | -1.76 |

| Shanghai Index | 3436.303 | -5.48 |

| FTSE futures | 6361 | -0.55 |

| DAX futures | 11283.5 | -0.28 |

| SMI Futures | 8940 | -0.28 |

| S&P future | 2087.8 | -0.01 |

| Global Indexes | Current Level | % Change |

| Gold | 1068.67 | -0.33 |

| Silver | 14.14 | -0.97 |

| VIX | 15.19 | -4.65 |

| Crude wti | 42.26 | -1.81 |

| USD Index | 99.76 | -0.03 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| GE Oct Import Price Index MoM | -0,20% | -0,70% | EUR/07:00 |

| GE Oct Import Price Index YoY | -3,90% | -4,00% | EUR/07:00 |

| UK Nov Nationwide House PX MoM | 0,50% | 0,60% | GBP/07:00 |

| UK Nov Nationwide House Px NSA YoY | 4,20% | 3,90% | GBP/07:00 |

| FR Oct PPI MoM | - | 0,10% | EUR/07:45 |

| FR Oct PPI YoY | - | -2,60% | EUR/07:45 |

| FR Oct Consumer Spending MoM | -0,10% | 0,00% | EUR/07:45 |

| FR Oct Consumer Spending YoY | 2,80% | 2,60% | EUR/07:45 |

| SP Nov P CPI EU Harmonised MoM | 0,00% | 0,30% | EUR/08:00 |

| SP Nov P CPI EU Harmonised YoY | -0,70% | -0,90% | EUR/08:00 |

| SP Nov P CPI MoM | 0,20% | 0,60% | EUR/08:00 |

| SP Nov P CPI YoY | -0,50% | -0,70% | EUR/08:00 |

| SW Oct Retail Sales MoM | 0,60% | 0,70% | SEK/08:30 |

| SW Oct Retail Sales NSA YoY | 3,80% | 3,70% | SEK/08:30 |

| TU Bloomberg Nov. Turkey Economic Survey | - | - | TRY/08:50 |

| NO Oct Retail Sales W/Auto Fuel MoM | 0,70% | -0,80% | NOK/09:00 |

| NO 3Q Manufacturing Wage Index QoQ | - | 0,00% | NOK/09:00 |

| NO Nov Unemployment Rate | 2,90% | 2,90% | NOK/09:00 |

| IT Nov Consumer Confidence Index | 116,5 | 116,9 | EUR/09:00 |

| IT Nov Business Confidence | 106 | 105,9 | EUR/09:00 |

| IT Nov Economic Sentiment | - | 107,5 | EUR/09:00 |

| TU Oct Foreign Tourist Arrivals YoY | - | -2,30% | TRY/09:00 |

| UK 3Q P GDP QoQ | 0,50% | 0,50% | GBP/09:30 |

| UK 3Q P GDP YoY | 2,30% | 2,30% | GBP/09:30 |

| UK 3Q P Private Consumption QoQ | 0,70% | 0,70% | GBP/09:30 |

| UK 3Q P Government Spending QoQ | 0,10% | 0,90% | GBP/09:30 |

| UK 3Q P Gross Fixed Capital Formation QoQ | 0,90% | 0,90% | GBP/09:30 |

| UK 3Q P Exports QoQ | 0,90% | 3,90% | GBP/09:30 |

| UK 3Q P Imports QoQ | 3,50% | 0,60% | GBP/09:30 |

| UK 3Q P Total Business Investment QoQ | 0,80% | 1,60% | GBP/09:30 |

| UK 3Q P Total Business Investment YoY | - | 3,10% | GBP/09:30 |

| UK Sep Index of Services MoM | 0,30% | 0,00% | GBP/09:30 |

| UK Sep Index of Services 3M/3M | 0,80% | 0,90% | GBP/09:30 |

| EC Nov Economic Confidence | 105,9 | 105,9 | EUR/10:00 |

| EC Nov Business Climate Indicator | 0,45 | 0,44 | EUR/10:00 |

| EC Nov Industrial Confidence | -2,1 | -2 | EUR/10:00 |

| EC Nov Services Confidence | 12 | 11,9 | EUR/10:00 |

| EC Nov F Consumer Confidence | - | -6 | EUR/10:00 |

| BZ Nov FGV Inflation IGPM MoM | 1,50% | 1,89% | BRL/10:00 |

| BZ Nov FGV Inflation IGPM YoY | 10,67% | 10,09% | BRL/10:00 |

| GE Dec GfK Consumer Confidence | 9,2 | 9,4 | EUR/12:00 |

| EC ECB's Knot Speaks at Sustainable Finance Lab in Amsterdam | - | - | EUR/12:00 |

| BZ Oct Outstanding Loans MoM | - | 0,80% | BRL/12:30 |

| BZ Oct Total Outstanding Loans | - | 3160b | BRL/12:30 |

| BZ Oct Personal Loan Default Rate | 5,80% | 5,70% | BRL/12:30 |

| CA Oct Industrial Product Price MoM | -0,10% | -0,30% | CAD/13:30 |

| CA Oct Raw Materials Price Index MoM | 0,30% | 3,00% | CAD/13:30 |

| IT Bank of Italy Governor Visco Speaks in Modena | - | - | EUR/16:00 |

| IN Oct Eight Infrastructure Industries | - | 3,20% | INR/23:00 |

Currency Tech

EURUSD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0615

S 1: 1.0458

S 2: 1.0000

GBPUSD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5087

S 1: 1.5027

S 2: 1.4566

USDJPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.38

S 1: 120.07

S 2: 118.07

USDCHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0236

S 1: 0.9739

S 2: 0.9476

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.