Market Brief

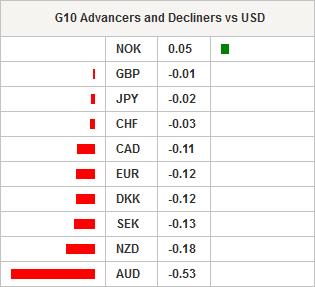

Choppy trading continues in the FX markets as liquidity conditions remain weak. USD price action remains broadly supportive following Fed Lockharts hawkish comments overnight. Atlanta Fed President Dennis Lockhart said that the US economy was ready for the first rate hike in September and it would take "significant deterioration" of economic data to change his mind. According to the Wall Street Journal Lockhart stated that “there is a high bar right now to not acting, speaking for myself." US rates and dollar shifted higher on the comments. We suspect that the USD will continue to pick up demand heading into this week’s payrolls numbers. Today, US 10 year yields rose further by 2bp to 2.237%. EURUSD continued to slide hitting 1.0848 in early Asia (two-day decline -1.30%). AUDUSD took the biggest fall in the G10 falling to 0.7343 from 0.7384. USDJPY was stable bouncing around 124.27 to 124.45 as movement in the US short end was limited. Emerging Asia currencies were broadly weaker as USDCNY rose to 6.2097. Asia regional equity indices were mixed as the Nikkei rose 0.56% , the Hang Seng up 0.25% however, Shanghai and ASX fell -0.95% and -0.42% respectively. Commodities were stable with oil slightly higher as US crude production fell.

The IMF released its initial findings for the upcoming review of its SDR basket. The report highlighted the progress of internationalization of the yuan while key financial performance were mixed. However, the report stated that there was still considerable work in analyzing the data before a formal decision could be made SDR basket structure (ie on Chinese currency reserve status). IMF staff members proposed that a delay of nine-month for any change to make the transition to a new basket smoother. Elsewhere China’s Caixin services PMI provided some well needed positive news rising to 53.8 in July, following a 51.8 in June. Yet China's composite PMI fell marginally to 50.2 in July from 50.6.

From Australia, AIG performance of services index rose to the highest level since 2014 to 54.1 in July, from 51.2 in June. New Zealand’s unemployment rate inched upwards to 5.9% in 2Q (in line with expectations) from a rate of 5.8% in 1Q. Finally, Japan’s services PMI expanding at a slower rate at 51.2 in July, against a prior read of 51.8 in June. While, July’s composite PMI unchanged at 51.5.

In the European session, markets expect Euro Area, German, Italian, Spanish and French composite PMIs. Euro-area retails sales are expected to decline to -0.2% m/m in June. In the UK, markets expect house prices to accelerate to 0.4% m/m from -0.2% m/m. UK services PMI is anticipated to slow marginally to 58 from 58.5. GBP trading should be subdued ahead of tomorrows event filled schedule. We remain bullish on the GBP against CHF, JPY and Euro on policy divergence (which should get substantial clarity after tomorrow). In Switzerland, inflation is expected to fall from 0.1% to -0.4%, yet y/y should be flat at 1.0%. We remain significantly bearish on the CHF prospects and suspect that USDCHF is the “purest” play for monetary policy divergence theme. USDCHF made short work of resistance at 0.9725, suggesting a bullish extension to 0.9863.

In the US session markets will get two important pieces to the Fed timing puzzle. ADP employment is anticipate to increase by 215k, below June 237k rise. US ISM non-manufacturing is projected to expand to 56.2 from 56.0.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.