Market Brief

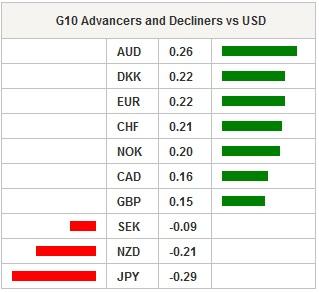

Forex price action was subdued in the Asian session as equity markets rallied and USD was broadly sold-off. However, prior to the negative USD sentiment the EURUSD touch a new two-year low at 1.2220 on divergent monetary policy expectations. Gains on Wall Street Friday, pushed Asia higher today. The Nikkei rose 0.08%, while the Hang Seng increased 1.26% and Shanghai climbed 0.61%. News that the Chinese cabinet unveiled rules to lower the regulatory hurdle for foreign banks in order to open the domestic financial sectors also helped raise sentiment. In oil news, Saudi Arabia stated on Sunday they would not cut production even if non-OPEC nations did so. This was one of the strongest signals that Saudi Arabia is dedicated use the price slump to push out competitors. Brent crude was stable about the $60 handle and is expected to remain there for rest of 2014. USDJPY was range-bound for most of the session yet was interrupted by a rogue spike (low participation and low liquidity environment) as European markets opened. With Tokyo holidays tomorrow and Christmas later in the week many Japanese speculative traders are stepping away from the markets. In addition, Tokyo businesses are officials closed to for the year on Friday limiting current real money trading. EURUSD traded lower but was able to recover on short-covering to 1.2268. We would suspect the EURUSD to remain under pressure into the new year as traders are getting comfortable with the ECB engaging in sovereign bond buying at their January 22nd 2015 meeting. ECB VP Constancio stated that he is expecting negative inflation in the coming months after oils price plunge which will put the economy at risk, therefore supporting QE. While the ECB Coene, in La Libre Belgique, was quoted as supporting government bond purchases. The EURs weakness will also be a result of traders further pricing in the Fed’s tightening cycle and lingering concerns over political developments from Greece. After the SNB surprising move into negative rates EURCHF was unchanged between 1.2028 and 1.2037. USDNZD was slightly higher, shrugging off weak consumer confidence data and picking up carry driven bids around the 1.2900 handle. Tomorrow’s New Zealand trade report should read NZ$500m deficit and NZ$750m y/y.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.