Market Brief

BoJ Surprise QQE Increase

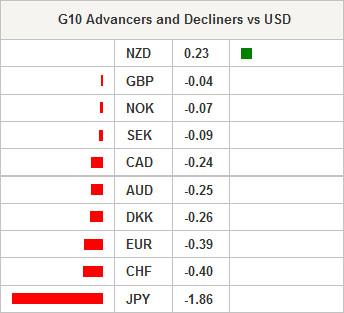

Forex markets were handed a surprise decision by the Bank of Japan which sent JPY significantly lower across the board. The BoJ announced an increase in the speed of expansion in its monetary base by “about” JPY80 trn per year (verse JPY60-70 trn). Previously the expansion was conducted through a combination of JGB purchases, liquidity through loan support programs and purchase of other assets. However now it looks as if a vast majority will be straight JGB purchases. Importantly to equity markets the speed of ETF and J-Reit purchases will increase as well (sending Nikkei higher). The vote was 5-4 with the majority citing downward pressure on prices as the key reason for more QQE. The market’s reaction to the unexpected decision (please note we had projected this outcome- see Weekly Market Report) drove USDJPY to new multi-years high at 111.53. Foreign exchange trading strategies kick into full gear as USDJPY took out critical levels in 110.67 August 2008 high and 111.47 the 1998 peak while EUR/JPY rallied above the 138.60 pivot, and the 200-dma at 139.06. Equity markets are broadly stronger across Asia. The Nikkei rallied a massive 4.83% (supported by the additional QQE and reallocation in GPIF) , the Hang Seng up 1.09% and Shanghai rose 1.22% and the Kospi has risen 0.23%. S&P futures are currently trading higher up 0.2%.

Elsewhere, in Japan, the media is reporting that Japan's Government Pension Investment Fund (GPIF) will report alterations in its asset allocation structure today. The press reports that GPIF domestic debt allocation will drop to 355 from 60% and foreign holding will increase to 15% from 11%. On the data front, Japan’s CPI increased 3.2% y/y below consensus and prior read of 3.3% in August. Core inflation rose 3.0% y/y in September, in line with expectations but slower than the 3.1% increase previously reported. USDJPY rally has run its course for today and our forex trading strategy would be short for a quick reversion to 110.80-111.00 support.

Russia might transition to a Free-float

Traders will be focused on Russia today as the central banks will report decisions on rates and possible Foreign exchange. The market is anticipating a 50bp hike to 8.50% in response to the collapse of the RUB and higher inflation outlook. However, we suspect that 50bp will be too little to discourage the mass exodus from RUB and expect a surprise move more in the lines of 75-100bp. There is also significant risk that today the rate announcement will be accompany with news of a transition to a free-float exchange rate regime. The CBR has spent roughly $24bn in October defending the upper-band. However, there is a probably that CBR would slight delay the transition in order to see improvement in current account due to winter fuel export revenue and avoid the colliding with external debt repayments allowing a more stable transition. Day trading strategies have helped push USDRUB to all time highs at 43.89 ( 1 month vols spiked to 23)

Mexico to hold rates

In Mexico, the central bank is expected to keep rates unchanged with a slight outside chance of a 25bp cut. The combination of higher inflation in Mexico and the Feds hawkish tone are the basis for our no-change call. Any hawkish development will be good for MXN as traders has a big appetite for EM with solid growth and monety policy in a non-easing cycle.

Swissquote SQORE Trade Idea:

Break Out Daily Model: Sell XAUUSD 1185.46.

For trade details & more great trade ideas,

visit Swissquote SQORE platform:

http://en.swissquote.com/fx/news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.